Allegheny, Pennsylvania is a county located in the southwestern part of the state. As part of the United States, Allegheny is subject to various federal laws, including the Truth in Lending Act (TILL). TILL is a consumer protection law that promotes the informed use of credit by requiring lenders to disclose important terms and costs associated with borrowing. In the context of retail installment contracts, which are commonly used for purchasing goods or services, TILL mandates specific general disclosures that must be provided to consumers in Allegheny, Pennsylvania. These disclosures are important as they help borrowers understand the terms and costs associated with their credit agreements. The general disclosures required by the Federal Truth in Lending Act for retail installment contracts in Allegheny, Pennsylvania, include: 1. Annual Percentage Rate (APR): This is a measure of the cost of credit expressed as a yearly interest rate. It includes both the interest rate charged by the lender and any additional fees or charges associated with the loan. The APR gives consumers a better understanding of the overall cost of borrowing. 2. Finance Charge: This is the total dollar amount that the borrower will pay over the life of the loan. It includes the interest charged by the lender, as well as any applicable fees. 3. Amount Financed: This is the actual amount of credit provided to the borrower. It excludes any prepaid finance charges, such as application fees or points paid upfront. 4. Total Payments: This disclosure states the total amount the borrower will have paid by the end of the loan term, including principal, interest, and any additional charges. 5. Payment Schedule: This disclosure details the frequency and amount of each payment the borrower will need to make to repay the loan. It also includes the number of payments required to fully satisfy the debt. 6. Total Sales Price: This is the sum of the amount financed and the finance charge. It represents the total cost of the purchase when credit is used. It is important to note that these are just general disclosures required by TILL for closed-end retail installment contracts. There may be additional disclosures specific to certain types of loans or transactions in Allegheny, Pennsylvania, depending on the nature of the credit agreement or the goods and services being financed. To ensure compliance with TILL and protect the rights of consumers, lenders and businesses in Allegheny, Pennsylvania must adhere to these mandated general disclosures. By providing clear and transparent information about the terms and costs of credit, borrowers can make informed decisions about their financial obligations.

Allegheny Pennsylvania General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

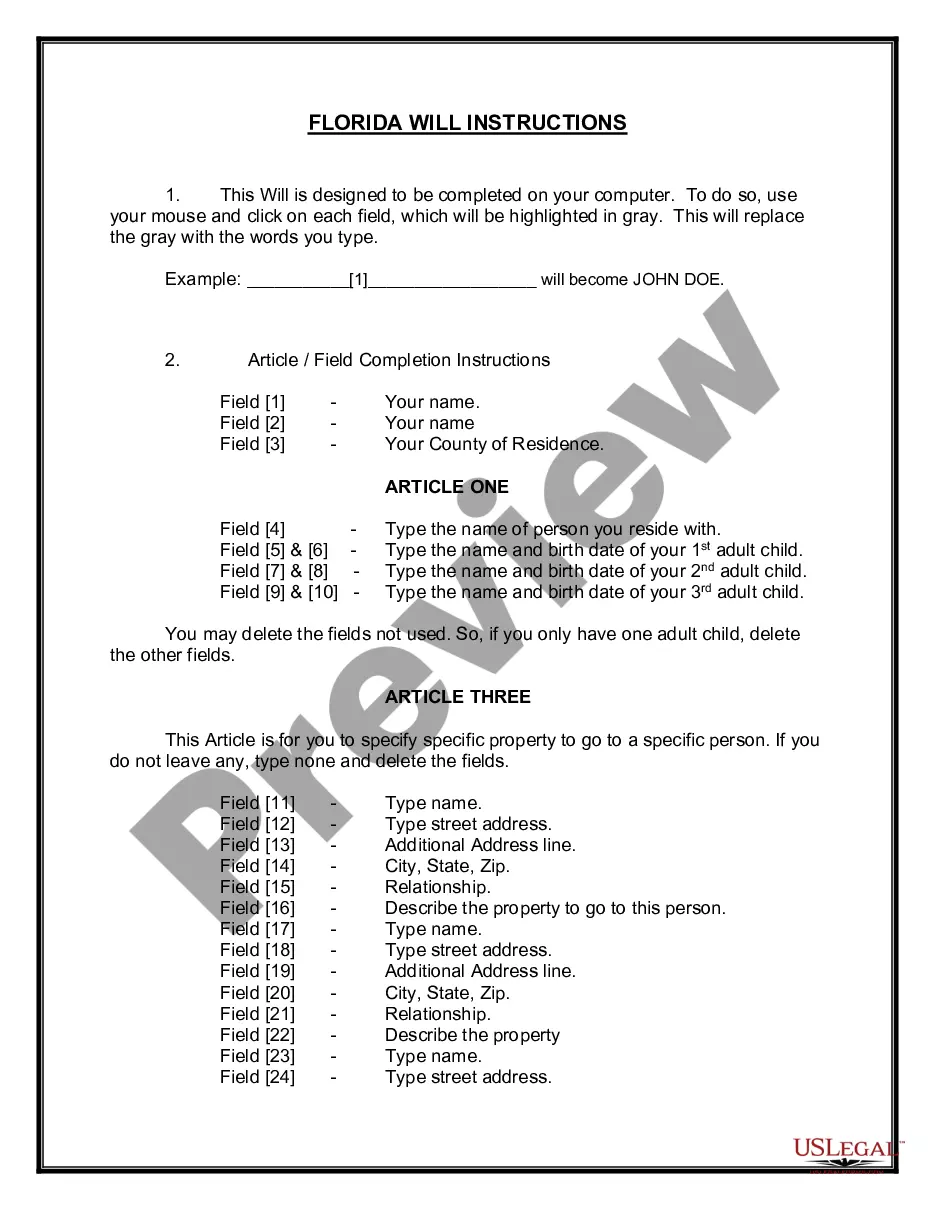

How to fill out Allegheny Pennsylvania General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

Creating documents, like Allegheny General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, to manage your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for various scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Allegheny General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures template. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Allegheny General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures:

- Ensure that your form is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Allegheny General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our service and download the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment details.

- Your template is all set. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!