Nassau, New York, is a vibrant county located within the state of New York. Home to a diverse community, it offers a rich history, picturesque landscapes, and numerous cultural attractions. When it comes to estate planning, individuals may find themselves faced with a specific legal concept known as a "Disclaimer of Right to Inherit." The Disclaimer of Right to Inherit, also referred to as a renunciation, is a legal action that allows an individual who would otherwise inherit property from an estate or trust to decline or disclaim their right to the inheritance. By doing so, to disclaim ant indicates that they do not wish to receive any or all of the assets or property associated with the estate or trust. In Nassau, New York, the process of disclaiming an inheritance is governed by specific laws and regulations outlined in the state's statutes. These laws ensure that the disclaimer is valid and legally binding. It is important to consult with an experienced attorney or estate planning professional to navigate the process accurately. There are different types of disclaimers that individuals in Nassau, New York, may consider, each catering to specific circumstances. These include: 1. General Disclaimer of Right to Inherit: This type of disclaimer applies to the entire inheritance, meaning to disclaim ant renounces their right to receive all assets or property associated with the estate or trust. 2. Partial Disclaimer of Right to Inherit: In certain situations, an individual may choose to disclaim only a portion of their inheritance, allowing them to reject specific assets or property while accepting others. 3. Qualified Disclaimer of Right to Inherit: A qualified disclaimer allows the individual to redirect the disclaimed assets to another beneficiary, such as a spouse, child, or sibling. This option requires strict adherence to the provisions set forth in the Internal Revenue Code. 4. Time-Limited Disclaimer of Right to Inherit: This type of disclaimer may be chosen when the individual needs additional time to evaluate the situation or gather more information before making a final decision. It is essential to remember that the disclaimer process should be undertaken with careful consideration and consultation with legal professionals. By disclaiming an inheritance, individuals can ensure that the assets or property pass to the next designated beneficiary or follow the designated distribution plan while avoiding potential tax implications or legal complexities. Properly executed disclaimers allow individuals in Nassau, New York, to exert control over their own estate planning, ensuring that their inheritance is distributed according to their wishes and the best interests of their loved ones.

Nassau New York Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Nassau New York Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

