Wake North Carolina Credit Card Application for Unsecured Open End Credit is an application process specifically designed for residents of Wake, North Carolina, who are interested in obtaining an unsecured credit card with an open-end credit line. This credit card application is facilitated by financial institutions based in the Wake area, offering a range of credit card options to suit different needs and preferences. Unsecured credit cards are a popular choice among individuals who do not wish to provide collateral or a cash deposit in order to obtain a credit line. With an unsecured credit card, cardholders can access a predetermined credit limit that can be used for various purchases and expenses. The Wake North Carolina Credit Card Application for Unsecured Open End Credit allows individuals to apply for a credit card conveniently and securely. The application process typically involves providing personal information such as name, address, social security number, employment details, and income verification. Financial institutions offering these credit cards may offer various types to cater to diverse customer requirements. Some different types of Wake North Carolina Credit Card Applications for Unsecured Open End Credit may include: 1. Rewards Credit Cards: These cards offer users the opportunity to earn rewards for every dollar spent on eligible purchases. Rewards can be in the form of cashback, travel miles, points, or discounts on specific products or services. 2. Low-Interest Credit Cards: These cards are ideal for individuals looking to minimize interest costs. They usually feature lower interest rates than other credit cards, helping cardholders save money on interest fees. 3. Student Credit Cards: Designed specifically for students, these credit cards offer features and benefits tailored to this demographic, such as lower credit limits and rewards relevant to student spending habits, such as discounts on textbooks or campus supplies. 4. Secured Credit Cards: Although not truly unsecured, these cards are designed for individuals who may not qualify for a standard unsecured credit card due to a limited credit history or poor credit score. A cash deposit is required as collateral, which typically determines the card's credit limit. 5. Business Credit Cards: These cards cater to the needs of business owners and offer features specifically designed for business use, such as expense tracking tools, employee card management, and business-specific rewards. By providing a variety of credit card options, the Wake North Carolina Credit Card Application for Unsecured Open End Credit aims to accommodate the diverse needs and preferences of Wake residents, assisting them in building credit, managing finances, and accessing credit for various purposes.

