Maricopa, Arizona Credit Card Application for Unsecured Open End Credit The Maricopa, Arizona Credit Card Application for Unsecured Open End Credit is a convenient and flexible financial tool that allows individuals to access funds for their personal or business needs. This credit card application can be obtained from various financial institutions based in Maricopa, Arizona. By completing the application process, individuals can apply for an unsecured open-end credit card, which means that it offers a revolving line of credit without requiring any collateral. When applying for the Maricopa, Arizona Credit Card Application for Unsecured Open End Credit, individuals are typically required to provide personal and financial information. This information ensures that the financial institution can assess the applicant's creditworthiness and determine an appropriate credit limit. The application form may encompass details such as the individual's full name, contact information, date of birth, social security number, employment status, income details, and any existing debts or liabilities. The Maricopa, Arizona Credit Card Application for Unsecured Open End Credit offers individuals the flexibility to make purchases, pay bills, and withdraw cash within the approved credit limit. Users have the freedom to revolve the balance by making minimum monthly payments or pay off the full amount. Making timely payments towards the credit card helps in building a positive credit history, which can be beneficial for future financial endeavors. It is important to note that there may be different types of Maricopa, Arizona Credit Card Applications for Unsecured Open End Credit available from various financial institutions. These types may include offerings specific to different credit card providers, each presenting its unique benefits, rewards, interest rates, and fees. Some common types of credit cards individuals can apply for may include: 1. Maricopa, Arizona Cashback Credit Card: This type of credit card offers a certain percentage of cashback on eligible purchases, allowing individuals to save money while making essential transactions. 2. Maricopa, Arizona Rewards Credit Card: This type of credit card provides individuals with rewards points or miles for every dollar spent. These rewards can often be redeemed for merchandise, travel bookings, or other valuable perks. 3. Maricopa, Arizona Low-Interest Credit Card: This type of credit card offers a lower annual percentage rate (APR) compared to others, making it an ideal choice for those seeking to minimize interest charges on purchases or balance transfers. 4. Maricopa, Arizona Secured Credit Card: Although not falling under the unsecured open-end credit category, individuals with limited or poor credit history may opt for a secured credit card to build or rebuild their credit. This type requires a cash deposit that serves as collateral for the credit limit. When applying for any of these Maricopa, Arizona Credit Card Applications for Unsecured Open End Credit, it is crucial to review the terms and conditions, interest rates, and fees associated with each card. Careful consideration of these factors ensures that individuals select the credit card that best suits their financial needs and goals.

Maricopa Arizona Credit Card Application for Unsecured Open End Credit

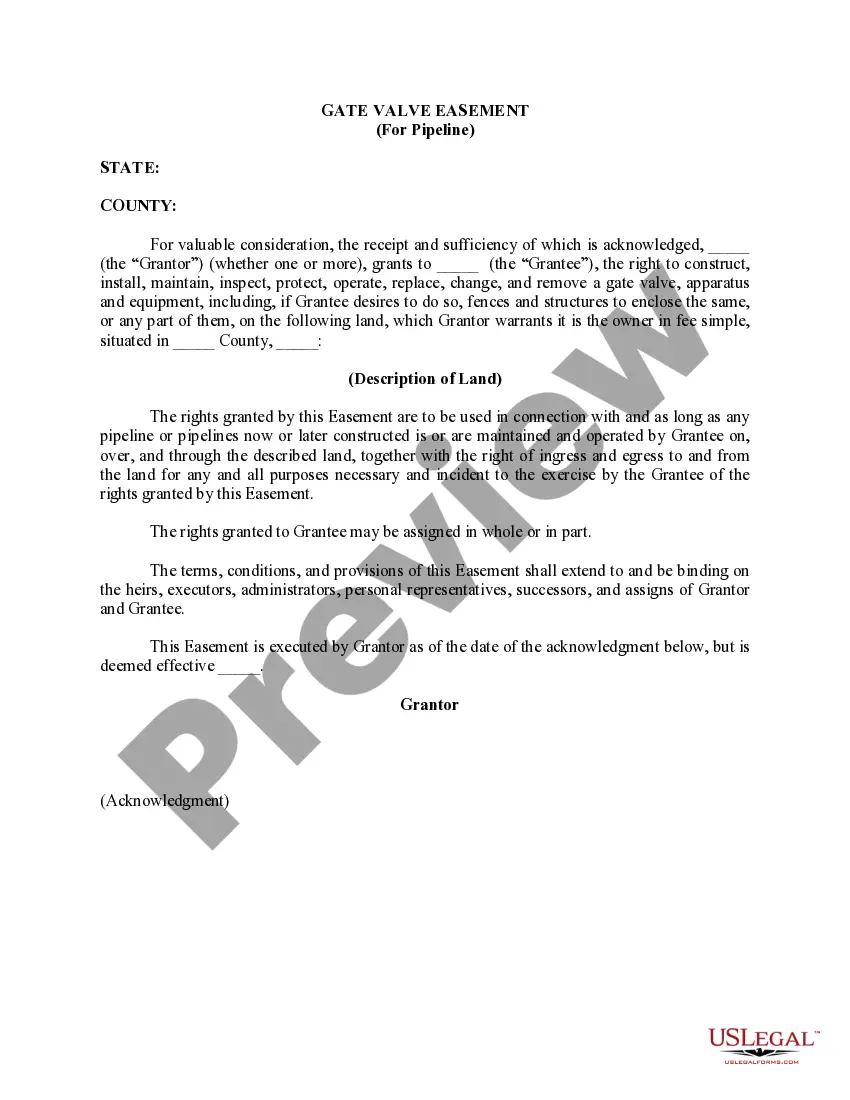

Description

How to fill out Maricopa Arizona Credit Card Application For Unsecured Open End Credit?

If you need to get a trustworthy legal paperwork supplier to find the Maricopa Credit Card Application for Unsecured Open End Credit, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support team make it simple to get and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to look for or browse Maricopa Credit Card Application for Unsecured Open End Credit, either by a keyword or by the state/county the document is intended for. After finding the required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Maricopa Credit Card Application for Unsecured Open End Credit template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and select a subscription option. The template will be immediately ready for download as soon as the payment is processed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Maricopa Credit Card Application for Unsecured Open End Credit - all from the comfort of your home.

Join US Legal Forms now!