Wayne, Michigan is a city located in Wayne County and is part of the Greater Detroit Metropolitan Area. As with many cities in the United States, Wayne residents and businesses must comply with federal laws, including the Truth in Lending Act (TILL), which imposes certain disclosure requirements for retail installment contracts. These disclosures are particularly important for closed-end transactions, where the loan amount is fixed and repayment occurs over a predetermined period. Under the TILL, creditors in Wayne, Michigan must provide consumers with accurate and timely information regarding the terms and conditions of their retail installment contracts. This law aims to protect consumers from unfair lending practices by ensuring they have access to necessary information to make informed decisions. The general disclosures required by TILL in Wayne, Michigan for retail installment contracts include: 1. Annual Percentage Rate (APR): This is the cost of credit, expressed as an annual interest rate, which includes not only the interest charged but also any applicable fees or charges associated with the loan. 2. Finance Charge: This refers to the total cost of credit, encompassing both the interest charges and any additional fees or charges imposed by the creditor. 3. Total Payments: This disclosure details the total amount the borrower will have to repay over the life of the contract, including both principal and interest. 4. Payment Schedule: The creditor must provide a clear breakdown of the number of payments required, the amount of each payment, and the due dates. 5. Total Sales Price: This is the total amount the borrower will pay over the life of the loan, which includes the principal amount borrowed, the finance charge, and any applicable fees. Additionally, TILL mandates specific disclosures for loans secured by real property and loans with variable interest rates. These disclosures aim to ensure borrowers are aware of potential risks or changes that may affect their repayment obligations. In conclusion, Wayne, Michigan residents involved in retail installment contracts must adhere to the general disclosures required under the Federal Truth in Lending Act. These disclosures provide borrowers with essential information about the terms, costs, and payment schedule of their loans. By complying with these regulations, lenders and borrowers can establish transparent and mutually beneficial lending relationships.

Wayne Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

How to fill out Wayne Michigan General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

Whether you intend to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are collected by state and area of use, so picking a copy like Wayne General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you several additional steps to obtain the Wayne General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

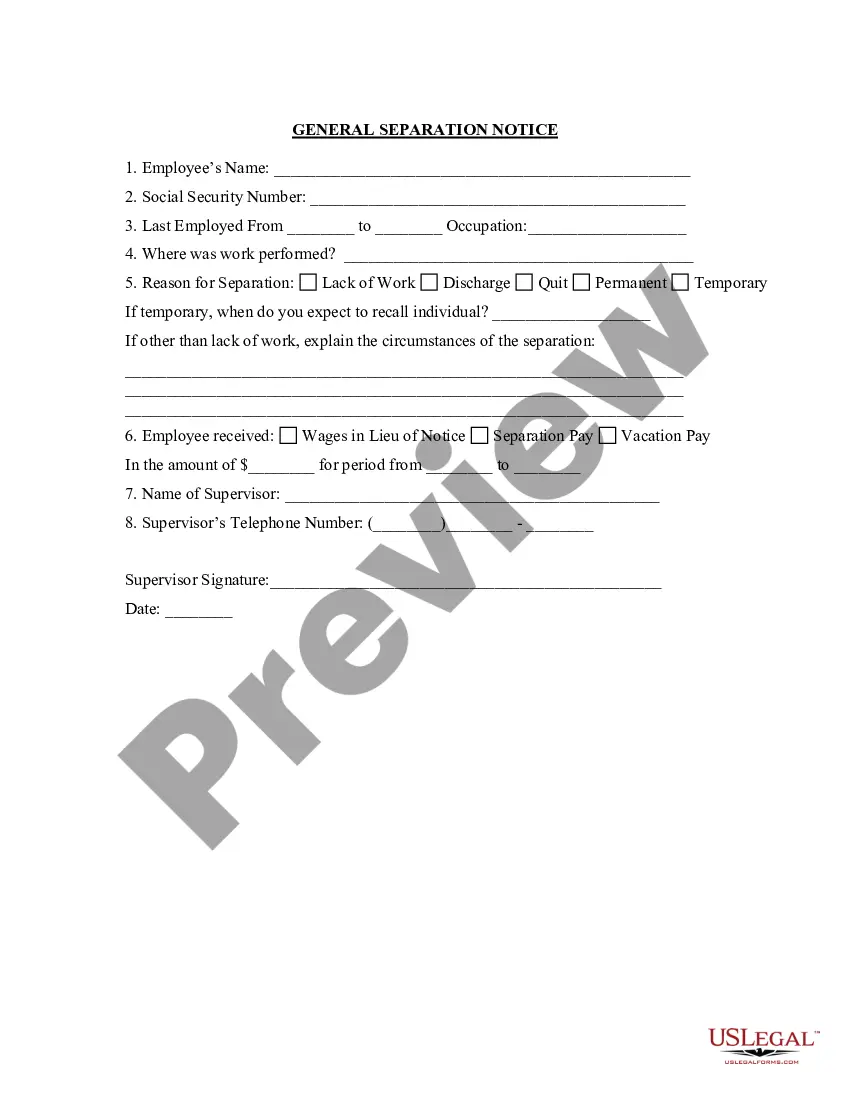

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Wayne General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!