Wake North Carolina Credit Card Application for Unsecured Open End Credit

Description

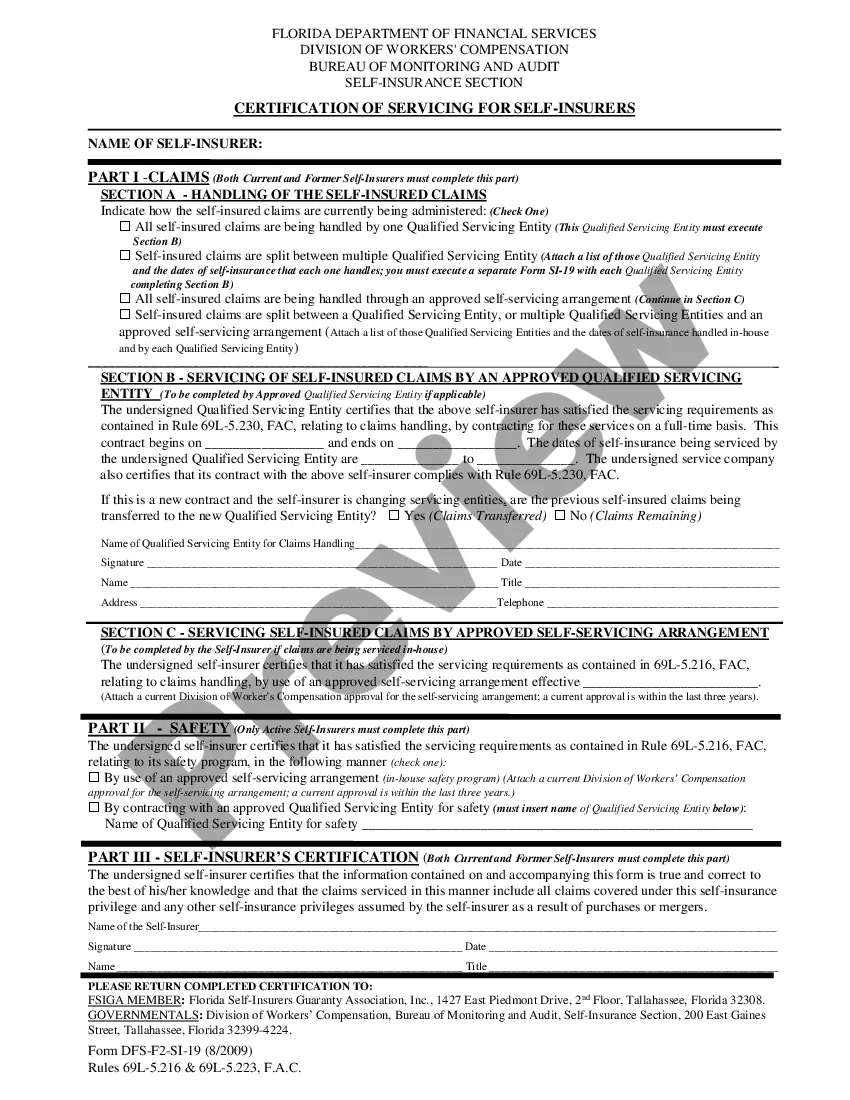

How to fill out Wake North Carolina Credit Card Application For Unsecured Open End Credit?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Wake Credit Card Application for Unsecured Open End Credit, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Therefore, if you need the latest version of the Wake Credit Card Application for Unsecured Open End Credit, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wake Credit Card Application for Unsecured Open End Credit:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Wake Credit Card Application for Unsecured Open End Credit and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

Here are the best credit cards for a 587 credit score: InfoSponsored Capital One Platinum Secured Credit CardSponsored Citi® Secured Mastercard®Regular APR26.99% (V)23.24% (V)Editors' Rating54.6Details, Rates & FeesLearn MoreLearn MoreWinnersCapital One Platinum Secured Credit Card5 more rows

An unsecured credit card is one that does not require a security deposit or any other collateral to open the account. In addition, rebuilding credit generally means you have a credit score of less than 640. In that case, most unsecured cards that you may qualify for will be costly.

Regulation Z generally prohibits a card issuer from opening a credit card account for a consumer, or increasing the credit limit applicable to a credit card account, unless the card issuer considers the consumer's ability to make the required payments under the terms of such account.

Credit cards you can get with a 500 credit score Capital One Platinum Secured Credit Card: No credit history.Petal 1 No Annual Fee Visa: No credit history.Discover it Secured: No credit history.Petal 2 Cash Back, No Fees Visa: No credit history.Mission Lane Visa: Bad to fair (300-670)

Yes, you can get an unsecured credit card with a 500 credit score, though it's probably not the best idea. It's harder to get approved for such a card, and it typically involves high fees, high interest rates, and little spending power.

Open-end credit examples Home equity lines of credit, or HELOCs. Department store credit cards. Service station credit cards. Bank-issued credit cards. Overdraft protection for checking accounts.

Most unsecured credit cards require credit in the good to excellent range (670-850). This range is where you'll become eligible for many different kinds of rewards cards. You can also find some cards that will accept a score in the fair to good range (580-669).

The following are all types of open-end credit: Home equity lines of credit, or HELOCs. Department store credit cards. Service station credit cards. Bank-issued credit cards. Overdraft protection for checking accounts.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due. The preapproved amount will be set out in the agreement between the lender and the borrower.

Credit cards and auto loans offer the best approval odds for someone with a 500 credit score. For example, people with credit scores below 580 take out roughly 12% of car loans versus only 6% of mortgages, according to 2017 Equifax data.

More info

Find great credit repair companies near you. Get free credit reports all the time. But it's much easier to do it without a subscription. Visit sites with free credit reports. Or, get free credit repair services from free credit repair companies near you. You decide, what matters to you best. #16. Learn about what other people can do about their credit. If you want to take a look what other people can do about their credit, you can find ways to pay off accounts and other debts on your own. #17. Don't worry about losing your personal information from your credit reporting. There is no need to worry about being penalized for it — but it would be foolish to assume your credit information is private. Learn more about the privacy of your personal information from us and the other top credit bureaus. #18. Become a financial expert. If you spend enough time learning about personal finance, you'll learn about things like compound interest, tax planning, and investing.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.