Title: Wake North Carolina Notice of Changes to Credit Card Agreement — A Comprehensive Overview Keywords: Wake North Carolina, notice of changes, credit card agreement, types Introduction: Understanding the Wake North Carolina Notice of Changes to Credit Card Agreement is crucial to staying informed about any modifications made to your credit card terms and conditions. This detailed description provides valuable information on the various types of credit card agreement changes that may arise and how they impact cardholders in Wake North Carolina. Types of Wake North Carolina Notice of Changes to Credit Card Agreement: 1. Interest Rate Changes: — Explanation: This type of change refers to adjustments in the interest rates applicable to your credit card balance. — Impact: Alterations in interest rates influence the amount of finance charges accrued on outstanding balances, potentially affecting cardholders' repayment strategies. 2. Fees and Charges Amendments: — Explanation: This refers to adjustments made to the fees associated with credit card usage, such as annual fees, late payment fees, balance transfer fees, or cash advance fees. — Impact: Changes in fees and charges impact the overall cost of maintaining a credit card account and should be carefully evaluated by cardholders to assess their financial implications. 3. Rewards Program Modifications: — Explanation: Some credit card providers may revise the rewards program terms, including alterations to earning rates, redemption options, or the expiration policies of rewards points. — Impact: These changes impact cardholders' ability to accrue and utilize rewards, potentially altering the value proposition of their credit card. 4. Change in Credit Limit: — Explanation: This type of modification signifies adjustments to the maximum amount of credit available on the cardholder's credit card account. — Impact: Changes in credit limits can affect the cardholder's spending capacity and credit utilization ratio, potentially impacting their credit score and access to credit. 5. Alterations in Payment Due Date or Grace Period: — Explanation: This refers to changes in the due date for credit card payments or the period during which cardholders can make payments without incurring interest charges. — Impact: Any modifications to payment due dates or grace periods require cardholders to adjust their repayment schedules, ensuring timely payments to avoid penalties or increased interest charges. Conclusion: The Wake North Carolina Notice of Changes to Credit Card Agreement plays a vital role in keeping credit card users informed about any modifications to their credit card terms and conditions. Familiarizing oneself with the types of changes that may occur, such as interest rate adjustments, fee changes, rewards program modifications, credit limit alterations, or amendments to payment due dates and grace periods, allows cardholders to make informed financial decisions based on updated terms.

Wake North Carolina Notice of Changes to Credit Card Agreement

Description

How to fill out Wake North Carolina Notice Of Changes To Credit Card Agreement?

How much time does it normally take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Wake Notice of Changes to Credit Card Agreement suiting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web catalog of templates, gathered by states and areas of use. Aside from the Wake Notice of Changes to Credit Card Agreement, here you can find any specific document to run your business or individual deeds, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Wake Notice of Changes to Credit Card Agreement:

- Examine the content of the page you’re on.

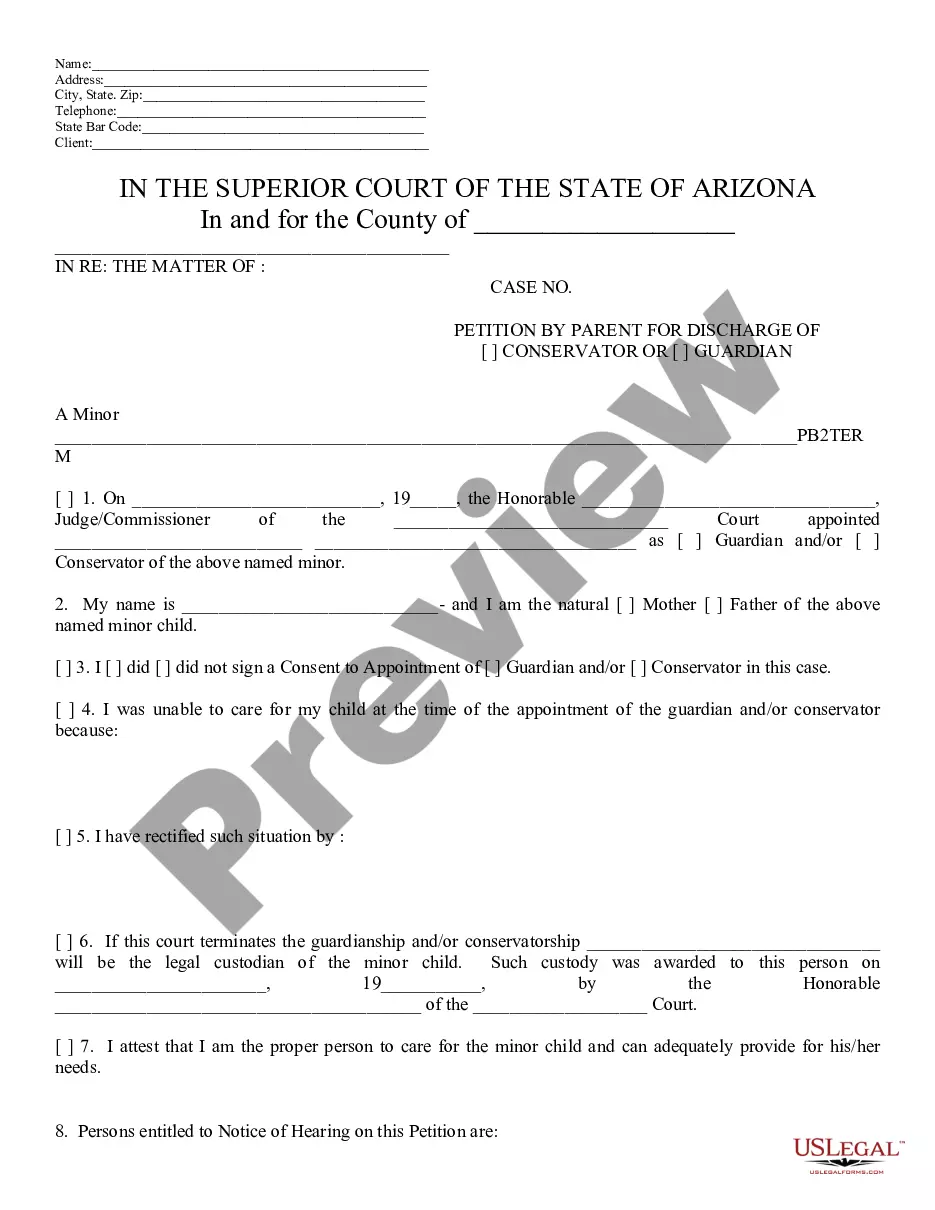

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Wake Notice of Changes to Credit Card Agreement.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!