Cook Illinois Credit Card Application for Unsecured Open End Credit is a financial service provided by Cook Illinois, a trusted financial institution. This credit card application offers individuals the opportunity to access unsecured open-end credit, allowing them to make purchases and payments conveniently, without the need for collateral or a specific spending limit. With Cook Illinois Credit Card Application for Unsecured Open End Credit, customers can enjoy the flexibility of a revolving credit line that can be used for various purchases, including everyday expenses, travel expenses, shopping, and more. This credit card application is designed to cater to individuals who seek financial convenience and flexibility in managing their expenses. One of the key features of the Cook Illinois Credit Card Application for Unsecured Open End Credit is the absence of the need for collateral, providing customers the freedom to utilize their credit line without risking their assets. Additionally, the open-end credit feature allows customers to carry outstanding balances, pay the minimum amount due, and carry forward their remaining balance to the next billing cycle. This can be especially beneficial for individuals who prefer to manage their debt more flexibly. The Cook Illinois Credit Card Application for Unsecured Open End Credit offers competitive interest rates, depending on factors such as credit history and creditworthiness. Customers can also enjoy added benefits such as cashback rewards, travel incentives, and exclusive discounts from partner merchants. These additional perks make the credit card application an attractive option for those who want to save money and enjoy value-added benefits. Different types of Cook Illinois Credit Card Application for Unsecured Open End Credit may include various membership tiers, each offering different benefits and rewards. For example, some tiers could provide higher cashback percentages, extended warranty on purchases, or concierge services. These different tiers allow individuals to choose the one that best suits their financial needs and spending habits. In conclusion, Cook Illinois Credit Card Application for Unsecured Open End Credit provides individuals with a convenient and flexible way to access unsecured credit. With its range of benefits, including no need for collateral, competitive interest rates, and additional perks, this credit card application is an excellent choice for individuals looking for financial flexibility and rewards.

Cook Illinois Credit Card Application for Unsecured Open End Credit

Description

How to fill out Cook Illinois Credit Card Application For Unsecured Open End Credit?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Cook Credit Card Application for Unsecured Open End Credit.

Locating samples on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Cook Credit Card Application for Unsecured Open End Credit will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Cook Credit Card Application for Unsecured Open End Credit:

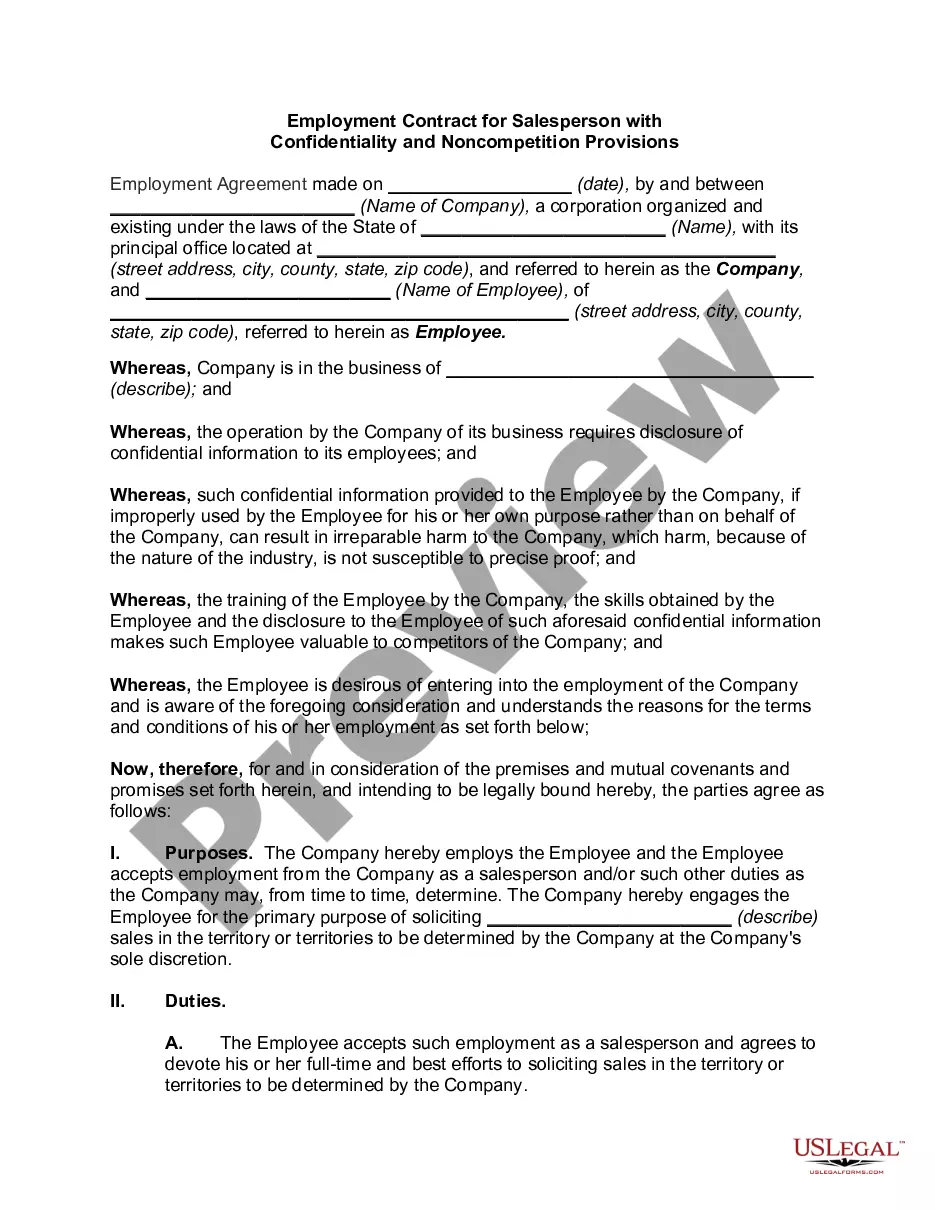

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Cook Credit Card Application for Unsecured Open End Credit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!