Allegheny Pennsylvania Credit Card Application for Unsecured Open End Credit is a financial service provided by various banks and financial institutions operating in Allegheny County, Pennsylvania. This type of credit card application for unsecured open-end credit aims to offer residents of Allegheny County a convenient and flexible line of credit for their everyday expenses and emergency needs. These credit card applications are designed to cater to different individuals' financial requirements, providing them with a purchasing power that can be used at various merchants, both online and offline. It offers a revolving credit limit, allowing cardholders to make purchases and repay the amount over time. There are several types of Allegheny Pennsylvania Credit Card Applications for Unsecured Open End Credit, including: 1. Standard Credit Cards: These are regular credit cards that come with a predetermined credit limit based on the individual's creditworthiness. After successfully applying and receiving approval, the applicant can use the card within the predefined limit. The cardholder will be required to make monthly minimum payments based on their outstanding balance. 2. Rewards Credit Cards: These credit cards provide additional benefits and rewards for cardholders. Rewards can range from cashback, travel points, or discounts on specific purchases. These rewards can be earned for every purchase made using the credit card, encouraging cardholders to utilize their cards more frequently. 3. Student Credit Cards: Designed specifically for students, these credit cards offer a lower credit limit and often come with educational resources to help young individuals understand and manage their finances responsibly. These credit cards can be beneficial for building credit history and managing expenses during their studies. 4. Secured Credit Cards: For individuals with limited or poor credit history, secured credit cards offer a means to rebuild or establish credit. These cards require a security deposit upfront, serving as collateral in the event of defaulting on payments. This type of credit card application can be an excellent option for individuals looking to improve their creditworthiness. To apply for an Allegheny Pennsylvania Credit Card Application for Unsecured Open End Credit, interested individuals usually need to provide their personal information, financial details, and proof of income. The application process typically involves a credit check to determine the applicant's creditworthiness. Overall, Allegheny Pennsylvania Credit Card Application for Unsecured Open End Credit aims to provide financial flexibility and convenience for residents of Allegheny County, assisting them in managing their expenses and building creditworthiness. It is essential to compare different credit card options, interest rates, fees, and rewards offered by various financial institutions before choosing the credit card that suits an individual's needs and financial situation best.

Allegheny Pennsylvania Credit Card Application for Unsecured Open End Credit

Description

How to fill out Allegheny Pennsylvania Credit Card Application For Unsecured Open End Credit?

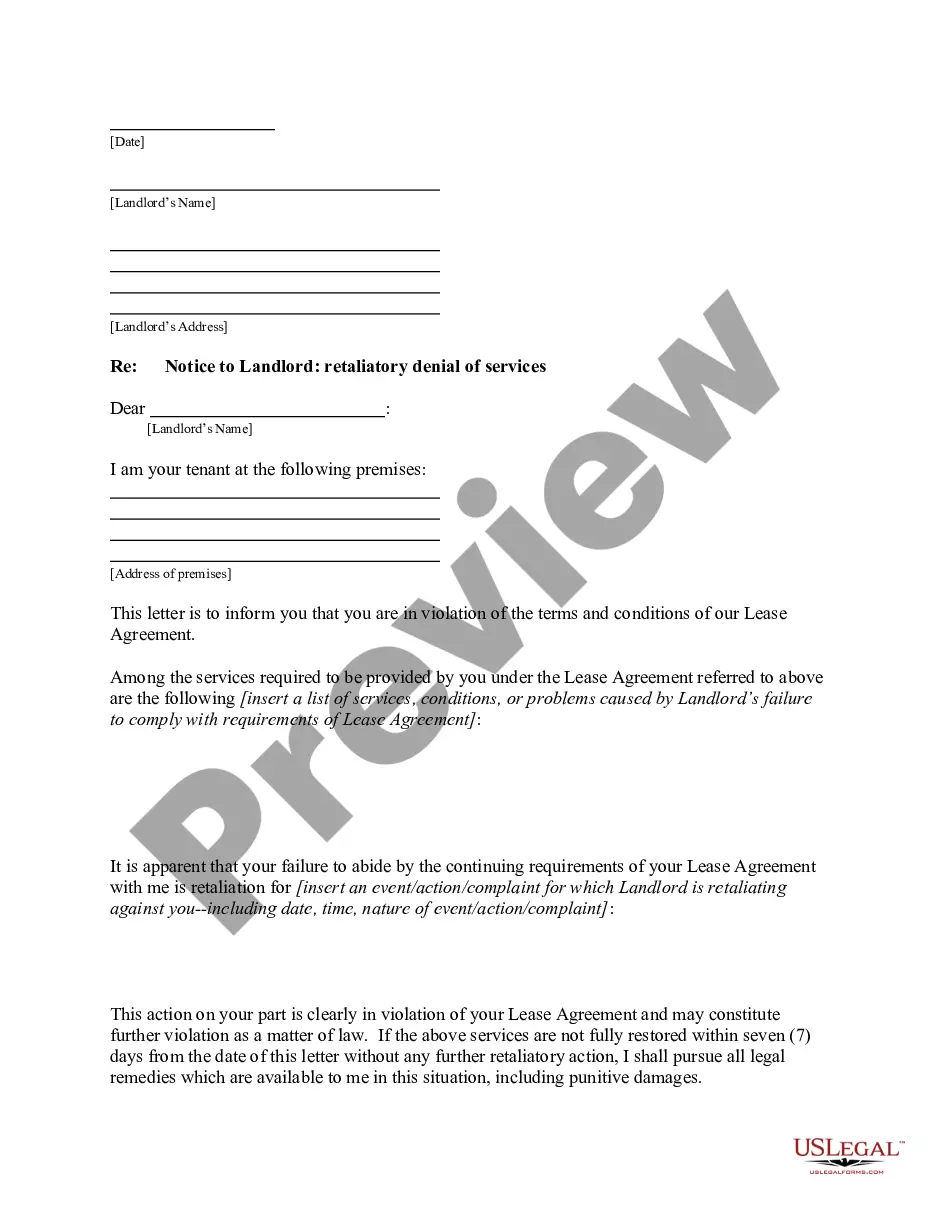

Do you need to quickly draft a legally-binding Allegheny Credit Card Application for Unsecured Open End Credit or probably any other document to take control of your personal or business affairs? You can select one of the two options: hire a legal advisor to draft a legal document for you or draft it completely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get professionally written legal paperwork without paying sky-high prices for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific document templates, including Allegheny Credit Card Application for Unsecured Open End Credit and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra troubles.

- To start with, carefully verify if the Allegheny Credit Card Application for Unsecured Open End Credit is adapted to your state's or county's regulations.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Allegheny Credit Card Application for Unsecured Open End Credit template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Moreover, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!