Wayne Michigan Credit Card Application for Unsecured Open End Credit allows individuals residing in Wayne, Michigan to apply for a credit card that offers flexible repayment options and no collateral requirements. This type of credit card is available for general consumer use and is not linked to any specific merchant or retailer. Open End Credit refers to a revolving line of credit where the borrower can utilize funds up to a pre-approved credit limit, repay them periodically, and then reuse the available credit as needed. It provides users with the convenience of being able to make purchases or handle unforeseen expenses without having to rely solely on cash or their checking accounts. The Wayne Michigan Credit Card Application for Unsecured Open End Credit typically includes various sections such as personal information, employment details, income verification, and credit history. Applicants are required to provide their full name, address, social security number, contact information, and date of birth. This information is necessary to determine the applicant's identity and assess their creditworthiness. Additionally, applicants must provide employment details, including their job title, employer name, duration of employment, and income information. Proof of income may be required through recent pay stubs, bank statements, or tax documents to verify the applicant's ability to repay the credit card debt. The credit history section of the application is crucial in evaluating the applicant's financial habits and responsible repayment behavior. It includes details about existing credit cards, loans, mortgages, and any delinquencies, bankruptcies, or legal judgments. A good credit score increases the likelihood of approval and may lead to better terms and interest rates. While there may not be specific variations of the Wayne Michigan Credit Card Application for Unsecured Open End Credit, different credit card issuers may offer various benefits and features. These can include rewards programs, cash-back incentives, travel perks, low introductory interest rates, or no annual fees. Applicants should research and compare different credit card options before making a decision to find the one that best suits their financial needs and preferences. Overall, the Wayne Michigan Credit Card Application for Unsecured Open End Credit provides residents of Wayne, Michigan with a flexible financial tool that helps build credit, provides convenience, and offers financial security in case of emergencies or unexpected expenses.

Wayne Michigan Credit Card Application for Unsecured Open End Credit

Description

How to fill out Wayne Michigan Credit Card Application For Unsecured Open End Credit?

Whether you plan to start your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Wayne Credit Card Application for Unsecured Open End Credit is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Wayne Credit Card Application for Unsecured Open End Credit. Adhere to the guide below:

- Make certain the sample meets your personal needs and state law requirements.

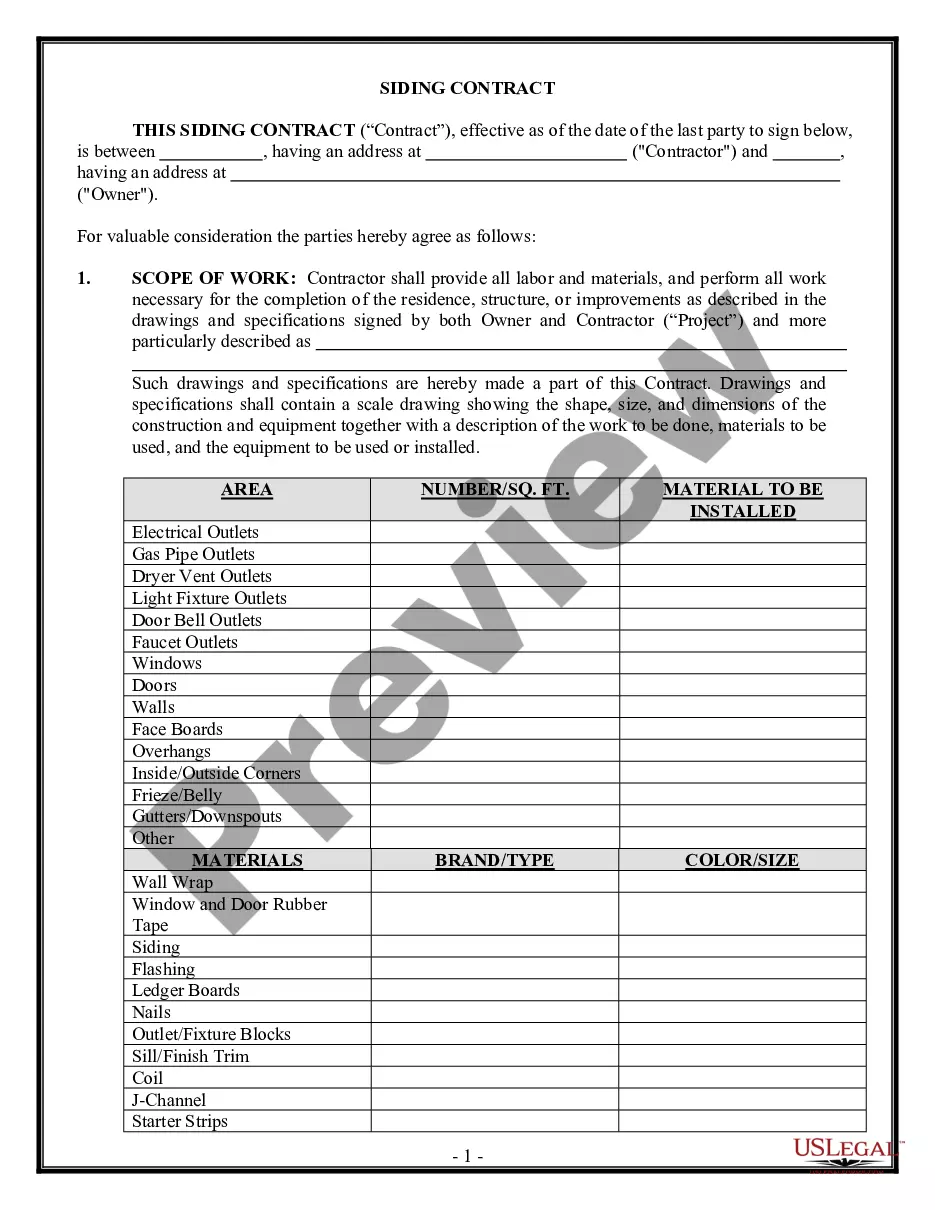

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Credit Card Application for Unsecured Open End Credit in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!