Contra Costa California Bank Account Monthly Withdrawal Authorization is a legal agreement that authorizes a financial institution in Contra Costa County, California, to withdraw a specified amount from a bank account on a monthly basis. This authorization can be set up for various purposes, such as making mortgage payments, paying utility bills, or funding an investment account. The bank accounts monthly withdrawal authorization offers a convenient and automated way for individuals or businesses to manage regular payments without the hassle of manual transactions. By signing this authorization, customers give their explicit consent to the financial institution to deduct funds from their bank accounts on a recurring basis. There are several types of Contra Costa California Bank Account Monthly Withdrawal Authorization, each tailored to specific financial needs and preferences: 1. Utility Bill Payment Authorization: This type of authorization allows the financial institution to withdraw funds from a bank account to cover utility bills such as electricity, water, or gas. 2. Mortgage Payment Authorization: With this authorization, the financial institution deducts the monthly mortgage payment from the bank account, ensuring timely repayment and avoiding potential late fees. 3. Investment Account Funding Authorization: This type of authorization allows the bank to withdraw a regular amount from the bank account and transfer it to an investment or retirement account. It helps individuals save and invest systematically while benefiting from the power of compounding. 4. Subscription Service Payment Authorization: Many subscription-based services, such as streaming platforms or memberships, require recurring payments. By signing this authorization, customers allow the bank to deduct the specified amount from their bank account each month. 5. Automatic Loan Repayment Authorization: This authorization enables the financial institution to withdraw the monthly loan installment from the bank account. It ensures that borrowers honor their loan agreements promptly. Contra Costa California Bank Account Monthly Withdrawal Authorization provides a convenient and efficient way to manage recurring payments and obligations. It saves time and effort by automating the payment process, ensuring timely and hassle-free transactional activities. However, customers should carefully review and understand the terms and conditions of any withdrawal authorization before signing to avoid any misunderstandings or unforeseen financial obligations.

Contra Costa California Bank Account Monthly Withdrawal Authorization

Description

How to fill out Contra Costa California Bank Account Monthly Withdrawal Authorization?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Contra Costa Bank Account Monthly Withdrawal Authorization, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Contra Costa Bank Account Monthly Withdrawal Authorization from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Contra Costa Bank Account Monthly Withdrawal Authorization:

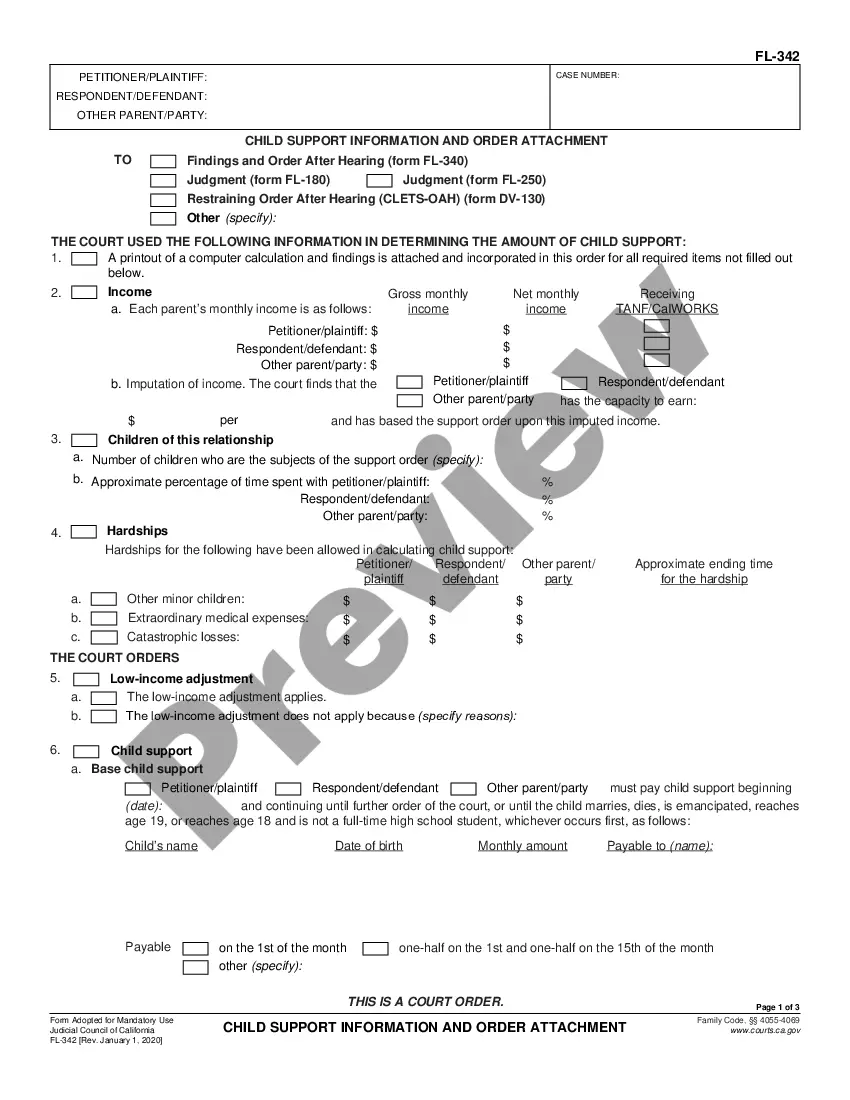

- Analyze the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!