Title: Understanding Harris Texas Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust Introduction: In Harris County, Texas, the process of estate planning and distribution includes the option for beneficiaries to disclaim their right to inherit property from an estate or trust. This disclaimer allows individuals to decline their entitlement to an inheritance, avoiding any legal responsibilities or potential tax liabilities associated with the assets. This article aims to provide a detailed description of Harris Texas Disclaimer of Right to Inherit or Inheritance — All Property from Estate or Trust, outlining its intricacies and highlighting different types that may exist. 1. Defining Harris Texas Disclaimer of Right to Inherit or Inheritance: A disclaimer of right to inherit or inheritance, specifically in Harris County, Texas, refers to a legal mechanism wherein a beneficiary voluntarily relinquishes their right to receive property or assets from an estate or trust. By disclaiming the inheritance, the beneficiary ensures that the property passes to other designated beneficiaries or heirs in a manner consistent with the estate plan. 2. Reasons for Harris Texas Disclaimer of Right to Inherit or Inheritance: Individuals may choose to disclaim their inheritance for various reasons, including: a) Tax Planning: By disclaiming the inheritance, beneficiaries can avoid potential tax issues related to income tax, estate tax, or generation-skipping transfer tax. b) Avoiding Creditors: In certain cases, beneficiaries may have significant debts or obligations, prompting them to disclaim the inheritance to protect the assets from being seized by creditors. c) Restructuring Estate Plan: Beneficiaries may wish to redirect the inheritance to other family members or loved ones who might be in greater need or who better align with the deceased's wishes. 3. Different Types of Harris Texas Disclaimer of Right to Inherit or Inheritance: While the option to disclaim an inheritance exists, it is important to understand that disclaimers must adhere to specific legal guidelines. Here are some potential types or circumstances that may arise: a) Full Disclaimer: A beneficiary may choose to fully disclaim their right to the entire inheritance or all property from an estate or trust. By doing so, they effectively renounce all their rights, allowing the assets to pass to alternate beneficiaries. b) Partial Disclaimer: In certain cases, a beneficiary may prefer to disclaim only a portion of the inheritance or specific assets that they feel are unsuitable or unwanted. The remaining property would then be distributed based on the estate plan. c) Time Restrictions: It is essential to note that Harris Texas may impose specific time limits within which a disclaimer must be made. Failing to meet the deadlines outlined by the state might render the disclaimer void. d) Posthumous Disclaimer: In rare instances, a disclaimer can occur after the death of the beneficiary, allowing their designated heirs to inherit the disclaimed property as outlined in the deceased beneficiary's estate plan. Conclusion: Harris Texas Disclaimer of Right to Inherit or Inheritance provides beneficiaries the flexibility to decline their entitlement to property or assets from an estate or trust. Whether for tax planning, creditor protection, or alignment with the decedent's wishes, disclaiming an inheritance can be a strategic decision. However, it is crucial to seek legal guidance to ensure compliance with Harris County's specific requirements and any time restrictions that may apply.

