A San Diego California Notice of Changes to Credit Card Agreement is an official document issued by a credit card company to its customers residing in San Diego, California, informing them about modifications to their existing credit card agreement. This disclosure aims to provide consumers with full transparency regarding any updates or adjustments made to the terms and conditions of their credit card usage. The Notice typically starts with a clear and concise heading mentioning the name of the credit card company, the words "Notice of Changes to Credit Card Agreement," and the effective date of the changes. This ensures that customers can quickly identify the purpose of the communication. The contents of the Notice elaborate on the specific amendments or revisions being made to the credit card agreement. This may include changes in interest rates, annual fees, billing cycles, payment deadlines, late payment fees, cash advance fees, balance transfer fees, grace periods, or other terms and conditions associated with credit card usage. When it comes to different types of San Diego California Notice of Changes to Credit Card Agreement, an array of modifications may be outlined: 1. Interest Rate Change: This type of notice informs cardholders about a change in the interest rate applicable to their credit card balance. It spells out the previous interest rate, the revised interest rate, and the effective date of the change. 2. Fee Adjustment Notice: This type of notice discloses modifications to various fees associated with credit card usage. It may include changes in annual fees, late payment fees, cash advance fees, foreign transaction fees, or any other additional charges. The notice outlines the previous fee amounts, the new fee amounts, and the effective date of the adjustment. 3. Terms and Conditions Update: This type of notice outlines broader modifications to the overall terms and conditions of the credit card agreement. It may include changes in payment deadlines, grace periods, restrictions on credit limit increases, balance transfer terms, or any other general provisions. The San Diego California Notice of Changes to Credit Card Agreement is sent to cardholders through various communication channels, including electronic statements, mailed paper statements, or secure online account notifications. The notice is designed to ensure that customers are made aware of any modifications in a timely manner and can make informed decisions regarding their credit card usage. It is important for cardholders to thoroughly review the Notice, understand the changes being made, and assess how these changes may impact their financial situation and credit card management. Should the cardholder disagree with the changes, they may have the option to reject the new terms and close their account, subject to the credit card company's policies and procedures. In conclusion, a San Diego California Notice of Changes to Credit Card Agreement is an official communication from a credit card company, notifying customers in San Diego about modifications to their credit card agreement. It outlines specific changes, such as interest rate adjustments, fee modifications, or updates to terms and conditions. Cardholders are advised to carefully review the Notice and assess the implications on their credit card usage and financial standing.

San Diego California Notice of Changes to Credit Card Agreement

Description

How to fill out San Diego California Notice Of Changes To Credit Card Agreement?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Diego Notice of Changes to Credit Card Agreement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Notice of Changes to Credit Card Agreement from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Diego Notice of Changes to Credit Card Agreement:

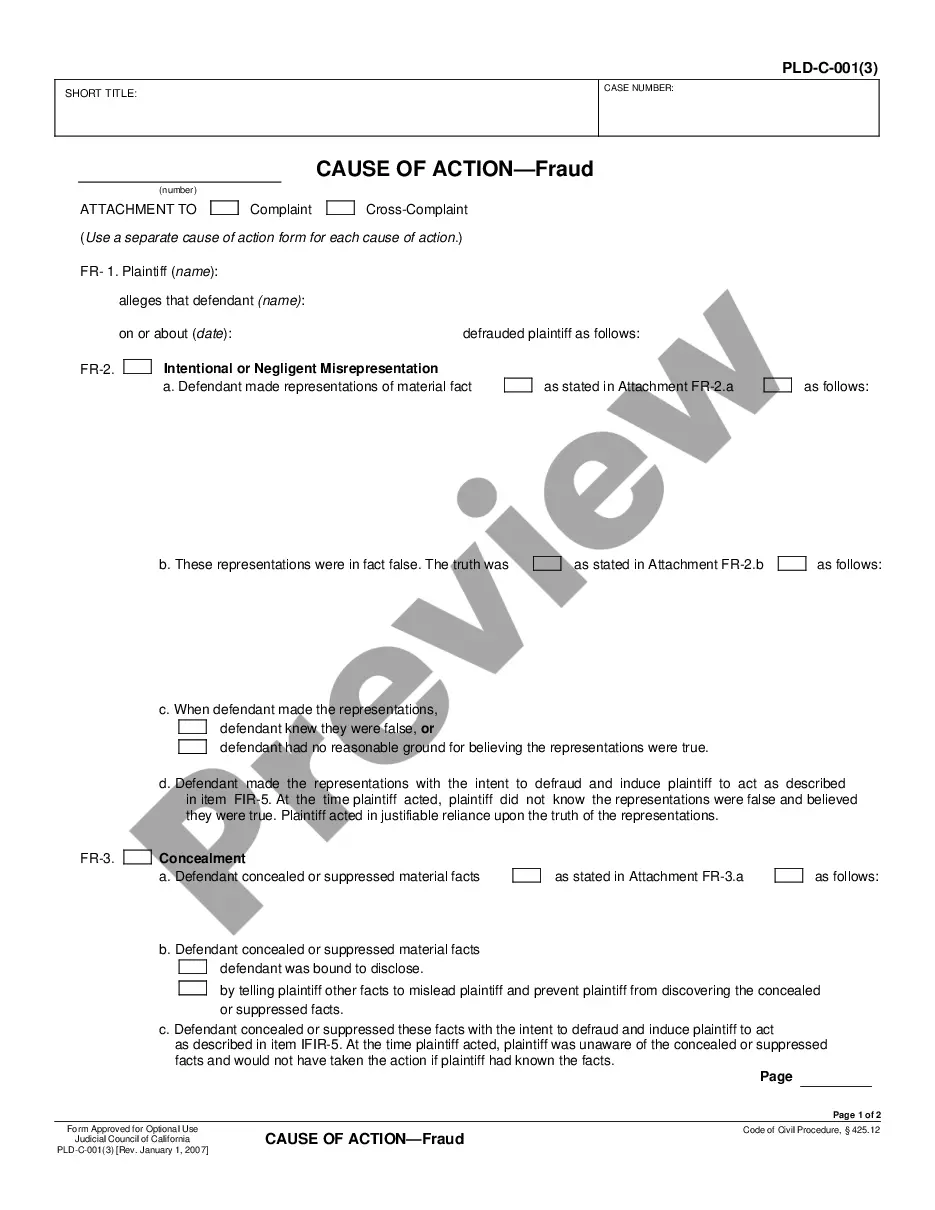

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your paperwork in order with the US Legal Forms!