Queens New York Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is a legal document commonly used in Queens, New York to resolve the redemption of stock in a close corporation. This resolution is passed by the board of directors of the corporation to initiate the process of redeeming outstanding shares of stock from shareholders. The purpose of such a resolution is to provide a formal authorization for the redemption of stock, which allows the corporation to repurchase shares from existing shareholders according to predetermined terms, conditions, and pricing. This action is often undertaken to consolidate ownership, reward shareholder loyalty, adjust equity proportions or prepare for a potential merger or acquisition. Key elements included in a Queens New York Resolution of Directors of a Close Corporation Authorizing Redemption of Stock may include: 1. Corporation details: The resolution begins by stating the full legal name of the close corporation and its principal place of business, specifically highlighting that it is located in Queens, New York. 2. Purpose of the resolution: The resolution outlines the purpose of the redemption, which may involve providing liquidity to shareholders, managing capital structure, reducing the number of shareholders, or facilitating changes in ownership ratios. 3. Description of stock to be redeemed: The resolution identifies and describes the class and number of shares to be redeemed, along with any restrictions or conditions associated with the redemption process. 4. Redemption terms and conditions: This section specifies the terms and conditions for the redemption, including the redemption price per share, any applicable payment schedule, the method of payment, and the timeline for completion. 5. Restrictions and limitations: The resolution may include any restrictions or limitations regarding who is eligible for stock redemption, such as limiting it to certain classes of shareholders or specifying that only fully paid-up shares can be redeemed. 6. Authorization and approval: The resolution grants the necessary authority to the officers and employees of the corporation to take any action necessary to effectuate the stock redemption, such as execution of necessary documents and coordination with shareholders. 7. Effective date: The resolution will indicate the effective date upon which the redemption process will commence. Different types or variations of Queens New York Resolution of Directors of a Close Corporation Authorizing Redemption of Stock may exist based on individual corporation requirements and specific circumstances. Some possible variations may include resolutions for partial redemption, contingent redemption, or mandatory redemption as dictated by the corporation's bylaws, shareholder agreements, or applicable laws. It is crucial for close corporations operating in Queens, New York, to seek legal advice and customize the resolution to ensure compliance with local and state laws and address any unique aspects of their corporate structure or shareholder agreements.

Queens New York Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

How to fill out Queens New York Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

