Clark Nevada Credit Card is a renowned financial institution that provides individuals with the opportunity to apply for an unsecured open-end credit card. This credit card application is designed to offer customers the freedom and flexibility to make purchases and manage their finances efficiently. With competitive interest rates, generous credit limits, and a wide range of benefits, this credit card option has become a popular choice among consumers. The Clark Nevada Credit Card Application for Unsecured Open End Credit is a straightforward and user-friendly process. Applicants can access the application online or visit a branch in person to begin the process. The application requires individuals to provide personal information such as their name, address, contact details, Social Security number, and employment information. Upon completion of the application, applicants undergo a comprehensive credit evaluation process to determine their eligibility for the Clark Nevada Credit Card. Credit history, income, and debt-to-income ratio are some factors considered during the evaluation. This process helps Clark Nevada ensure responsible lending practices and offer credit limits that align with each applicant's financial profile. Once the application is approved, applicants receive their Clark Nevada Unsecured Open End Credit Card, which can be used to make purchases at millions of locations worldwide. Cardholders also have the option to access cash advances from ATMs or transfer balances from other credit cards, subject to certain terms and conditions. The Clark Nevada Credit Card for Unsecured Open End Credit includes various types, each tailored to meet specific customer needs: 1. Clark Nevada Rewards Credit Card: This type of credit card enables users to earn rewards points for every dollar spent. These points can be redeemed for travel, merchandise, gift cards, or cashback, providing additional value to cardholders. 2. Clark Nevada Cashback Credit Card: With this credit card, users can earn cashback rewards on their purchases. This allows cardholders to receive a percentage of their spending back as a cash reward, helping them save money or pay off their balance more quickly. 3. Clark Nevada Travel Credit Card: Designed for frequent travelers, this credit card offers exclusive travel benefits such as airline miles, hotel discounts, and travel insurance. Cardholders can take advantage of these perks to enhance their travel experiences while managing their expenses effectively. 4. Clark Nevada Student Credit Card: Specifically designed for college students, this credit card helps young individuals establish credit while providing features and rewards suitable for their unique needs. It offers convenient financial management tools and encourages responsible spending habits. 5. Clark Nevada Secured Credit Card: This type of credit card is available to individuals who may have limited or poor credit history. By providing a security deposit, applicants can obtain this card and start rebuilding their credit. Responsible usage and timely payments can improve credit scores over time. Overall, the Clark Nevada Credit Card Application for Unsecured Open End Credit offers individuals a reliable and rewarding financial solution. Whether seeking rewards, cashback, or unique benefits tailored to specific lifestyles, individuals can choose the type of credit card that best suits their needs and financial goals.

Clark Nevada Credit Card Application for Unsecured Open End Credit

Description

How to fill out Clark Nevada Credit Card Application For Unsecured Open End Credit?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Clark Credit Card Application for Unsecured Open End Credit without expert assistance.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Clark Credit Card Application for Unsecured Open End Credit by yourself, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Clark Credit Card Application for Unsecured Open End Credit:

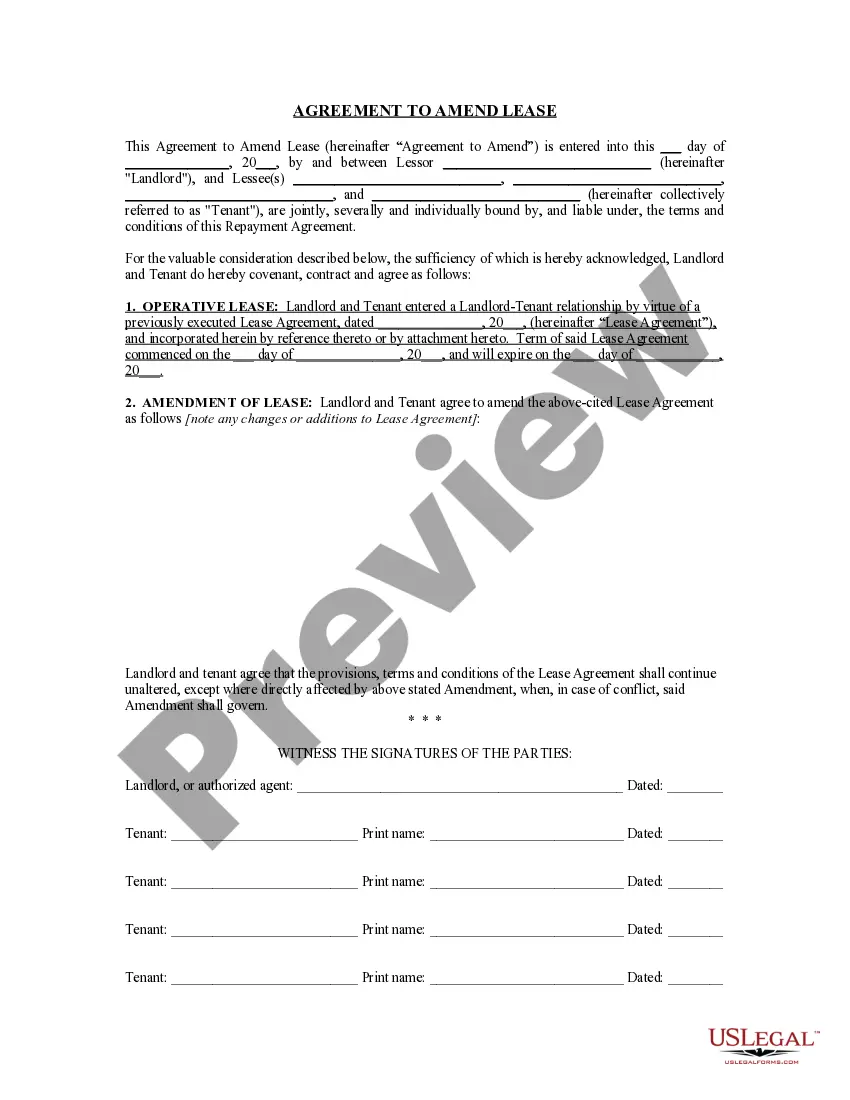

- Examine the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal forms for any scenario with just a couple of clicks!