King's New York Buy-Sell Agreement is a legal document designed specifically for shareholders of closely held corporations. This agreement serves as a tool to govern the purchase and sale of shares between two individual shareholders within the corporation. It outlines various provisions and terms that are essential to ensure a smooth transition of ownership and protect the interests of all parties involved. The agreement is tailored to address the specific needs and requirements of shareholders within the closely held corporation. It helps to establish a fair and transparent process for buying and selling shares, ensuring that both parties are treated equitably in the transaction. Under the Kings New York Buy-Sell Agreement, there are several types that can be implemented: 1. Fixed Price Agreement: This type of agreement sets a predetermined price for the shares, which remains constant regardless of market fluctuations. It provides stability and predictability in the event of a shareholder's desire to sell their shares or other triggering events. 2. Formula Agreement: In a formula agreement, the value of the shares is determined using a pre-defined formula. This formula typically considers various financial factors such as the company's earnings, book value, or a combination of different metrics. This type of agreement allows for flexibility in valuing the shares based on the company's performance. 3. Appraisal Agreement: An appraisal agreement involves obtaining a professional appraisal to determine the fair market value of the shares. This type of agreement ensures a fair valuation process, providing an impartial assessment of the shares' worth. It eliminates any potential disagreements between shareholders over the value of the shares. 4. Hybrid Agreement: A hybrid agreement combines elements from multiple types of agreements to suit the specific needs and circumstances of the closely held corporation and its shareholders. It may include a fixed price for a portion of the shares and a formula or appraisal method for the remaining portion. Regardless of the specific type, the Kings New York Buy-Sell Agreement typically includes provisions related to triggering events, such as the death, disability, retirement, or voluntary sale of a shareholder's shares. It outlines the process for initiating a buyout, including the notice period, share valuation, terms of payment, and any additional conditions or restrictions that may apply. By implementing the Kings New York Buy-Sell Agreement between two shareholders of a closely held corporation, both parties can have peace of mind knowing that there is a clear framework in place to manage the transfer of shares in a fair and efficient manner.

Kings New York Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

How to fill out Kings New York Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

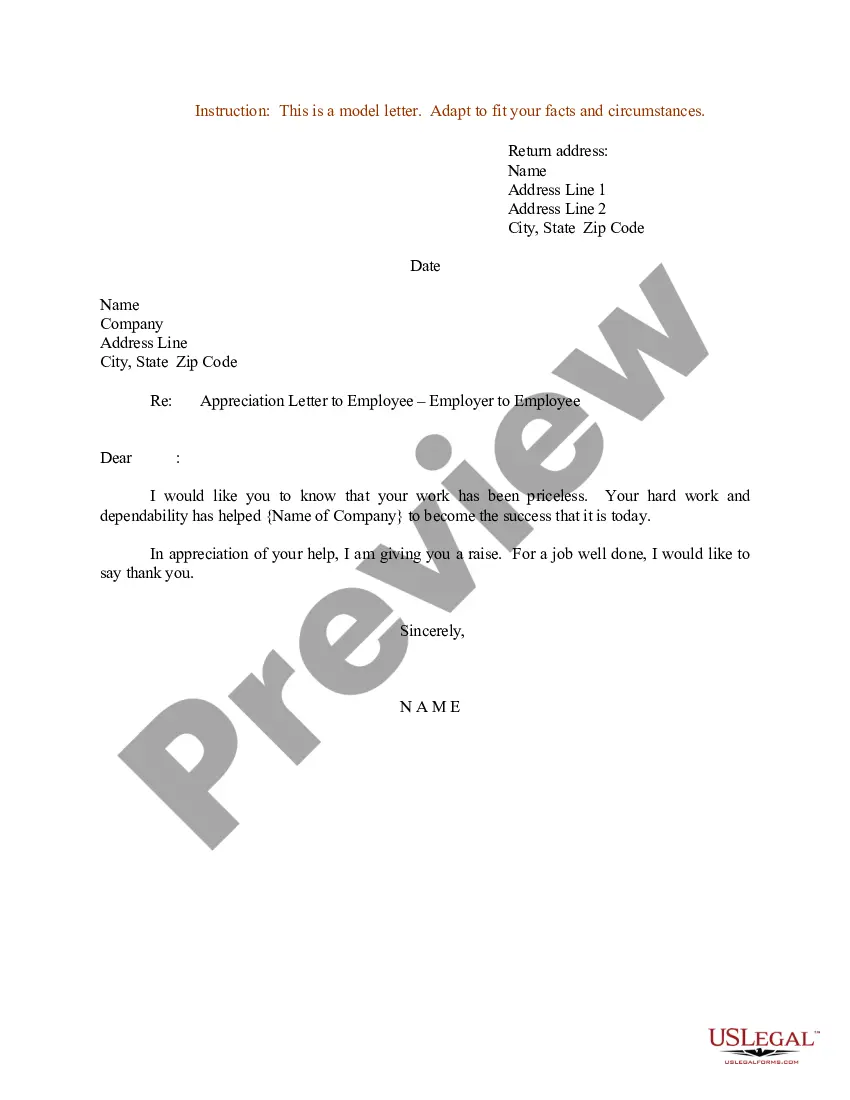

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to create some of them from scratch, including Kings Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching process less frustrating. You can also find detailed resources and tutorials on the website to make any tasks related to paperwork execution simple.

Here's how you can purchase and download Kings Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Go over the document's preview and outline (if available) to get a general information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the similar document templates or start the search over to find the correct file.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Choose the option, then a needed payment method, and purchase Kings Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Kings Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to deal with an extremely challenging case, we advise getting an attorney to review your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific documents effortlessly!