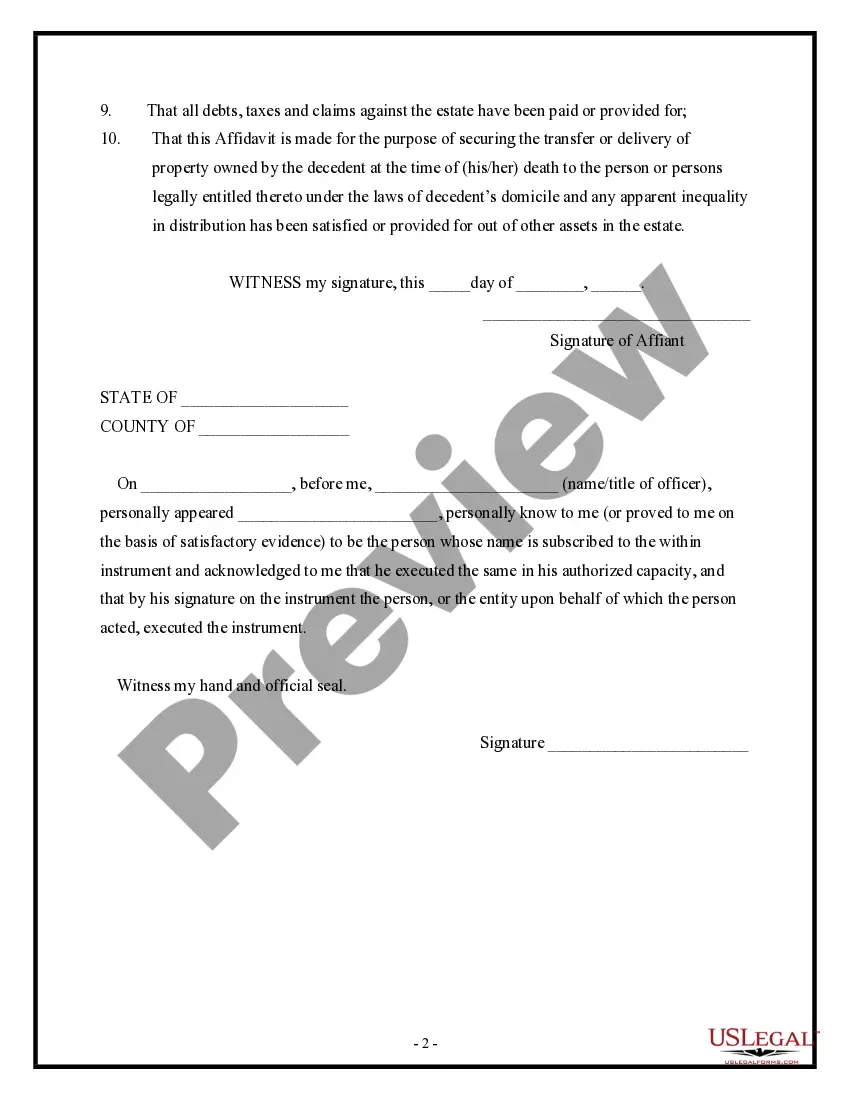

The Wake North Carolina Affidavit of Domicile is a legal document that serves to confirm an individual's primary residence within the county. It is an essential form used in various situations, such as property transfers, estate settlements, or tax purposes. This affidavit is required to establish residency within Wake County, North Carolina, and is commonly used in cases where an individual needs to prove their domicile or the place where they permanently reside. The Wake North Carolina Affidavit of Domicile typically includes key information such as the individual's full legal name, address, and contact details. Additionally, it requires the individual to declare that their primary residence is located within Wake County and that they have no intention of abandoning or changing it. This statement helps affirm that the individual considers Wake County their permanent home. Different types of Wake North Carolina Affidavit of Domicile may exist depending on the specific purpose or department within the county. Some potential variations may include: 1. Wake County Property Transfer Affidavit of Domicile: This affidavit is required when transferring or selling property within Wake County. It confirms that the seller or transferring party is a resident of Wake County and legally entitled to sell the property. 2. Wake County Estate Settlement Affidavit of Domicile: This particular affidavit is used during the settlement of an estate. It helps establish the domicile of the deceased individual, determining the appropriate jurisdiction for estate administration and probate processes. 3. Wake County Tax Affidavit of Domicile: This affidavit is crucial for tax-related matters, such as claiming residency-based tax exemptions or credits. It serves as proof of domicile within Wake County for tax purposes. Overall, the Wake North Carolina Affidavit of Domicile is a vital legal document that verifies an individual's residency within the county. It helps ensure accurate record-keeping, protects the rights of individuals in property transactions or estate settlements, and assists in tax-related matters.

Affidavit Of Domicile

Description

How to fill out Wake North Carolina Affidavit Of Domicile?

If you need to get a reliable legal document supplier to obtain the Wake Affidavit of Domicile, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can browse from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning resources, and dedicated support team make it easy to get and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Wake Affidavit of Domicile, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Wake Affidavit of Domicile template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Wake Affidavit of Domicile - all from the comfort of your home.

Join US Legal Forms now!