Harris Texas Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

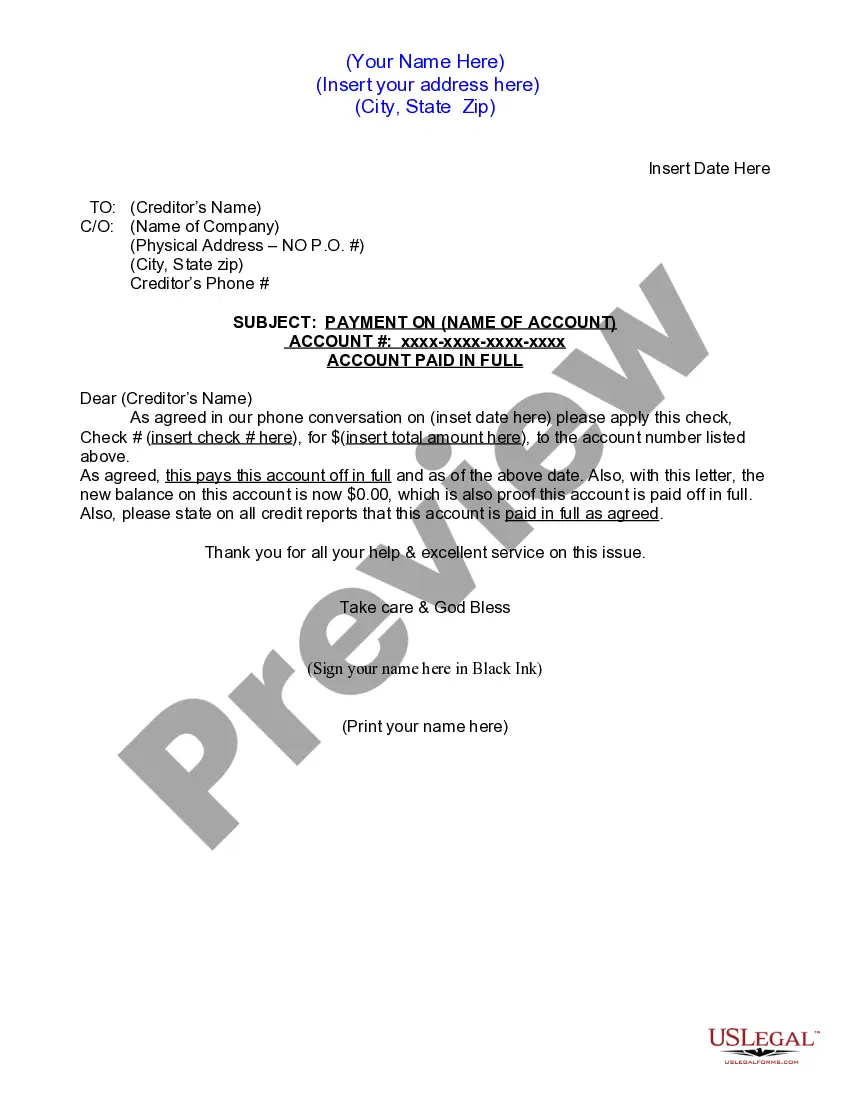

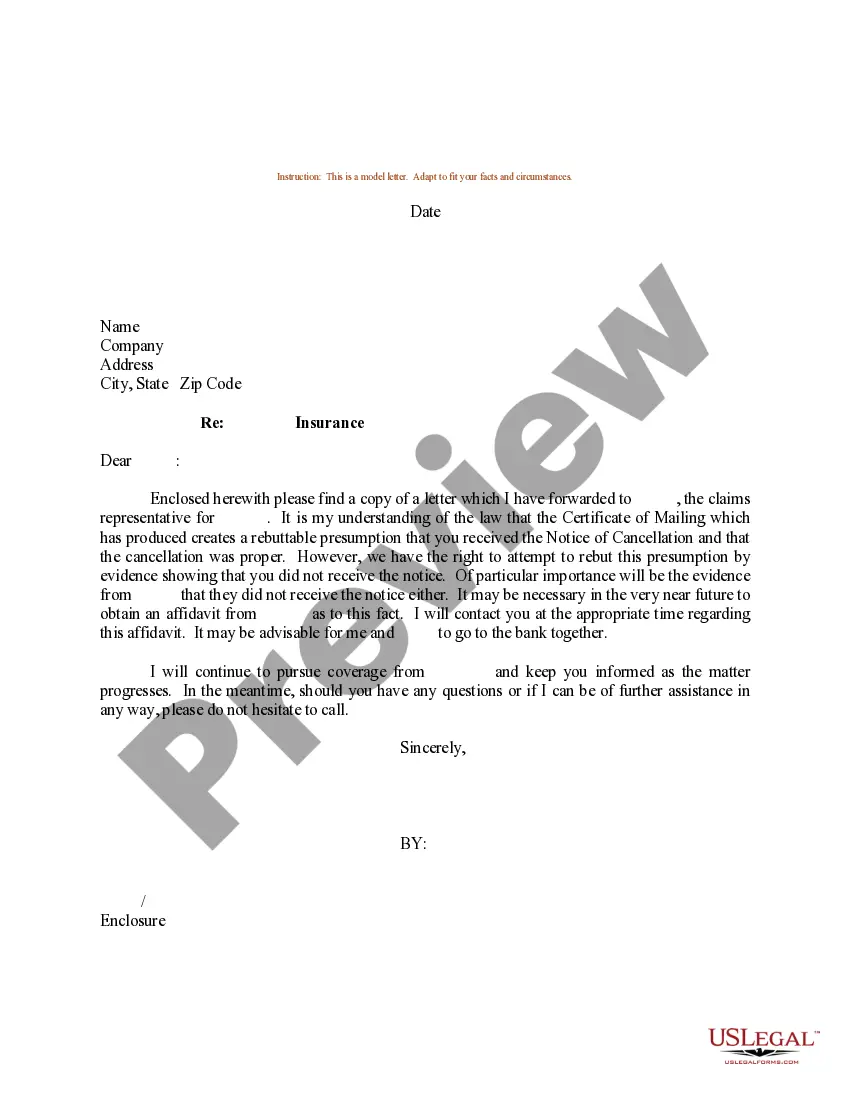

How to fill out Harris Texas Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Harris Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Harris Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Harris Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Harris Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!