Allegheny Pennsylvania Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust In Allegheny, Pennsylvania, a disclaimer of right to inherit or inheritance refers to the legal act of renouncing or rejecting one's right to receive all or a portion of the property from an estate or trust. This disclaimer can be made by an individual who has been named as a beneficiary in a will or trust but wishes to decline their entitlement. A disclaimer of inheritance can be an important tool for individuals who may not wish to accept the property due to various reasons such as personal financial situations, tax implications, or an intention to avoid potential creditors. It allows them to voluntarily relinquish their rights, diverting the property to other beneficiaries or following the default distribution provisions in the absence of alternate instructions. It is essential to understand that a disclaimer must meet certain legal requirements to be valid. The disclaimer must be in writing, duly signed and acknowledged by the disclaiming party, and filed with the appropriate court or trustee within a specific timeframe, usually nine months from the date of the decedent's passing. Failure to meet these requirements may result in the disclaimer being considered invalid. It is also worth noting that different types of disclaimers may exist in Allegheny, Pennsylvania, depending on the nature of the inheritance or the specific circumstances. Some commonly encountered disclaimers include: 1. Disclaimer of Right to Inherit Real Property: This type of disclaimer applies when an individual wishes to decline their right to inherit real estate or land from an estate or trust. They may choose this option due to various factors such as an inability to maintain the property or associated financial burdens. 2. Disclaimer of Right to Inherit Personal Property: Personal property disclaimers involve renouncing one's entitlement to receive items such as jewelry, vehicles, artwork, or other tangible assets. Reasons for making this type of disclaimer could include sentimental value or the desire to avoid potential tax liabilities. 3. Partial Disclaimer of Inheritance: In some cases, a beneficiary may wish to disclaim only a portion of their inheritance. This type of disclaimer allows individuals to renounce specific assets or a designated fraction of their entitlement while still accepting the rest. 4. Disclaimer of Inheritance for Tax Planning: Individuals with significant wealth or potential estate tax concerns may choose to disclaim their inheritance strategically. This can be done to redirect the assets to someone else, such as a charitable organization, in order to optimize tax savings or minimize taxable income. When considering a disclaimer of right to inherit or inheritance in Allegheny, Pennsylvania, it is crucial to consult with an experienced attorney who specializes in estate planning. They can help navigate the legal requirements, evaluate the potential consequences, and guide individuals in making informed decisions. Disclaimer: The above content is provided for informational purposes only and should not be construed as legal advice. It is recommended to consult with a qualified attorney for personalized guidance regarding Allegheny Pennsylvania Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust.

Allegheny Pennsylvania Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

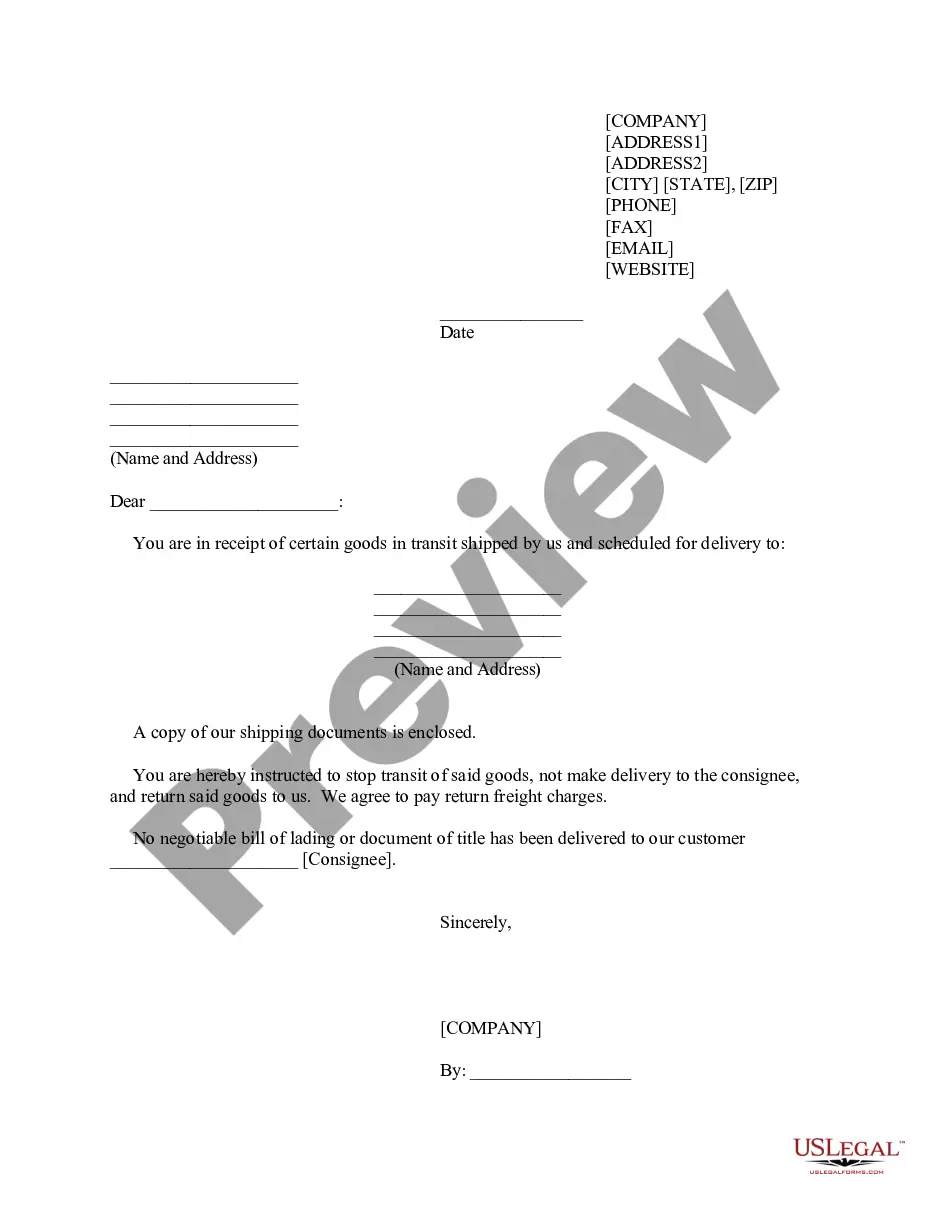

How to fill out Allegheny Pennsylvania Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Are you looking to quickly draft a legally-binding Allegheny Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust or probably any other document to manage your personal or business affairs? You can select one of the two options: hire a legal advisor to draft a legal document for you or create it entirely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal papers without having to pay unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-compliant document templates, including Allegheny Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the Allegheny Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the document isn’t what you were looking for by using the search box in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Allegheny Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!