Hennepin Minnesota Affidavit of Domicile for Deceased

Description

How to fill out Affidavit Of Domicile For Deceased?

Do you require to swiftly generate a legally-enforceable Hennepin Affidavit of Domicile for the Deceased or perhaps another document to manage your personal or business affairs.

You can choose between two alternatives: engage a legal professional to prepare a legal document for you or create it entirely by yourself.

First, verify if the Hennepin Affidavit of Domicile for Deceased is compliant with your state's or county's regulations.

If the form has a description, ensure to check what it is intended for.

- Fortunately, there's an additional option - US Legal Forms.

- It will assist you in obtaining well-drafted legal documents without having to incur excessive fees for legal services.

- US Legal Forms features an extensive catalog of over 85,000 state-compliant form templates, including the Hennepin Affidavit of Domicile for the Deceased and form bundles.

- We provide documents for a wide range of life situations: from divorce filings to real estate agreements.

- We've been in operation for over 25 years and have earned an impeccable reputation among our clients.

- Here's how you can join them and acquire the required template without unnecessary difficulties.

Form popularity

FAQ

Whose responsibility is it to get probate? If the person who died left a valid will, this will name one or more executors, and it is their responsibility to apply for probate. If there isn't a will, then inheritance rules called the rules of intestacy will determine whose responsibility it is to get probate.

When Is Probate Necessary? Probate laws in Minnesota apply to the estates of people who were residents of Minnesota at the time of their death. Probate also applies to other states' residents who own real property in Minnesota. Having a will does not avoid probate.

Probate is a legal process to settle the estate of a person who died (a decedent). In probate, a court appoints a personal representative to administer the decedent's estate.

Settling an Estate in Minnesota A petition is filed with the court to open probate for the estate.The executor will find and inventory all assets, appraising anything of significant value. The executor will notify creditors and pay any debts.The executor will file any tax returns needed and pay the taxes owed.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Non-probate assets are automatically transferred to a beneficiary or heir upon death....Typical examples of non-probate property include: Life insurance policies; Joint tenancy properties; P.O.D. accounts; Trust properties; Property with a Transfer on Death Deed; and. Retirement accounts.

To start a probate case, a petition or application must be filed with the court and a personal representative must be appointed by a court order. The personal representative is responsible for the following: Collection, inventory, and appraisal of assets of the person who has died. Protection of the estate's assets.

In Minnesota, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

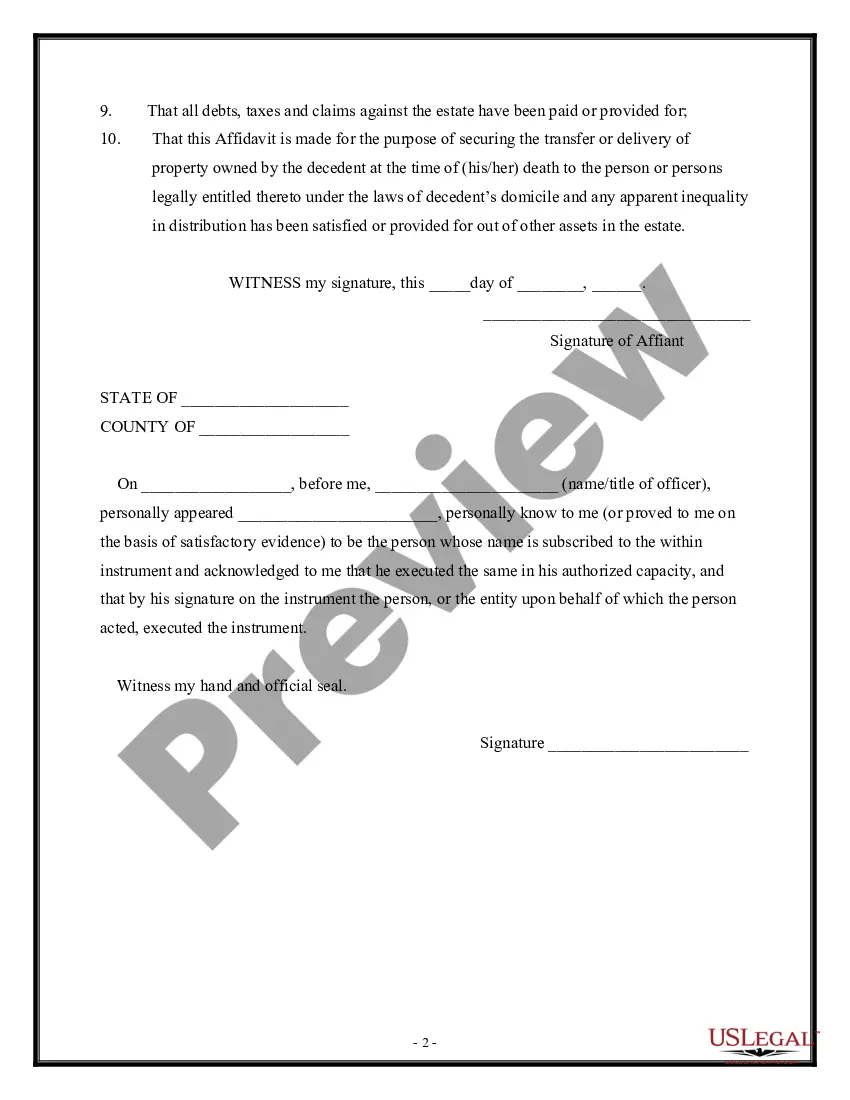

How to Write (1) Name Of Minnesota Deceased.(2) County Of Minnesota Deceased.(3) Name of Minnesota Petitioner.(4) Address Of Minnesota Petition. (5) Date Of Minnesota Decedent Death.(6) Basis For Minnesota Petitioner Claim.(7) Minnesota Decedent Estate Assets.(8) Signature Date Of Minnesota Petitioner.