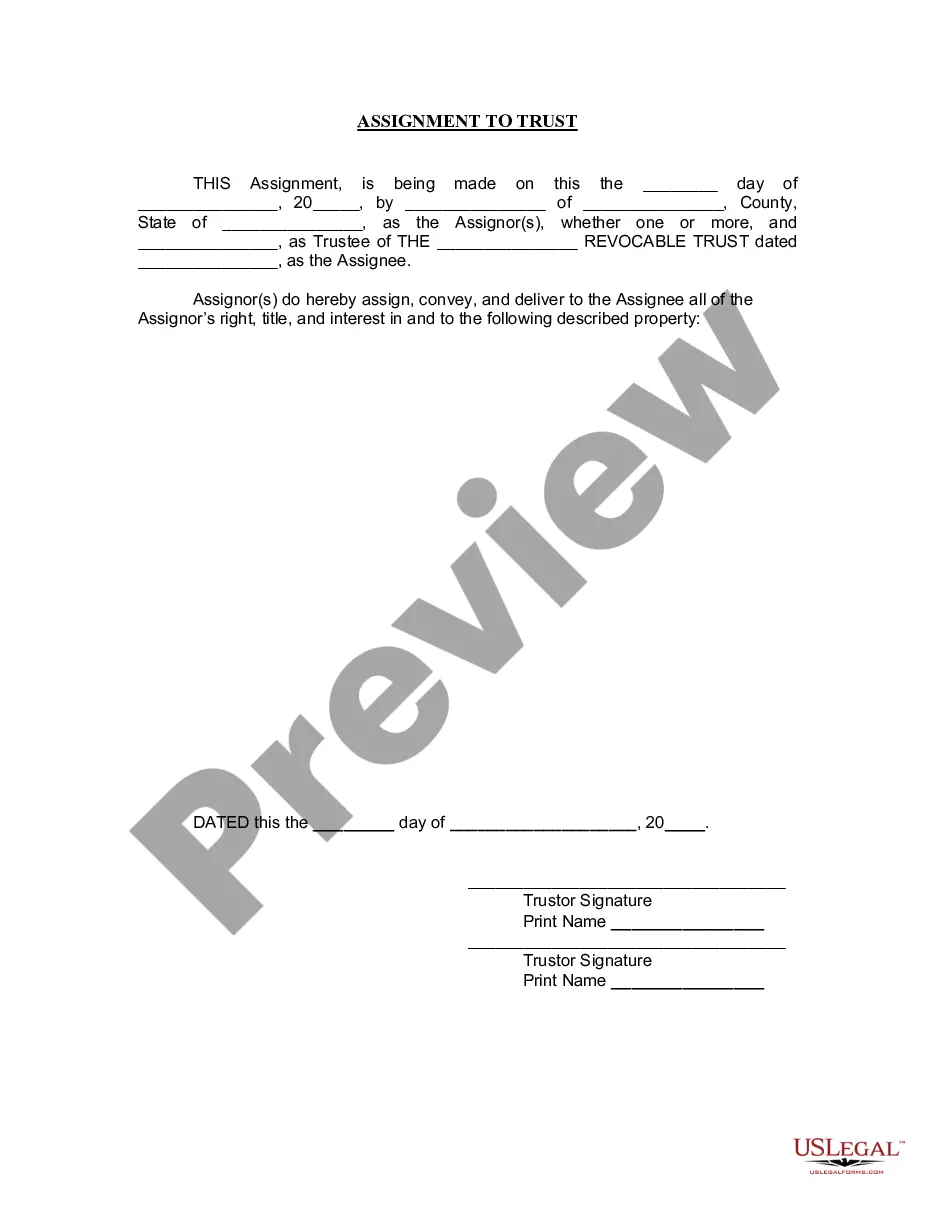

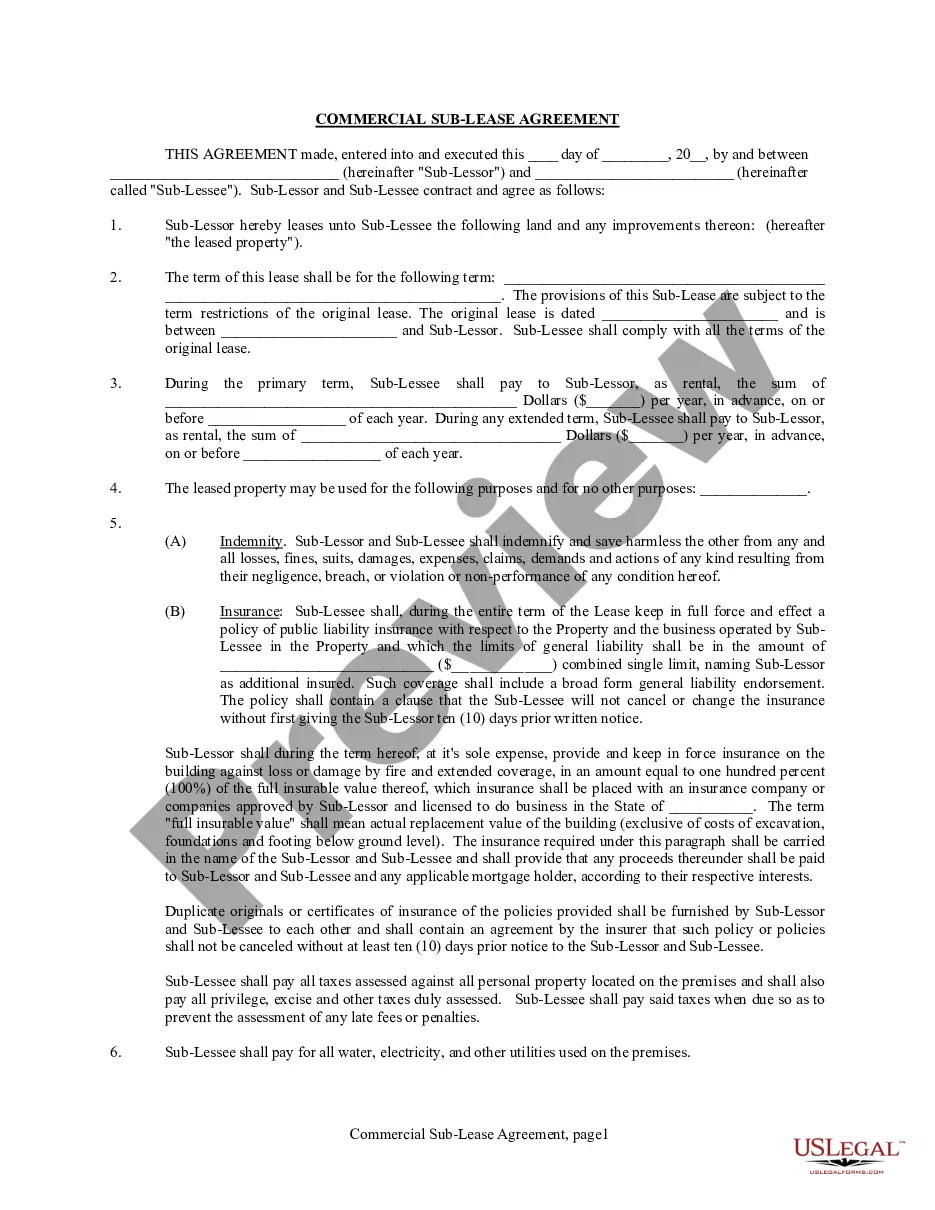

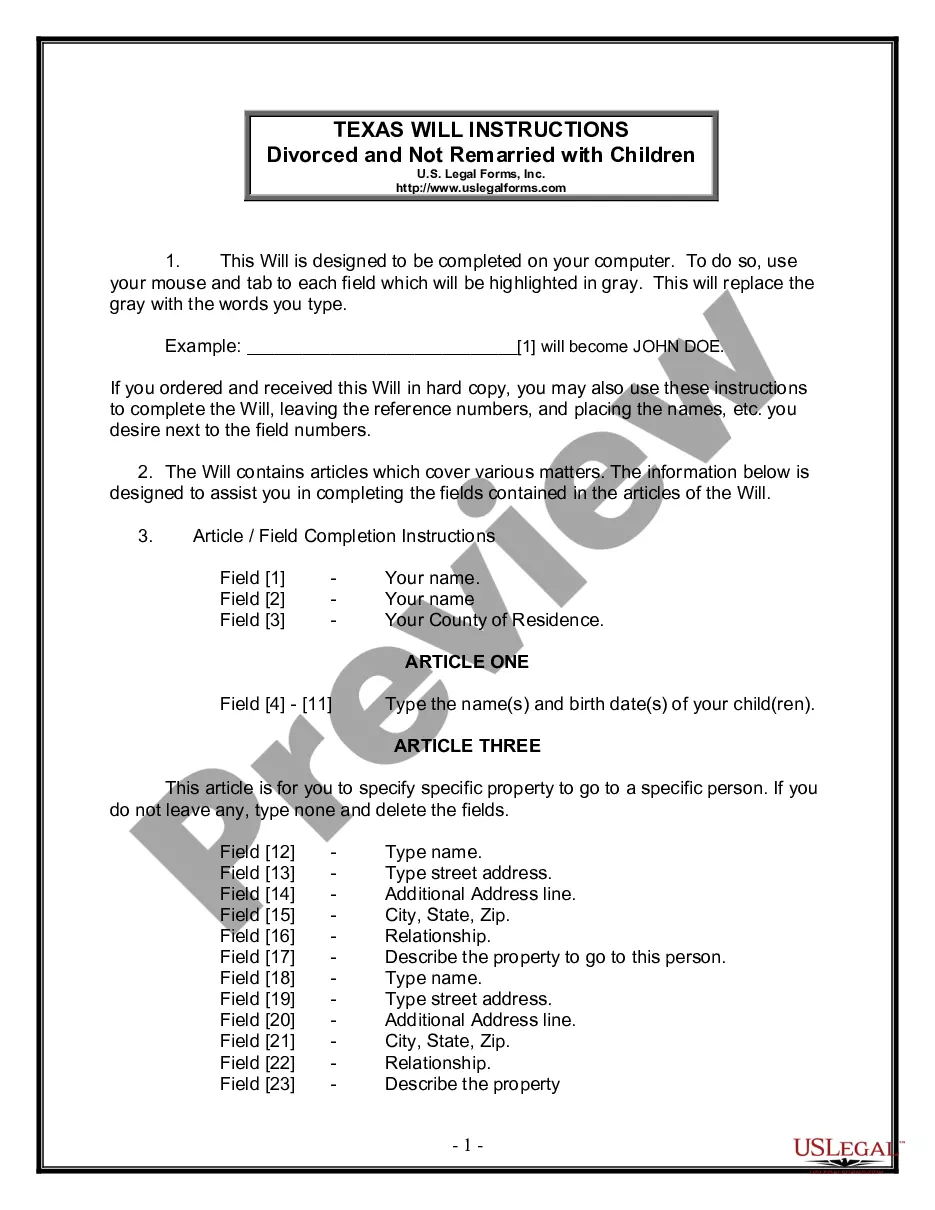

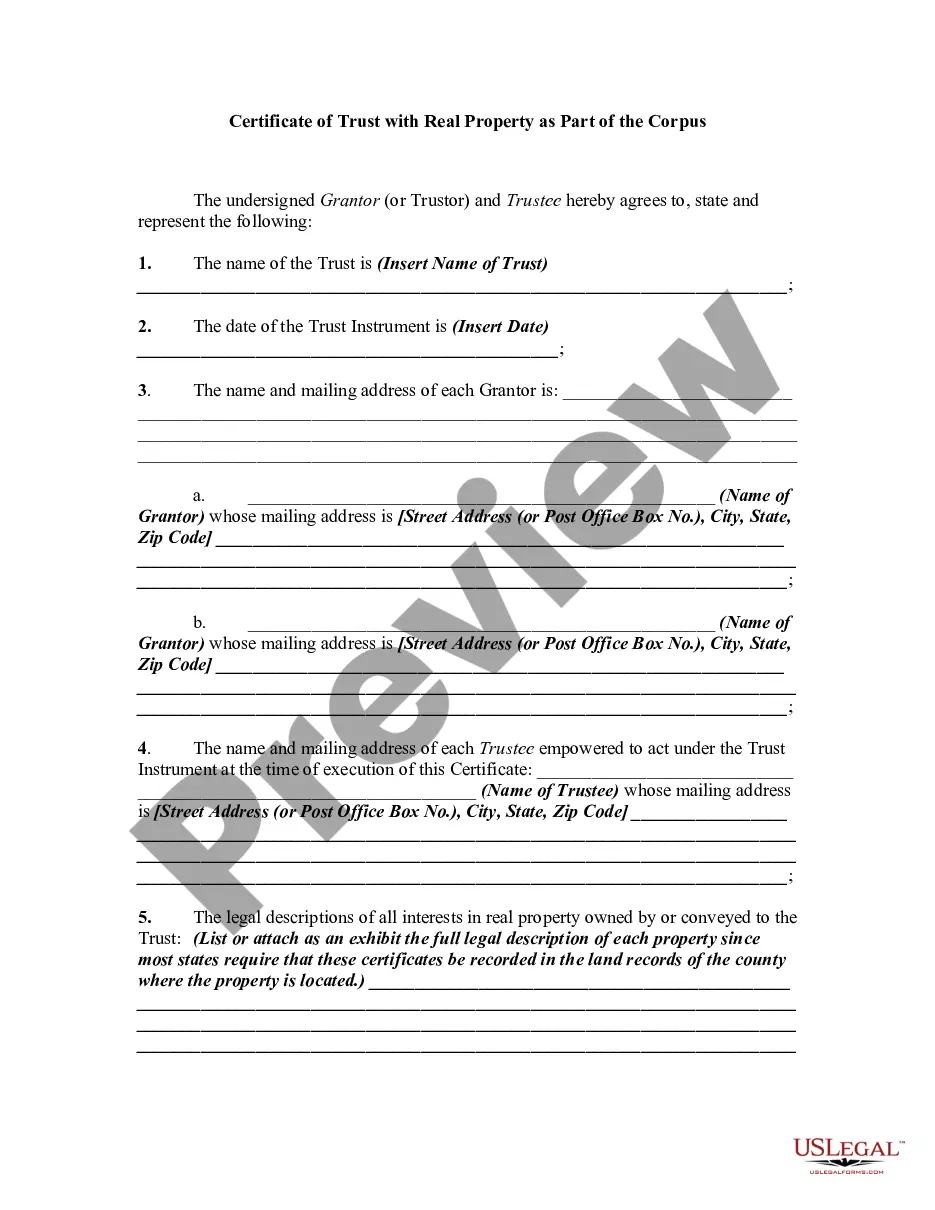

Creating paperwork, like Nassau Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can consider your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for different scenarios and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Nassau Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly straightforward! Here’s what you need to do before getting Nassau Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust:

- Ensure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Nassau Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our website and get the form.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

The disclaimer must be in writing and signed by the disclaimant; The disclaimer must be delivered to the individual entrusted with administering the inheritance within a specific period of time; The disclaimant cannot accept any benefit from the inheritance; and.

A disclaimer is a refusal or renunciation by an estate beneficiary or a donee of a gift of a transfer to the beneficiary during life or at death, by will, trust or otherwise. The Missing Transfer.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estateusually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

When you receive a gift from someone's estate, you can refuse to accept the gift for any reason. This is called "disclaiming" the gift, and the refusal is called a disclaimer. When you disclaim a gift, you do not get to decide who gets it. Instead, it passes on to the next beneficiary, as if you did not exist.

The disclaimer must be in writing and signed by the disclaimant; The disclaimer must be delivered to the individual entrusted with administering the inheritance within a specific period of time; The disclaimant cannot accept any benefit from the inheritance; and.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to disclaim, or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estateusually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

July 17, 2019. A Qualified Disclaimer occurs when a beneficiary of a will or trust refuses to accept the property or assets bequeathed to him or her. When the beneficiary submits a qualified disclaimer, the IRS allows the property to move to the next person in line according to the will or trust.