A Phoenix Arizona Buy-Sell Agreement between Two Shareholders of a closely held corporation is a legal document that outlines the terms and conditions for buying and selling shares within the corporation. It provides a framework for the transfer of ownership and helps protect the interests of the shareholders. This agreement is essential for closely held corporations as it establishes a clear process for buying out a shareholder's interest in specific situations, such as retirement, death, disability, or voluntary departure. It ensures that the remaining shareholder(s) have the opportunity to purchase the departing shareholder's shares at a predetermined price or based on a valuation method outlined in the agreement. The Phoenix Arizona Buy-Sell Agreement can be categorized into various types, including: 1. Cross-Purchase Agreement: In this type of agreement, the remaining shareholder(s) agree to buy the shares of the departing shareholder in proportion to their existing ownership interest. Each shareholder has the option to purchase the shares individually, making it a more straightforward and flexible arrangement. 2. Stock Redemption Agreement: This agreement involves the corporation repurchasing the shares of the departing shareholder. The corporation uses its own funds to buy back the shares, essentially reducing the number of outstanding shares and redistributing the ownership among the remaining shareholder(s). 3. Hybrid Agreement: A hybrid agreement combines elements from both the cross-purchase and stock redemption agreements. Here, some shareholders may opt to purchase the departing shareholder’s shares individually, while others may prefer the corporation to buy back the shares. This arrangement can be more complex but provides flexibility to meet the specific needs and preferences of the shareholders. Key provisions found in a Phoenix Arizona Buy-Sell Agreement may include: — Triggering Events: Clearly defining the situations in which the agreement is activated, such as death, disability, retirement, or voluntary departure. — Valuation Method: Outlining the method used to determine the value of the shares being sold, such as using a formula, independent appraisal, or predetermined price set in the agreement. — Purchase Terms: Specifying the payment terms, such as lump sum or installment payments, and any applicable interest rates or financing arrangements. — Rights of First Refusal: Granting the remaining shareholder(s) the first opportunity to purchase the shares before they can be sold to an outside party. — Non-Compete Agreements: Restricting the departing shareholder from engaging in a competing business within a specified time frame and geographic area. A well-drafted Phoenix Arizona Buy-Sell Agreement is crucial for ensuring a smooth transition of ownership and maintaining the stability and continuity of a closely held corporation. It provides clarity and protection for the shareholders involved while avoiding potential disputes and conflicts.

Phoenix Arizona Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

How to fill out Phoenix Arizona Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Whether you plan to open your company, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so picking a copy like Phoenix Buy-Sell Agreement between Two Shareholders of Closely Held Corporation is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Phoenix Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. Adhere to the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

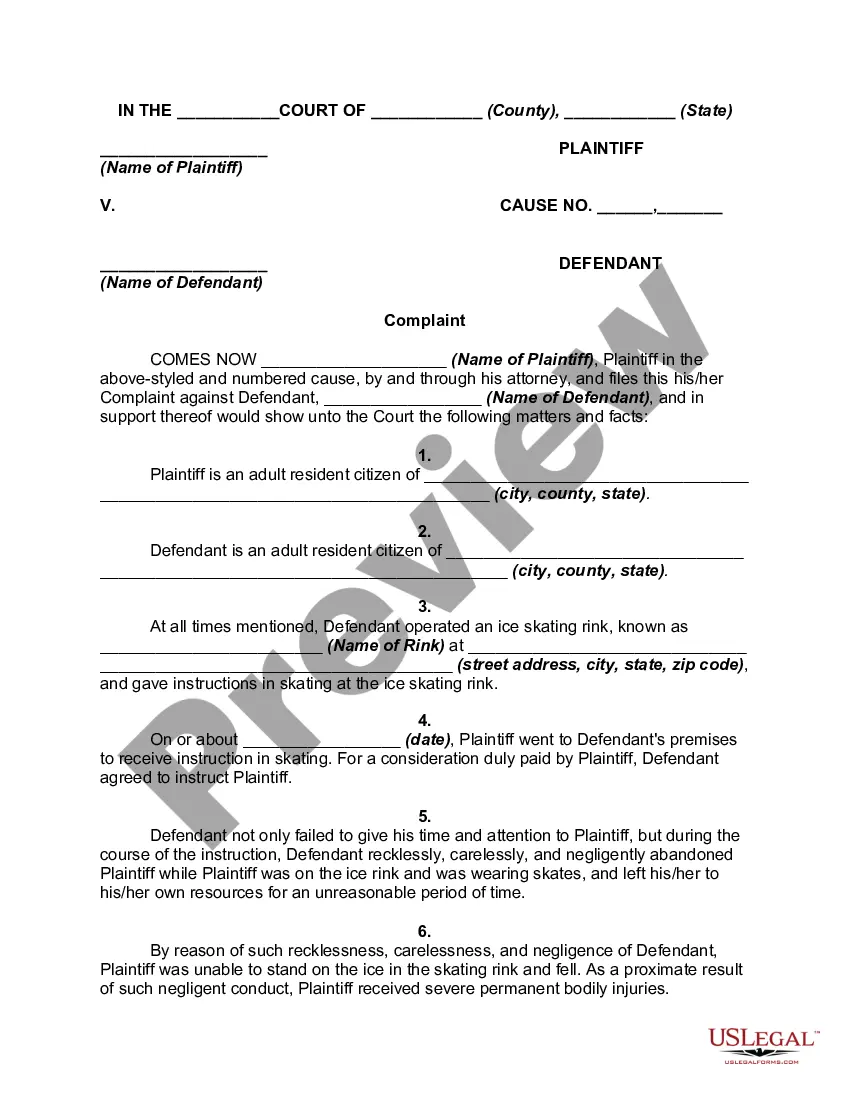

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Opt for the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Phoenix Buy-Sell Agreement between Two Shareholders of Closely Held Corporation in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!