A San Diego California Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the purchase and sale of shares in the corporation. This agreement is crucial to protect the interests of both shareholders and ensure a smooth transition of ownership in the event of certain trigger events, such as death, disability, retirement, or voluntary withdrawal. The agreement typically includes various key elements, including: 1. Purchase and Sale Terms: It establishes the terms and conditions for the transfer of shares between the shareholders, including the purchase price, payment method, and any applicable conditions. 2. Trigger Events: The agreement identifies specific events that can trigger a buy-sell situation, such as death, disability, retirement, divorce, bankruptcy, or voluntary withdrawal from the corporation. Each trigger event may have specific provisions and procedures for executing the buy-sell agreement. 3. Valuation Methodology: The agreement typically outlines the valuation method used to determine the fair market value of the shares being sold. Common approaches include book value, market value, or a formula-based approach, which may entail the use of financial statements, industry benchmarks, or independent appraisers. 4. Right of First Refusal: The agreement may grant a right of first refusal to the corporation or other shareholders, allowing them the opportunity to purchase the shares before they are offered to any third party. This provision helps maintain ownership within a limited group and ensures that the price and terms are favorable to the existing shareholders. 5. Funding Mechanisms: Funding mechanisms are often included in the agreement to ensure that the purchase price can be paid in a timely manner. Shareholders may agree to secure life insurance policies or establish sinking funds to cover the potential buyout obligations. Different types of San Diego California Buy-Sell Agreements between Two Shareholders of Closely Held Corporations include: 1. Cross-Purchase Agreement: Each shareholder agrees to purchase the shares of the other shareholder in the event of a trigger event. This arrangement is often used when there are only two shareholders involved. 2. Stock Redemption Agreement: The corporation agrees to repurchase the shares held by the shareholder in the event of a trigger event. This arrangement is commonly used when the corporation prefers to maintain control over its ownership structure. 3. Hybrid Agreement: A combination of the cross-purchase and stock redemption agreements, where certain shareholders will have the option to purchase the shares while others have the option to have the corporation buy back the shares. In conclusion, a San Diego California Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a vital legal instrument to ensure a smooth transition of ownership and protect the rights and interests of shareholders. By outlining the purchase and sale terms, trigger events, valuation methodology, right of first refusal, and funding mechanisms, this agreement helps maintain stability and continuity within the corporation.

San Diego California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

How to fill out San Diego California Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including San Diego Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in various types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how to locate and download San Diego Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

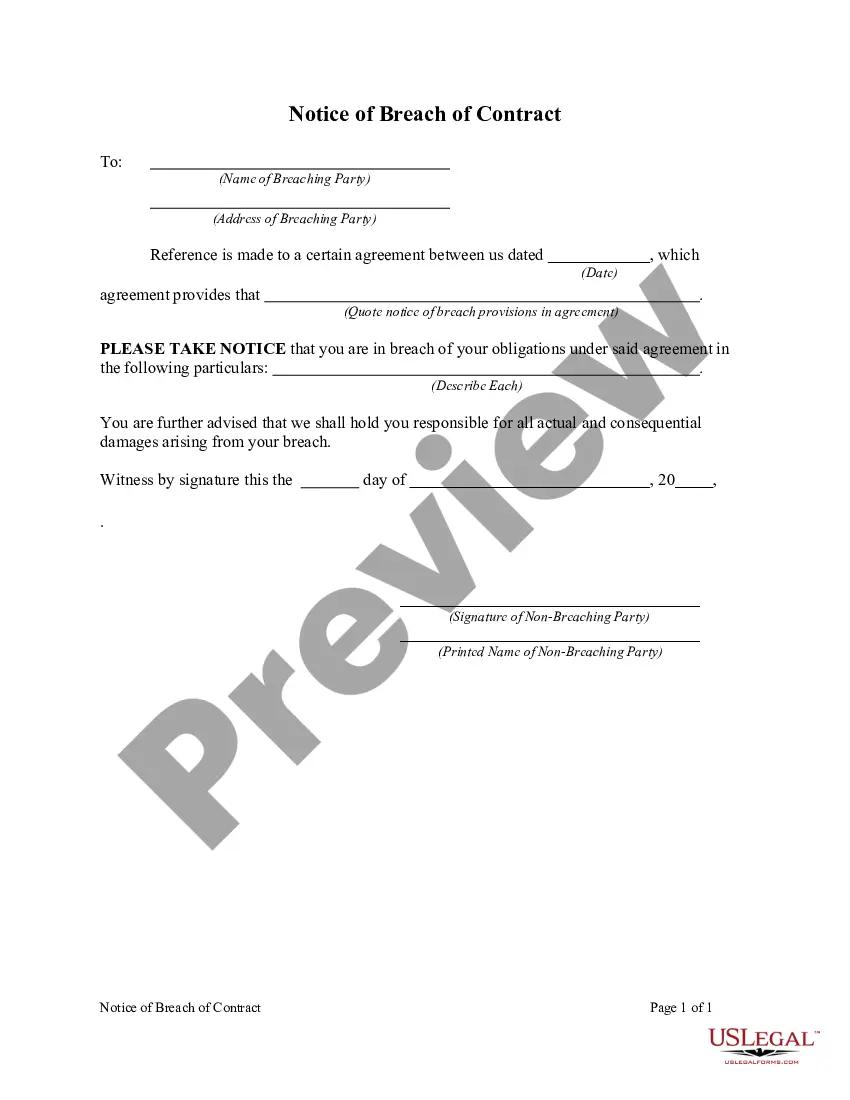

- Go over the document's preview and description (if available) to get a general information on what you’ll get after getting the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the related forms or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and buy San Diego Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate San Diego Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you need to cope with an extremely complicated case, we recommend using the services of a lawyer to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of customers. Join them today and purchase your state-compliant documents effortlessly!