Travis Texas Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is a formal document that outlines the specific details associated with the redemption of company stock held by a close corporation. This resolution is typically passed by the board of directors of the corporation and includes crucial information regarding the redemption process, stockholder eligibility, and any applicable terms and conditions. The redemption of stock is a significant event for the corporation as it involves repurchasing and canceling outstanding shares owned by stockholders, thereby reducing the total number of shares in circulation. This can be done for various reasons, such as retiring the shares, consolidating ownership, or managing the financial structure of the corporation. When drafting a Travis Texas Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it is crucial to include relevant details such as the purpose of the redemption, the total number of shares to be redeemed, the redemption price, and any specific conditions or limitations associated with the redemption process. It is also essential to specify the timeframe within which the stockholders can submit their shares for redemption and the method of payment for the redeemed shares. Different types of Travis Texas Resolution of Directors of a Close Corporation Authorizing Redemption of Stock may include specific variations based on the preferences and requirements of the corporation. For example, there could be resolutions for: 1. Partial Redemption: This type of resolution allows the corporation to repurchase only a portion of the outstanding shares, as opposed to redeeming all the shares held by stockholders. 2. Voluntary Redemption: This resolution outlines the process by which stockholders can voluntarily submit their shares for redemption, typically at a predetermined price or within a specified timeframe. 3. Mandatory Redemption: In certain situations, the corporation may have the right or obligation to redeem shares. This resolution outlines the circumstances under which such mandatory redemption may occur, such as non-compliance with certain stockholder agreements or upon the occurrence of specific events. 4. Conditional Redemption: This type of resolution establishes certain conditions or criteria that must be met for the redemption to take place. These conditions may include financial performance targets, the occurrence of specific events, or the approval of a majority of stockholders. Overall, a Travis Texas Resolution of Directors of a Close Corporation Authorizing Redemption of Stock serves as a legally binding document that ensures the redemption process is conducted smoothly and transparently, protecting the interests of both the corporation and its stockholders.

Travis Texas Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

How to fill out Travis Texas Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a lawyer to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Travis Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario collected all in one place. Therefore, if you need the latest version of the Travis Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Travis Resolution of Directors of a Close Corporation Authorizing Redemption of Stock:

- Glance through the page and verify there is a sample for your region.

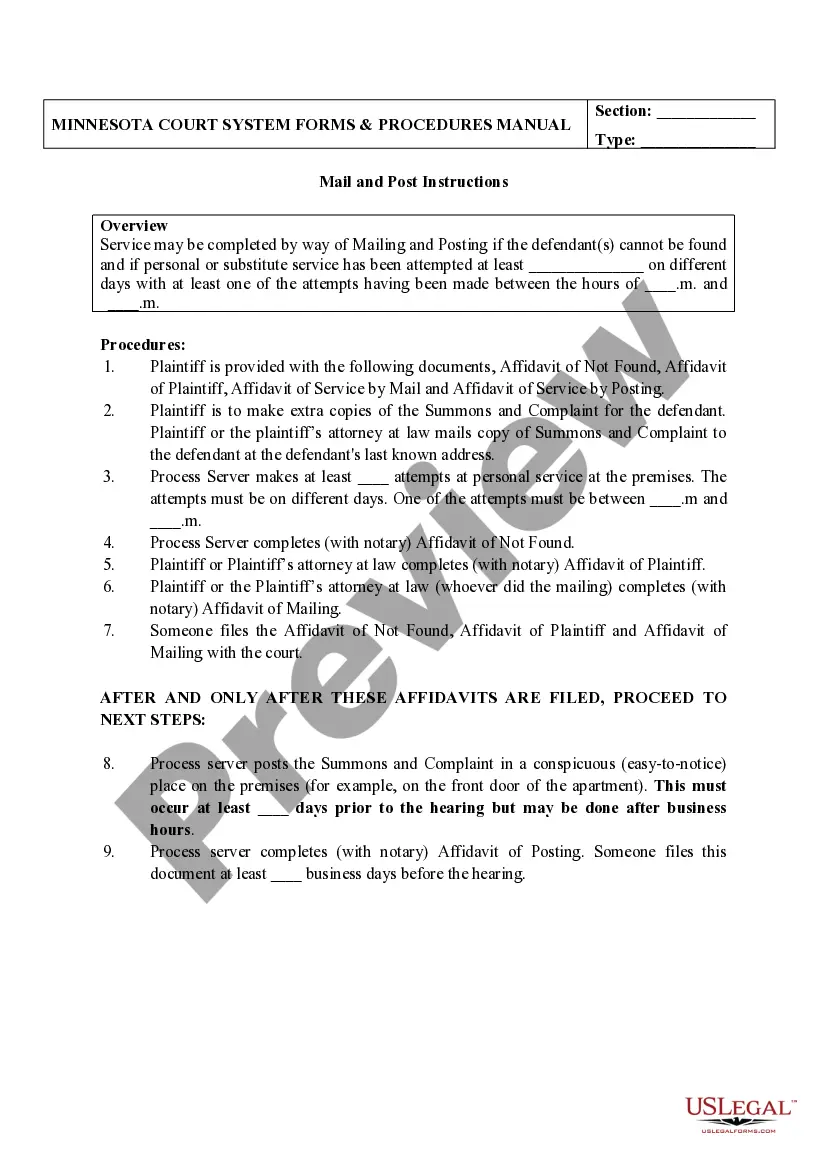

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Travis Resolution of Directors of a Close Corporation Authorizing Redemption of Stock and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!