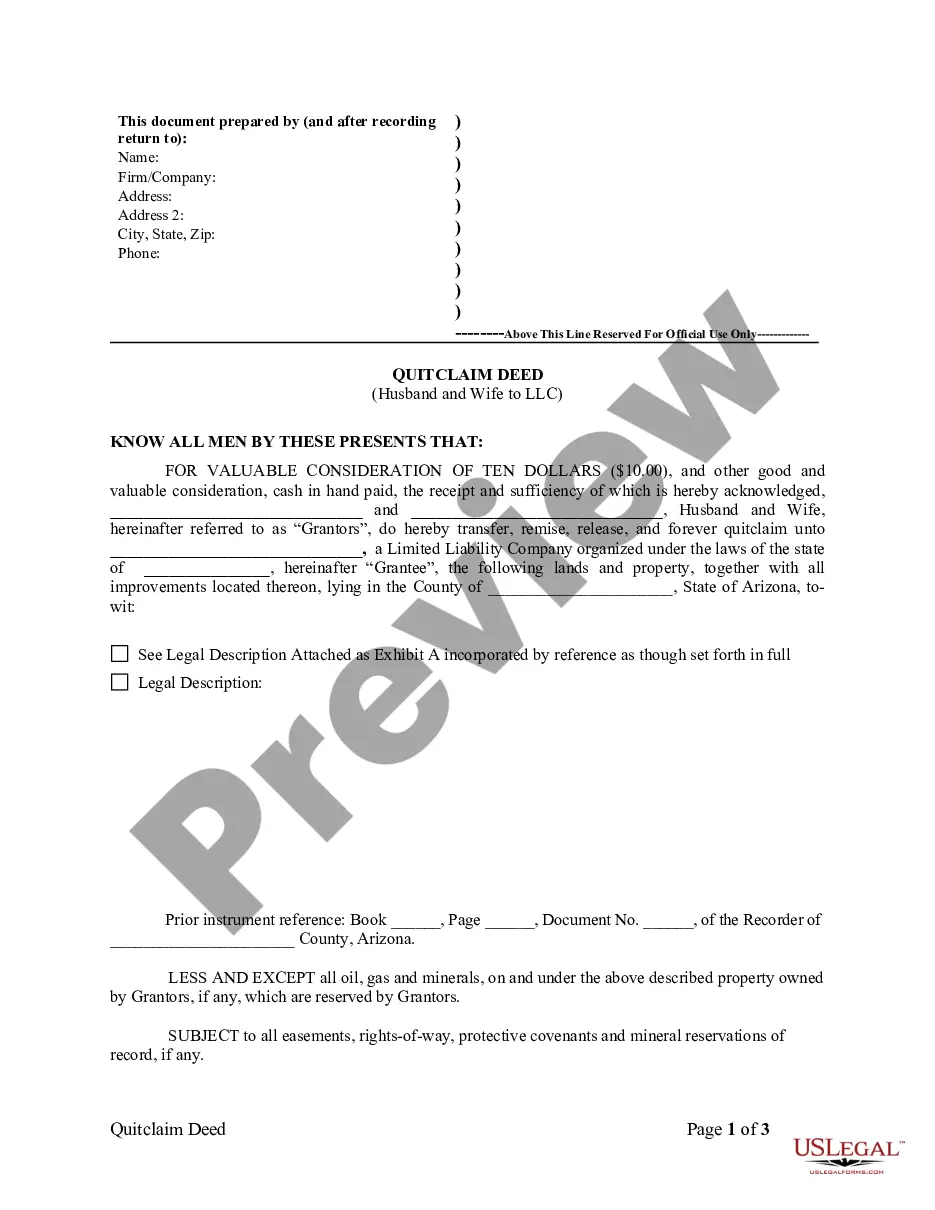

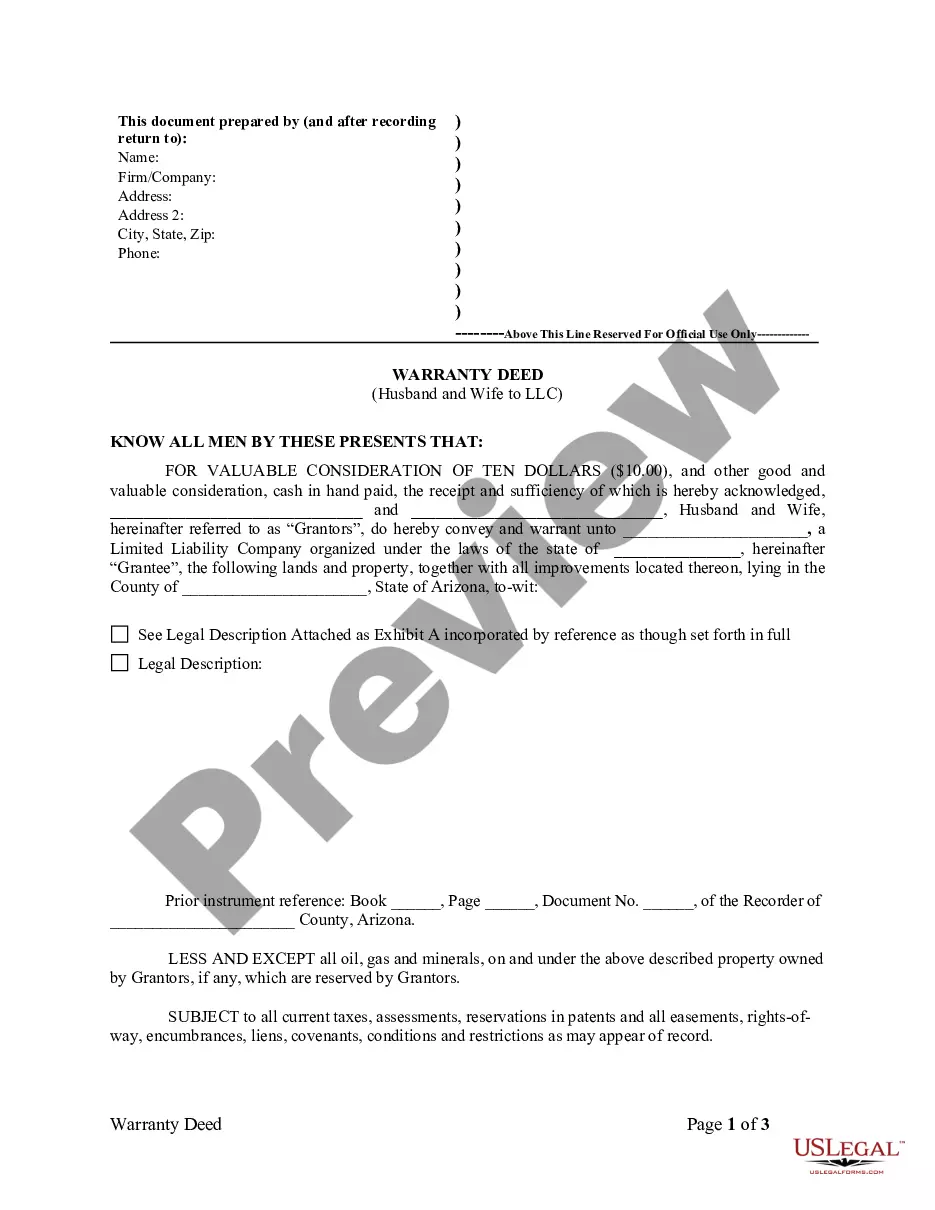

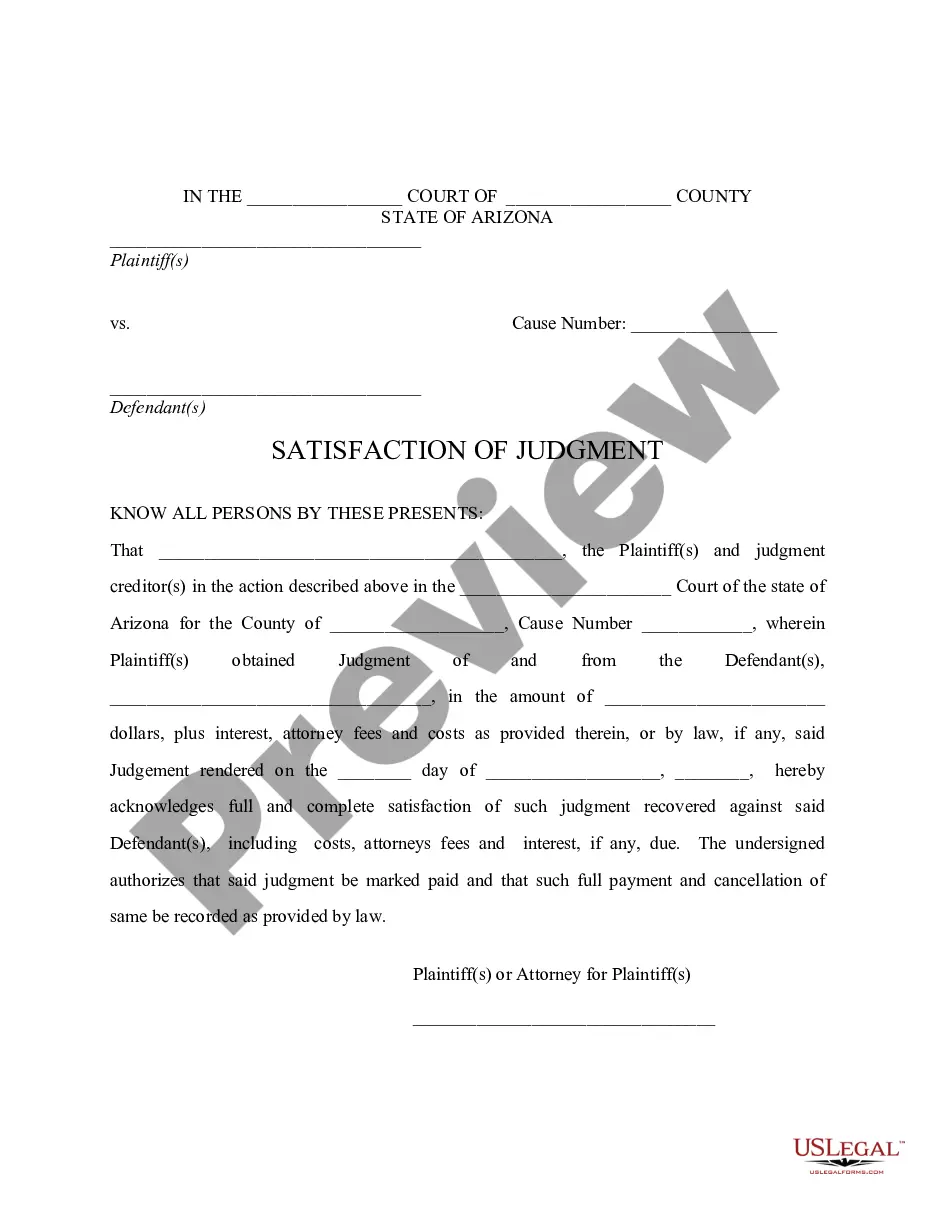

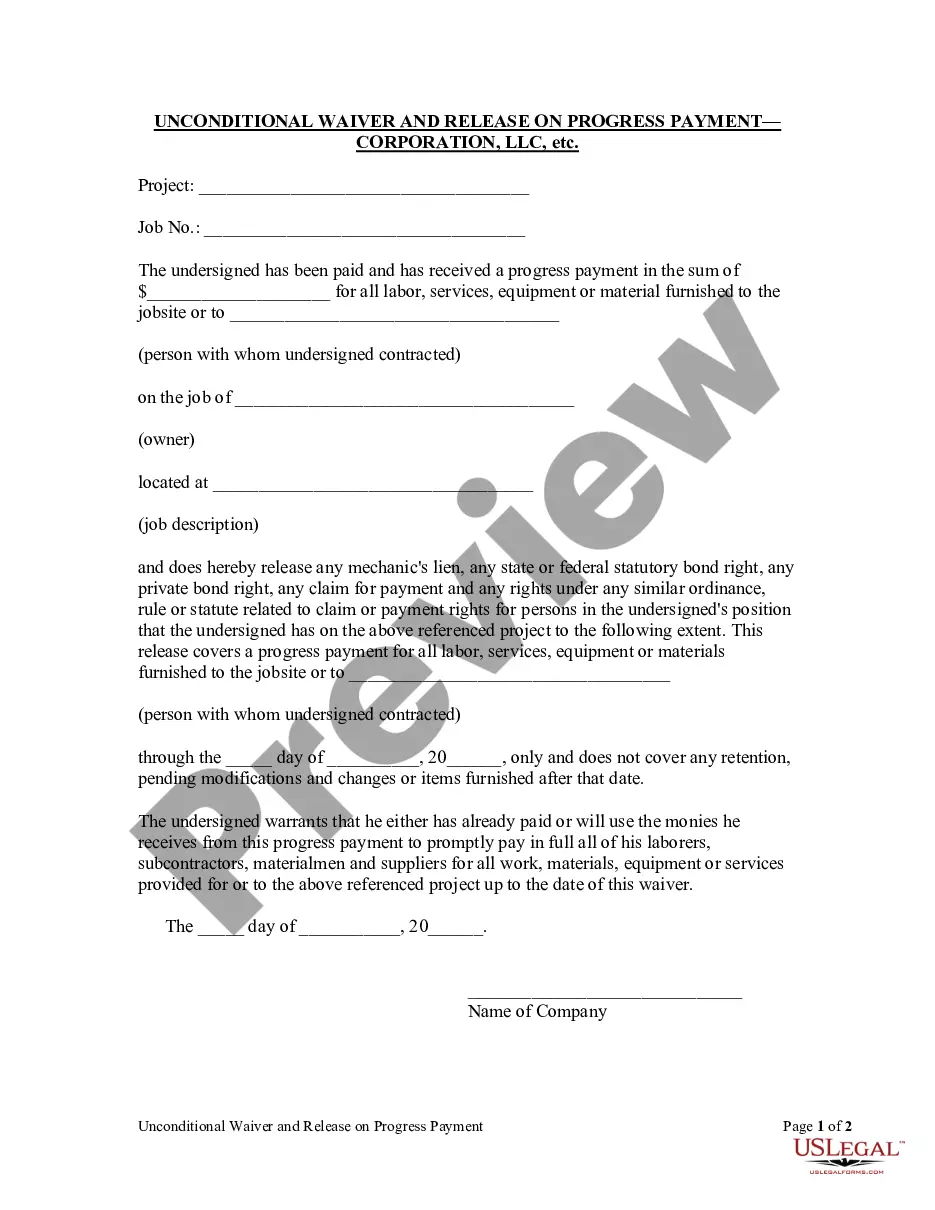

San Diego California Guaranty by Corporation — Complex is a legal agreement provided by a corporation to guarantee certain obligations or commitments made by an individual or entity in the San Diego area. This complex serves as a form of assurance to ensure that financial and contractual obligations are met. The purpose of a Guaranty by Corporation — Complex is to protect parties involved in a transaction or agreement from potential risks or losses. It provides an added layer of assurance that the corporation will step in and fulfill the obligations if the individual or entity fails to do so. In San Diego, there are various types of Guaranty by Corporation — Complex: 1. Real Estate