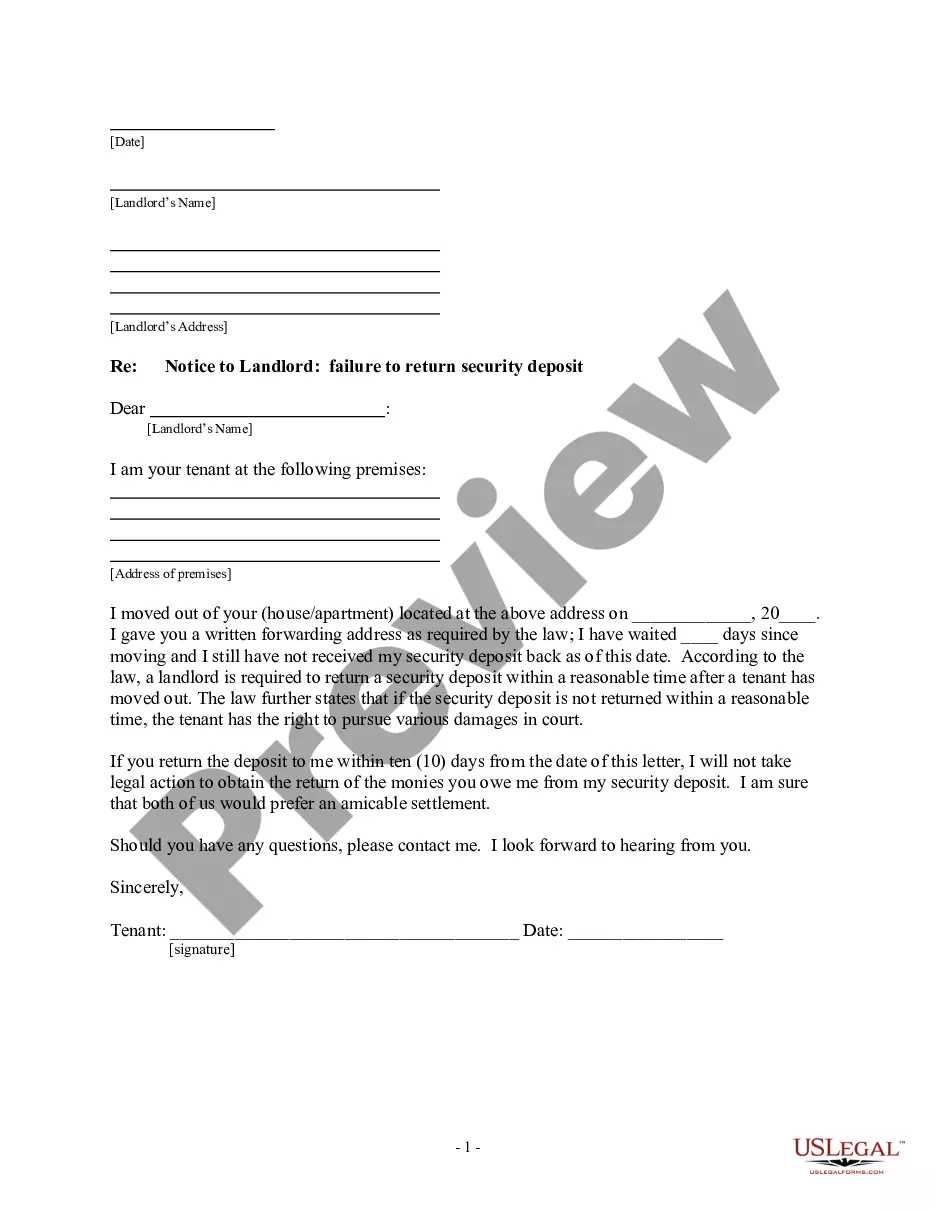

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Queens Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Queens Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Queens Resolution of Directors of a Close Corporation Authorizing Redemption of Stock:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Queens Resolution of Directors of a Close Corporation Authorizing Redemption of Stock and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

Corporate Authorization Documents means (i) the resolutions of the board of directors of the Company (the Board of Directors), in form and substance satisfactory to the Investors, authorizing the transactions contemplated hereby, including, without limitation, the issuance of the Shares and the execution and delivery

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A board of directors is a group of people that act as a governing body on behalf of the shareholders of a company.

A board resolution is sometimes also called a corporate resolution. It's a formal document that solidifies in writing important decisions that boards of directors make. Boards usually write up board resolutions when they appoint new directors to the board.

Shareholders can make decisions about the company by passing a resolution, usually at a meeting. A "special resolution" usually involves more important questions affecting the company as a whole or the rights of some or all of its shareholders. by having all of the shareholders record and sign their decision.

A corporate resolution to open a business bank account is a document that clearly shows the bank who has the authority to start an account on behalf of your corporation. If this information isn't specifically covered in your Articles of Incorporation or bylaws, your bank may require a resolution.

The corporate resolution for signing authority is a specific corporate resolution that authorizes specific corporate officers with the legal standing to sign contracts on behalf of the corporation.

A resolution is a decision approved by the incorporators, shareholders, or management of a corporation. Resolutions can be made during a board meeting, or they can be made by an agreement without a meeting (as long as a written consent to action is obtained from the shareholders or directors involved).

Corporate resolution (also known as a board resolution) is a written legal document, issued by the board of directors of a corporation, documenting a binding decision made on behalf of the corporation.

A Directors' Resolution is an official internal document for a corporation describing a decision or an action of the board of directors. Where a Directors' meeting can not be held the same matters can be authorized by a Directors' resolution that is signed by all the Directors.