Wayne, Michigan Notice of Changes to Credit Card Agreement: A Comprehensive Overview Introduction: The Wayne, Michigan Notice of Changes to Credit Card Agreement serves as a communication tool used by credit card issuers to inform cardholders about modifications to the terms and conditions of their credit card agreements. This written notice ensures transparency and compliance with federal regulations, allowing cardholders to stay informed about changes that may impact their credit card usage. Types of Wayne, Michigan Notice of Changes to Credit Card Agreement: 1. Annual Percentage Rate (APR) Changes: — This type of notice explicitly outlines alterations to the interest rates applied to the credit card balance, specifying whether there will be an increase or decrease. — Cardholders need to be aware of APR changes as this directly affects the cost of borrowing money on their credit card. 2. Fee Changes: — Fee-related notice describes any modifications to various credit card fees such as annual fees, late payment fees, balance transfer fees, foreign transaction fees, and cash advance fees. — These notices enable cardholders to understand any revised costs associated with the use of their credit card. 3. Grace Period Changes: — A notice of changes to the grace period notifies cardholders about alterations in the timeframe between the billing cycle's closing date and the payment due date, during which no interest is charged. — Changes to the grace period could affect the amount of interest accumulated, influencing cardholders' repayment strategies. 4. Rewards Program Changes: — Credit card issuers often adjust rewards program terms, such as redemption rates, categories eligible for rewards, or expiration policies. — Cardholders should carefully review such notices to reassess the value and benefits of the rewards program associated with their credit card. 5. Liability Changes: — Changes in liability inform cardholders about alterations to their responsibility in case of credit card theft, loss, or unauthorized transactions. — It is of utmost importance for cardholders to understand their liability, ensuring they follow any security measures suggested by the issuer. 6. Other Modifications: — This category includes any other changes to credit card agreements that are not covered by the aforementioned types. These may include changes to credit limits, dispute resolution procedures, or access to account information. Conclusion: The Wayne, Michigan Notice of Changes to Credit Card Agreement is a crucial document that empowers cardholders to remain informed about any revisions made to the terms and conditions governing their credit card. By providing timely and comprehensive details about specific modifications, credit card issuers ensure transparency and allow cardholders to make well-informed financial decisions. It is vital for cardholders to carefully review these notices to fully understand how the changes may impact their credit card usage, fees, interest rates, rewards, and liability.

