San Diego California Credit Card Application with Bonus Features on Using Card: A credit card application in San Diego, California offers a range of bonus features that can enhance your overall credit card experience. Whether you're a frequent traveler, a shopping enthusiast, or someone who wants to maximize rewards, these credit cards are designed to meet your needs. 1. Travel Rewards Credit Cards: San Diego offers credit cards with bonus features specifically tailored for travel enthusiasts. These cards often provide generous sign-up bonuses, allowing you to earn a significant number of travel points or miles upon approval. Additionally, they offer perks like travel insurance, airport lounge access, and priority boarding. These cards are perfect for individuals who frequently travel within or outside of San Diego. 2. Cashback Credit Cards: For those who prefer earning cashback rewards, San Diego presents credit card applications with bonus features focused on cashback offers. With these cards, you can earn a certain percentage of cashback on every purchase made using the card. Some cards even provide higher cashback rates for specific categories such as dining, gas, or groceries. This feature is especially attractive for individuals who wish to save money while making everyday purchases in San Diego. 3. Rewards Credit Cards: San Diego credit card applications provide rewards credit cards aimed at customers who enjoy accumulating points for everyday purchases. These cards offer points on every transaction, which can be redeemed for a variety of options like merchandise, gift cards, or travel rewards. Some cards have partnerships with popular retailers and brands, allowing you to earn bonus points for shopping at specific stores in San Diego. 4. Balance Transfer Credit Cards: San Diego credit card applications also include balance transfer cards that offer bonus features specifically designed to help individuals manage their existing credit card debt. These cards often provide low or zero percent introductory APR on balance transfers, allowing you to consolidate your debts onto one card and save on interest payments. This feature can be useful for San Diego residents looking to pay off credit card balances quickly. 5. Student Credit Cards: San Diego credit card applications even cater to students by offering credit cards designed specifically for their needs. These cards often provide bonus features such as cashback rewards on categories like textbooks and school supplies, as well as tools for building credit. They usually have lower credit limits to help students manage their spending responsibly while establishing a good credit score. When considering a San Diego California Credit Card Application with Bonus Features on Using Card, analyze your spending habits and goals to choose the card that aligns best with your needs. Research the terms and conditions, such as interest rates, annual fees, and promotional offers, before making a decision. With the right credit card, you can make the most of San Diego's vibrant lifestyle while enjoying the benefits and rewards tailored to your preferences.

San Diego California Credit Card Application with Bonus Features on Using Card

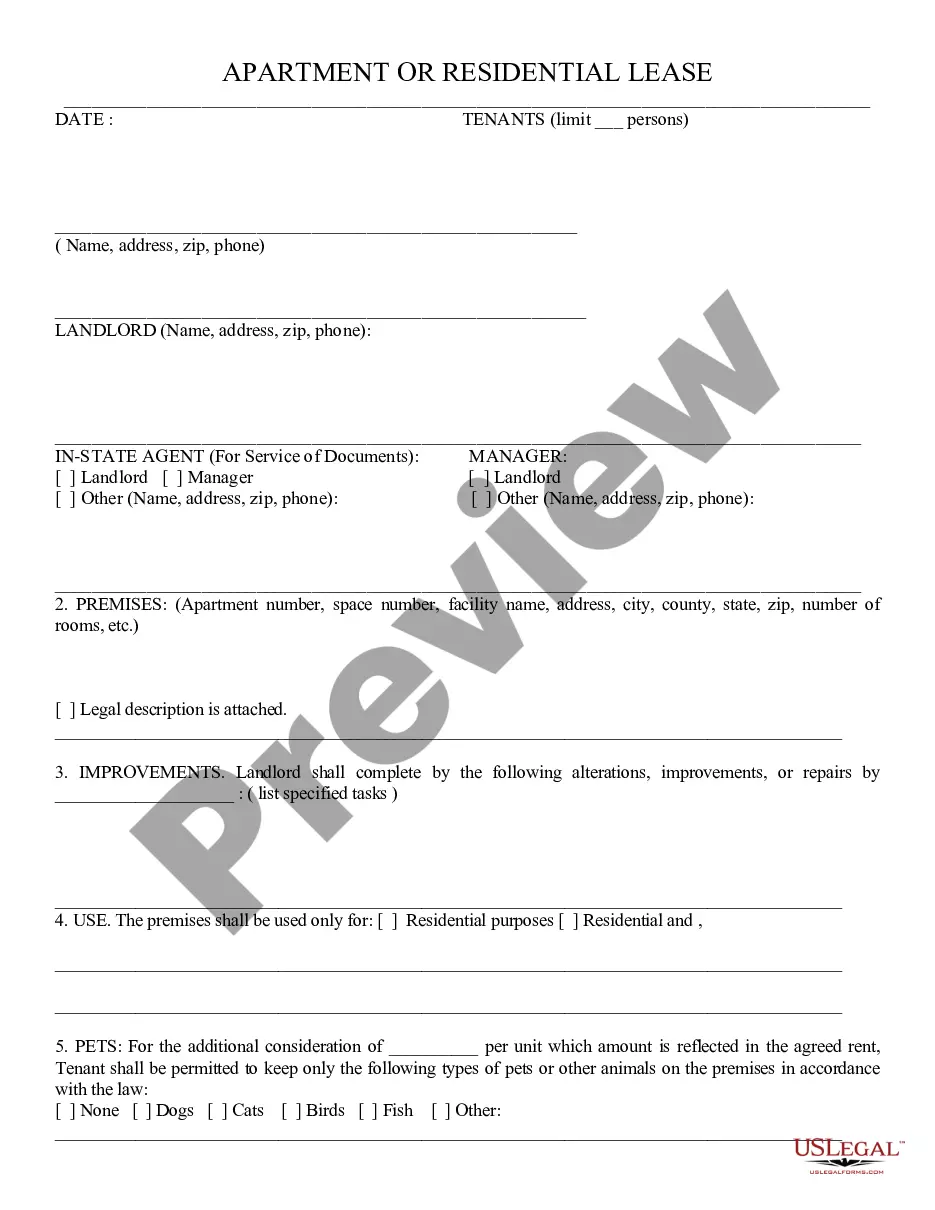

Description

How to fill out San Diego California Credit Card Application With Bonus Features On Using Card?

Draftwing forms, like San Diego Credit Card Application with Bonus Features on Using Card, to manage your legal matters is a challenging and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for different cases and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the San Diego Credit Card Application with Bonus Features on Using Card template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting San Diego Credit Card Application with Bonus Features on Using Card:

- Make sure that your form is specific to your state/county since the rules for writing legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a quick description. If the San Diego Credit Card Application with Bonus Features on Using Card isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin utilizing our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!