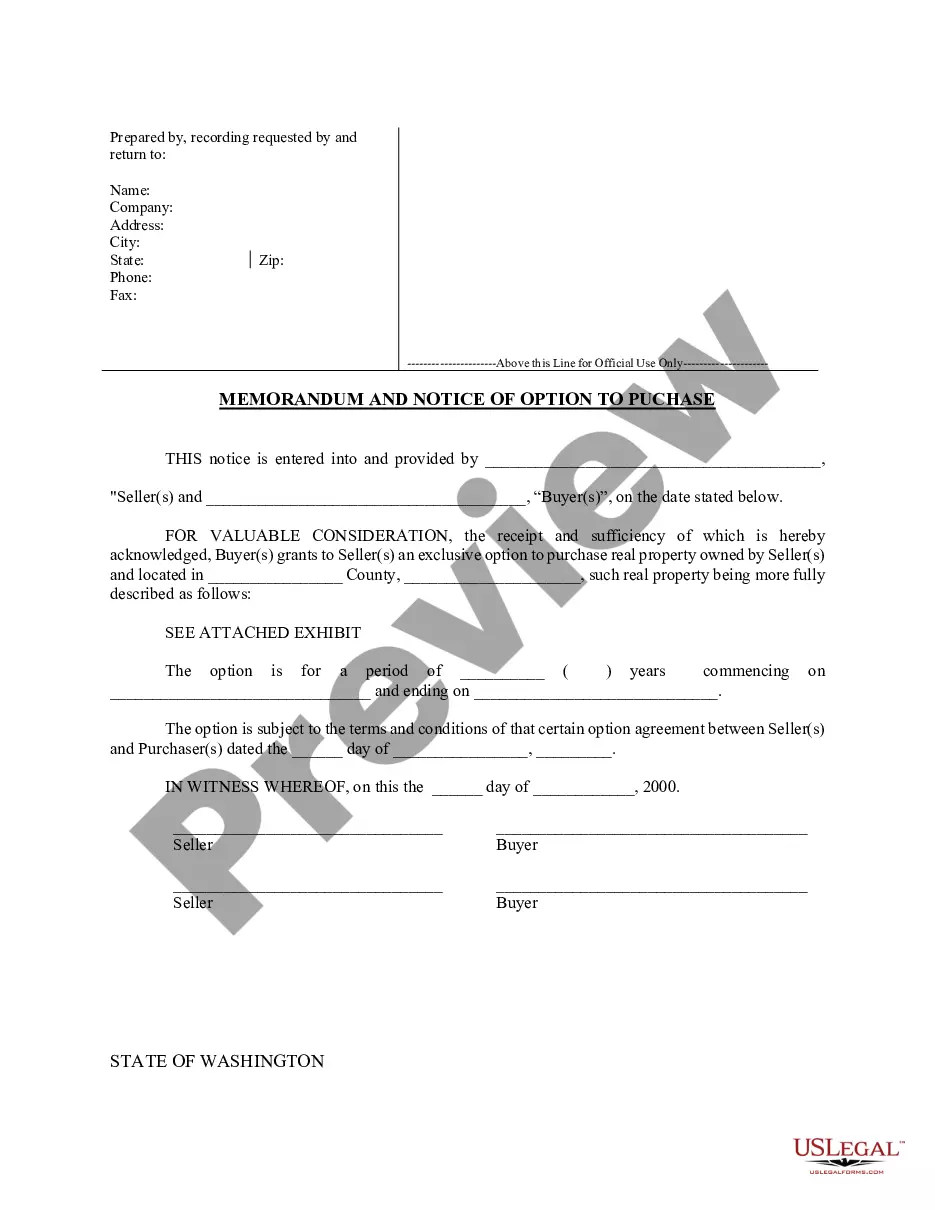

Maricopa Arizona Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the purchase and sale of shares between two shareholders in a closely held corporation based in Maricopa, Arizona. This agreement provides protection and guidance to the shareholders in the event of certain triggering events, such as death, disability, divorce, retirement, or voluntary exit from the corporation. The main purpose of a buy-sell agreement is to establish a fair and orderly process for the transfer of shares in a closely held corporation, while avoiding potential disputes, conflicts, and disruptions to the business operations. By defining the procedures and mechanisms for the sale, valuation, and transfer of shares, this agreement helps maintain stability, continuity, and control within the corporation. There are different types of Maricopa Arizona Buy-Sell Agreements between Two Shareholders of Closely Held Corporations, including: 1. Cross-Purchase Agreement: In this type of agreement, the remaining shareholder(s) have the right and obligation to purchase the shares of the departing shareholder. Each shareholder is typically required to have a life insurance policy on the life of the other shareholder(s) to fund the purchase upon death. 2. Stock Redemption Agreement: This agreement allows the corporation itself to buy back the shares from the departing shareholder. This option is often preferred when there are multiple shareholders, as it simplifies the process and eliminates the need for each shareholder to have life insurance policies. 3. Hybrid Agreement: This agreement combines elements of both the cross-purchase and stock redemption agreements. It provides flexibility by allowing both the remaining shareholders and the corporation to buy back the shares based on the triggering event. Key provisions included in a Maricopa Arizona Buy-Sell Agreement may encompass: 1. Transfer Restrictions: The agreement can restrict the transfer of shares to non-shareholders or outside parties, ensuring that shares are only transferred among existing shareholders. 2. Triggering Events: The agreement should define the triggering events, such as death, disability, divorce, retirement, or voluntary exit, which would activate the buy-sell provisions. 3. Valuation Method: A predetermined valuation method or formula is essential to determine the fair market value of the shares when a triggering event occurs. Common methods include appraisals, formula-based calculations, or independent third-party valuations. 4. Purchase Price and Payment Terms: The agreement should outline the purchase price for the shares and establish the terms of payment, including lump-sum payments, installments, or financing arrangements. 5. Right of First Refusal: The agreement may provide the remaining shareholder(s) with a right of first refusal, requiring the departing shareholder to first offer their shares to the other shareholder(s) before seeking outside buyers. 6. Dispute Resolution: It is advisable to include dispute resolution mechanisms, such as mediation or arbitration, to handle disagreements that may arise during the execution of the buy-sell agreement. In conclusion, a Maricopa Arizona Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is an important legal document that ensures a smooth and orderly transition of shares in the event of specific triggering events. By addressing various scenarios and establishing clear guidelines, this agreement protects the interests of shareholders and promotes the stability and continuity of the closely held corporation located in Maricopa, Arizona.

Maricopa Arizona Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

How to fill out Maricopa Arizona Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Maricopa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation meeting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. In addition to the Maricopa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, here you can get any specific form to run your business or individual affairs, complying with your regional requirements. Professionals check all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Maricopa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Maricopa Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!