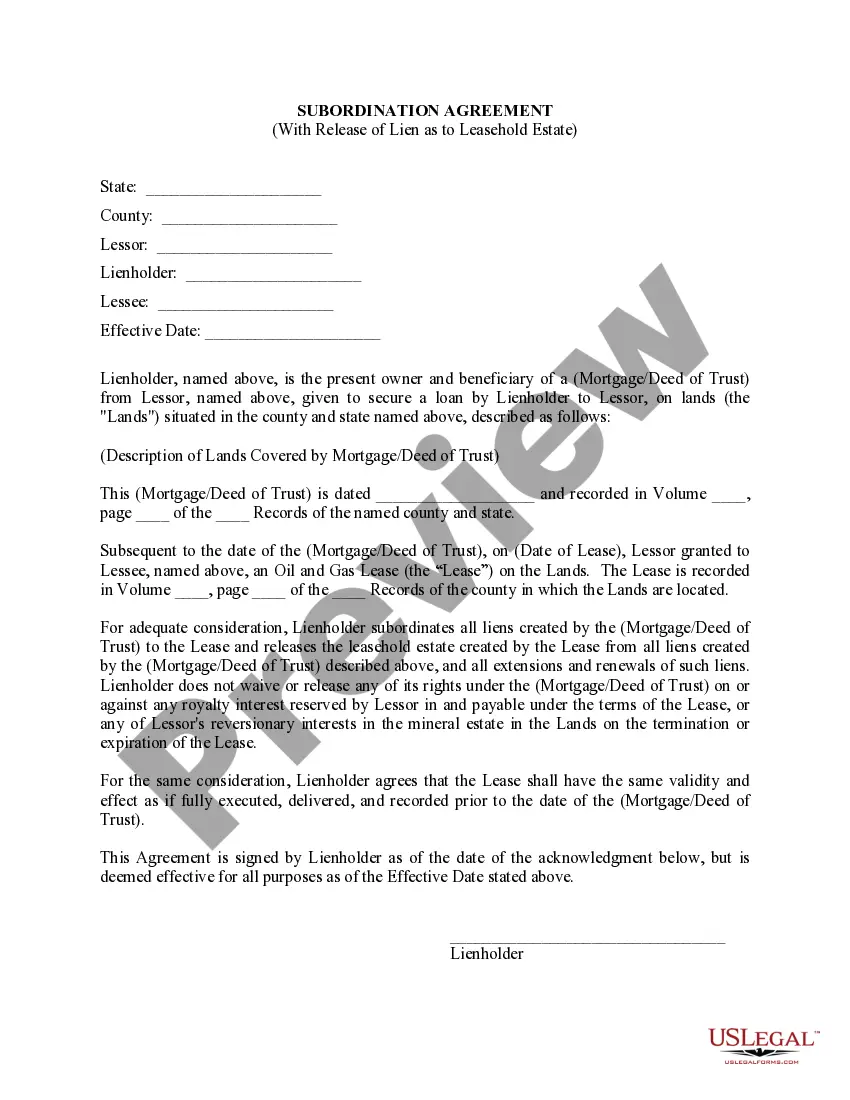

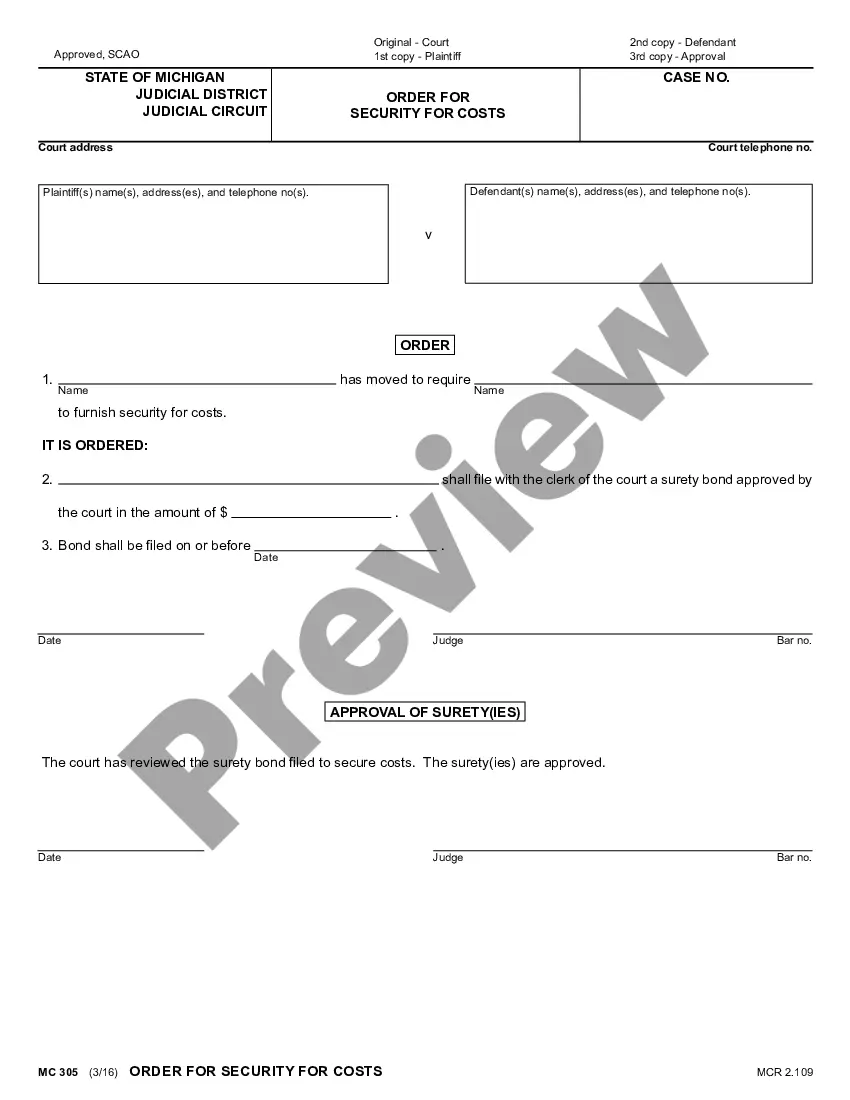

Maricopa Arizona Guaranty by Individual — Complex is a legal agreement that serves as a form of financial protection for individuals residing in Maricopa, Arizona. This guarantee ensures that if an individual fails to fulfill their obligations, such as paying rent or meeting financial responsibilities, another person (the guarantor) will step in and provide financial support on their behalf. This type of guaranty helps to minimize the risk for landlords or creditors who may be hesitant to enter into agreements with individuals who have limited credit history or unstable financial situations. It provides an added assurance that if the tenant or borrower defaults, the guarantor will assume responsibility and ensure the obligations are met. The Maricopa Arizona Guaranty by Individual — Complex can take on several forms, depending on the specific agreement between the parties involved. Some common types of guaranty arrangements include: 1. Residential Rental Guaranty: This form of guaranty is commonly utilized in residential lease agreements. It ensures that if the tenant fails to fulfill their rental obligations, such as paying rent or damages, the guarantor will cover the expenses. 2. Commercial Lease Guaranty: This type of guaranty is prevalent in commercial real estate transactions. It ensures that if the business tenant defaults on the lease agreement, the guarantor will be legally bound to fulfill the financial obligations. 3. Loan Guaranty: A loan guaranty is often required by lenders to secure a loan. If the borrower defaults on repayment, the guarantor is obligated to cover the outstanding debt. 4. Service Contract Guaranty: Service providers, such as contractors or suppliers, may require a guaranty to ensure payment for their services. If the client fails to make payment, the guarantor will step in to fulfill the financial obligations. Overall, Maricopa Arizona Guaranty by Individual — Complex provides a vital layer of financial security for parties involved in various agreements, protecting against potential defaults and financial risks. It is important for all parties to thoroughly understand the terms and conditions outlined in the guaranty agreement to ensure both their rights and liabilities are clearly defined and protected.

Maricopa Arizona Guaranty by Individual - Complex

Description

How to fill out Maricopa Arizona Guaranty By Individual - Complex?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Maricopa Guaranty by Individual - Complex.

