Cuyahoga County, Ohio, is a populous county located in the northeastern part of the state. With its county seat in Cleveland, Cuyahoga County is home to a diverse population and rich history. Within the realm of estate planning and probate law, one particular topic that arises is the Cuyahoga Ohio Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust. This legal mechanism allows individuals to waive their rights to receive property or assets from someone's estate or trust. There are two main types of Cuyahoga Ohio Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust: 1. Disclaimer of Right to Inherit: This type of disclaimer refers to relinquishing one's right to inherit property or assets from an estate or trust. This can occur when a beneficiary does not wish to receive their entitled portion due to various reasons, such as avoiding tax consequences, disclaiming an asset with creditors, or allowing it to pass to another beneficiary. 2. Disclaimer of Inheritance — All Property from Estate or Trust: This form of disclaimer encompasses a broader scope, where an individual renounces their entire inheritance from an estate or trust. By disclaiming all property, the individual effectively forfeits their rights to any assets or benefits they would have received. The Cuyahoga Ohio Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust serves as a legally recognized way to decline one's entitlement to assets. It is important to note that disclaimers must be made in writing and comply with specific legal requirements to be valid. In many cases, individuals choose to disclaim their inheritance to establish alternative plans for the distribution of assets. This may involve redirecting the property to other family members, charities, or organizations that hold significant meaning to the disclaiming party. By doing so, individuals can ensure that their inheritance is directed in a manner consistent with their personal values and objectives. However, it is essential to consult with an experienced estate planning attorney in Cuyahoga County, Ohio, who specializes in probate law to fully understand the implications and legal process of disclaiming an inheritance. Estate planning professionals can guide individuals through the steps required to execute a valid and effective disclaimer, ensuring compliance with all relevant laws and regulations. In conclusion, the Cuyahoga Ohio Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust allows individuals in Cuyahoga County, Ohio, to renounce their entitlement to inherit property or assets from an estate or trust. This legal mechanism enables individuals to redirect their inheritance to other beneficiaries or entities, aligning with their personal wishes and objectives. To ensure the successful execution of a disclaimer, it is crucial to consult with a knowledgeable estate planning attorney.

Cuyahoga Ohio Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Cuyahoga Ohio Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

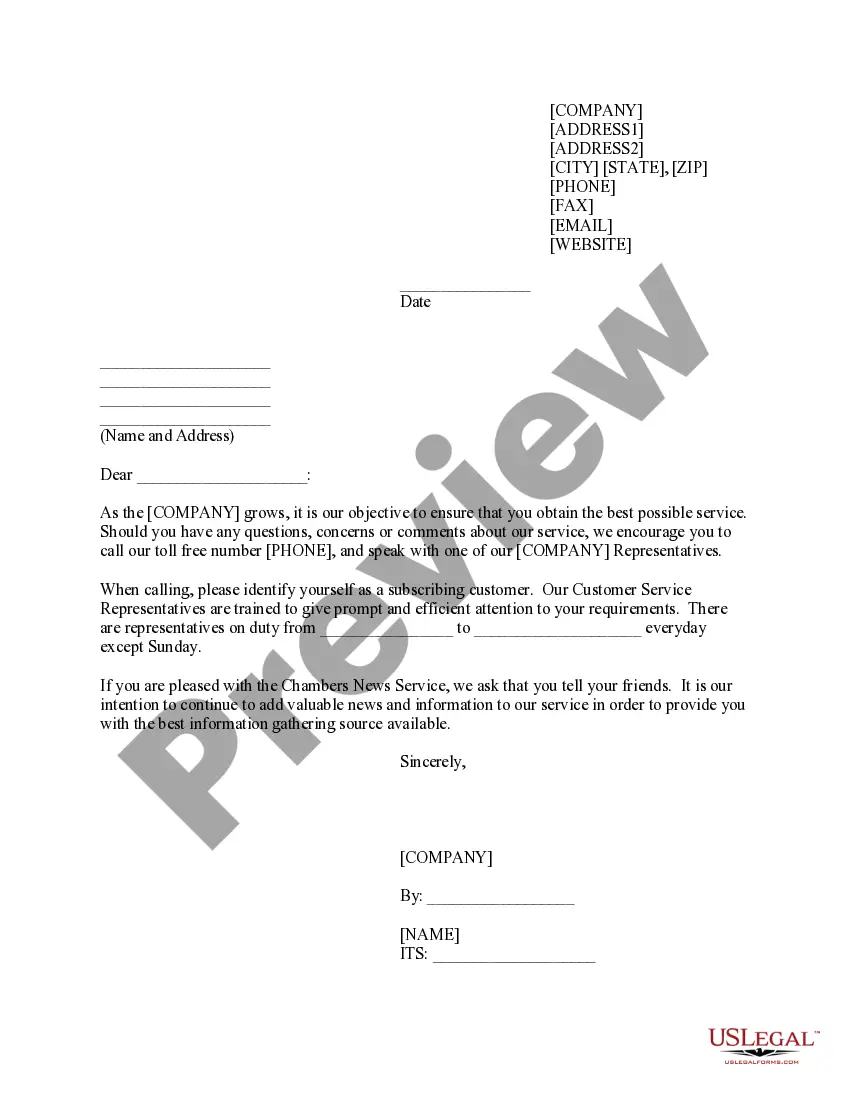

Creating paperwork, like Cuyahoga Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, to take care of your legal affairs is a challenging and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can acquire your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal forms crafted for various scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Cuyahoga Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is fairly simple! Here’s what you need to do before downloading Cuyahoga Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust:

- Ensure that your form is specific to your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Cuyahoga Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start utilizing our website and get the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!