Guaranty: In real estate transactions, a corporation may provide a guaranty to secure the obligations of a borrower or developer. This type of complex is commonly used in mortgage financing, commercial leasing, construction projects, and property development. 2. Financial Guaranty: Financial institutions and corporations may provide guaranties to guarantee the payment obligations of borrowers, issuers of debt, or participants in financial transactions. This helps mitigate the risk associated with lending or investing activities. 3. Performance Guaranty: In contracts or agreements involving the provision of goods or services, a corporation may guarantee the performance of the contracted party. This ensures that the agreed-upon work or deliverables will be completed as per the terms of the agreement. 4. Payment Guaranty: This type of guaranty covers payment obligations of an individual or entity. The corporation agrees to make payments on behalf of the guarantor, ensuring that the agreed-upon payments are made on time and in full. 5. Debt Guaranty: Corporations may provide guaranties to secure loans or debt obligations of individuals or entities. This guarantees the repayment of the debt in the event of default or non-payment by the primary borrower. San Diego California Guaranty by Corporation — Complex is an essential legal tool that ensures parties involved in contractual arrangements are protected and provides an additional level of certainty in transactions. It is crucial for individuals and corporations engaging in various business activities to consider seeking such guaranties to safeguard their interests and mitigate potential risks.

San Diego California Guaranty by Corporation - Complex

Description

How to fill out San Diego California Guaranty By Corporation - Complex?

Creating documents, like San Diego Guaranty by Corporation - Complex, to manage your legal matters is a tough and time-consumming process. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents intended for different cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the San Diego Guaranty by Corporation - Complex template. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading San Diego Guaranty by Corporation - Complex:

- Ensure that your template is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the San Diego Guaranty by Corporation - Complex isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start utilizing our service and get the form.

- Everything looks great on your side? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!