Locating templates on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Maricopa Guaranty by Individual - Complex will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Maricopa Guaranty by Individual - Complex:

- Make sure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Maricopa Guaranty by Individual - Complex on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

In addition to the regular location standards, detached accessory buildings are permitted to be constructed/placed at a minimum 3 foot setback in any location other than the required front yard. Accessory buildings cannot occupy more than 30 percent of the required rear yard or side yard.

All fencing over 1 foot in height requires a permit from the Planning and Development Departments.

In most residentially, zoning districts, accessory structures can be located in the rear of your property, can be as close as 3 feet to the rear and side property lines, with a maximum height of 15 feet. The building must be 6 feet away from other structures.

For Building: 1. One-story detached accessory structures used as tool and storage sheds, playhouses and similar uses provided the floor area does not exceed 200 square feet. (These would still require a zoning permit) 2. Fences not over 7 feet high, but these do require a zoning permit.

A Planned Area Development Overlay District (PAD Overlay) establishes alternate general development standards (except density) of the base zoning district and parking standards. PAD Overlays in mixed-use zoning districts that do not identify standards shall establish standards.

High medium density residential (R1-6): the principal land uses of this district are single-family dwellings. No residence in this district shall have livable floor area of less than one thousand two hundred square feet.

The exact amount a building needs to be set back from the property line will vary from one location to another. However, the required setback on the side is typically between 5 ? 10 feet, while the front and back require around 10 ? 20 feet at a minimum.

Building permits are required for all structures with the exception of a structure that is less than 200 square feet with no electrical, plumbing or mechanical.

To do that, your attorney will need to submit a petition for guardianship to the county probate court. File forms for temporary guardianship ? once the court clerk has accepted the petition, you can submit the appropriate forms for a temporary guardianship.

About PADs A psychiatric advance directive (PAD) is a legal document that documents a person's preferences for future mental health treatment, and allows appointment of a health proxy to interpret those preferences during a crisis.