Wayne Michigan Notice of Changes to Credit Card Agreement

Description

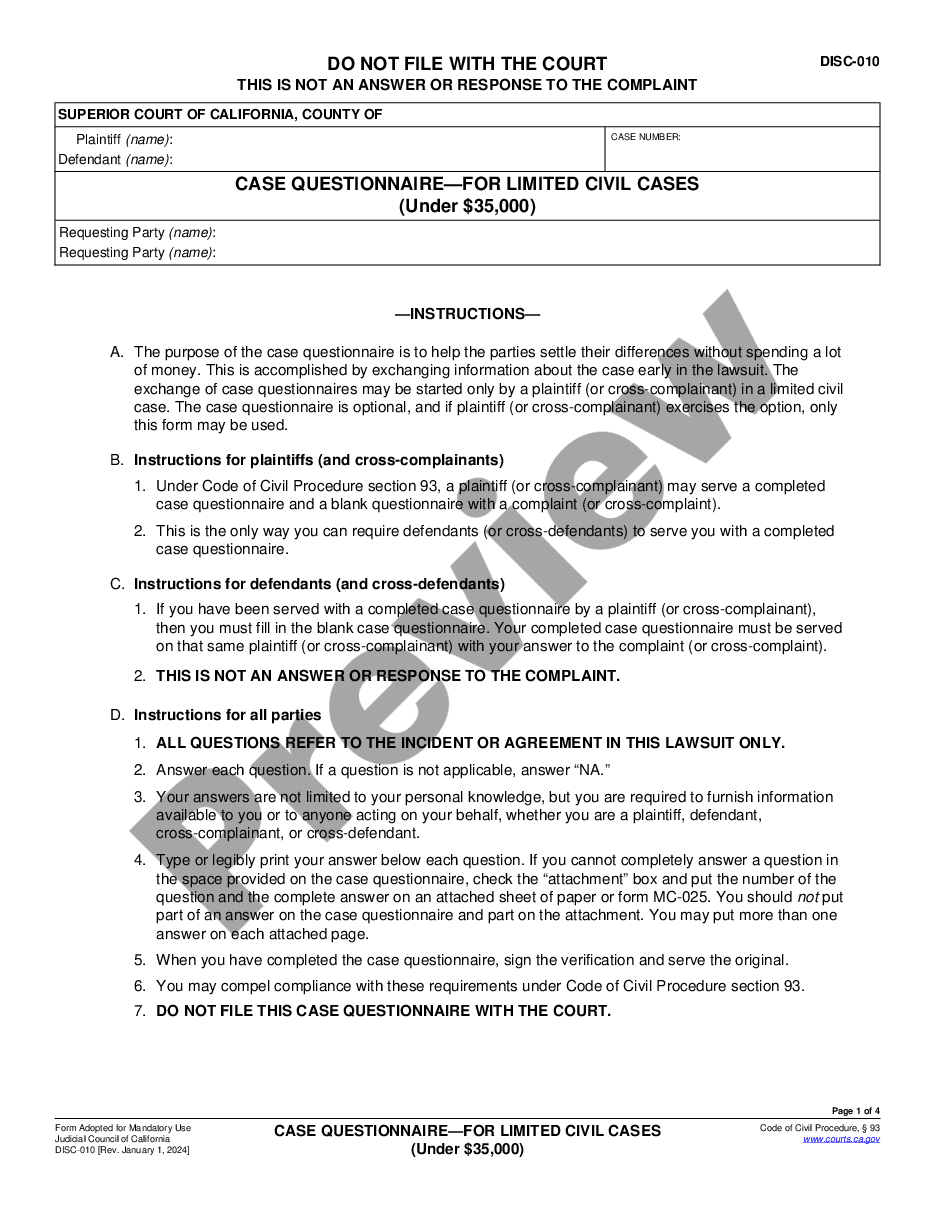

How to fill out Wayne Michigan Notice Of Changes To Credit Card Agreement?

Drafting documents for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Wayne Notice of Changes to Credit Card Agreement without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Wayne Notice of Changes to Credit Card Agreement on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Wayne Notice of Changes to Credit Card Agreement:

- Look through the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Yes, Your Card Issuer Can Change Your Terms This may mean a lower or higher credit limit or a lower or higher interest rate.

Account Disclosures means the terms, conditions and information applicable to your Account from time to time including any Statement, fee schedule and other applicable terms and conditions governing your Account that we provide to you, each of which is considered part of the Account Agreement.

Generally, the notice must be provided to you at least 45 days before the change takes effect. There are some exceptions: If you agreed to a particular change, the bank must still provide you with a written notice, but it does not have to be provided before the change takes effect.

Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees, and late fees) that ap- ply to your account; or make other significant changes to the terms of your card.

A notice letter informs a bank's customer about his or her accountand often explains that action is required by the customer. Financial institutions send notice letters regarding items such as a past-due payment, loan maturity, or loan default.

With an adjustable-rate mortgage, for example, your loan servicer is required to give you notice at least seven months before the first increase in your mortgage payment. After that you'll be notified two to four months in advance of each change if that change impacts your monthly payment.

The credit card company has the right to change the terms of your credit card agreement. For significant changes, the card issuer generally must give you notice 45 days in advance.

Your credit card company must send you a notice 45 days before they can increase your interest rate; change certain fees (such as annual fees, cash advance fees, and late fees) that ap- ply to your account; or make other significant changes to the terms of your card.

Whenever the creditor changes the consumer's billing cycle, it must give a change-in-terms notice if the change affects any of the terms described in § 1026.9(c)(2)(i), unless an exception under § 1026.9(c)(2)(v) applies; for example, the creditor must give advance notice if the creditor initially disclosed a 28-day

When you make a purchase with your credit card, you are borrowing money from your card issuer. You don't have to use your own money until you pay your credit card bill. By contrast, debit cards are linked to your checking account.