San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

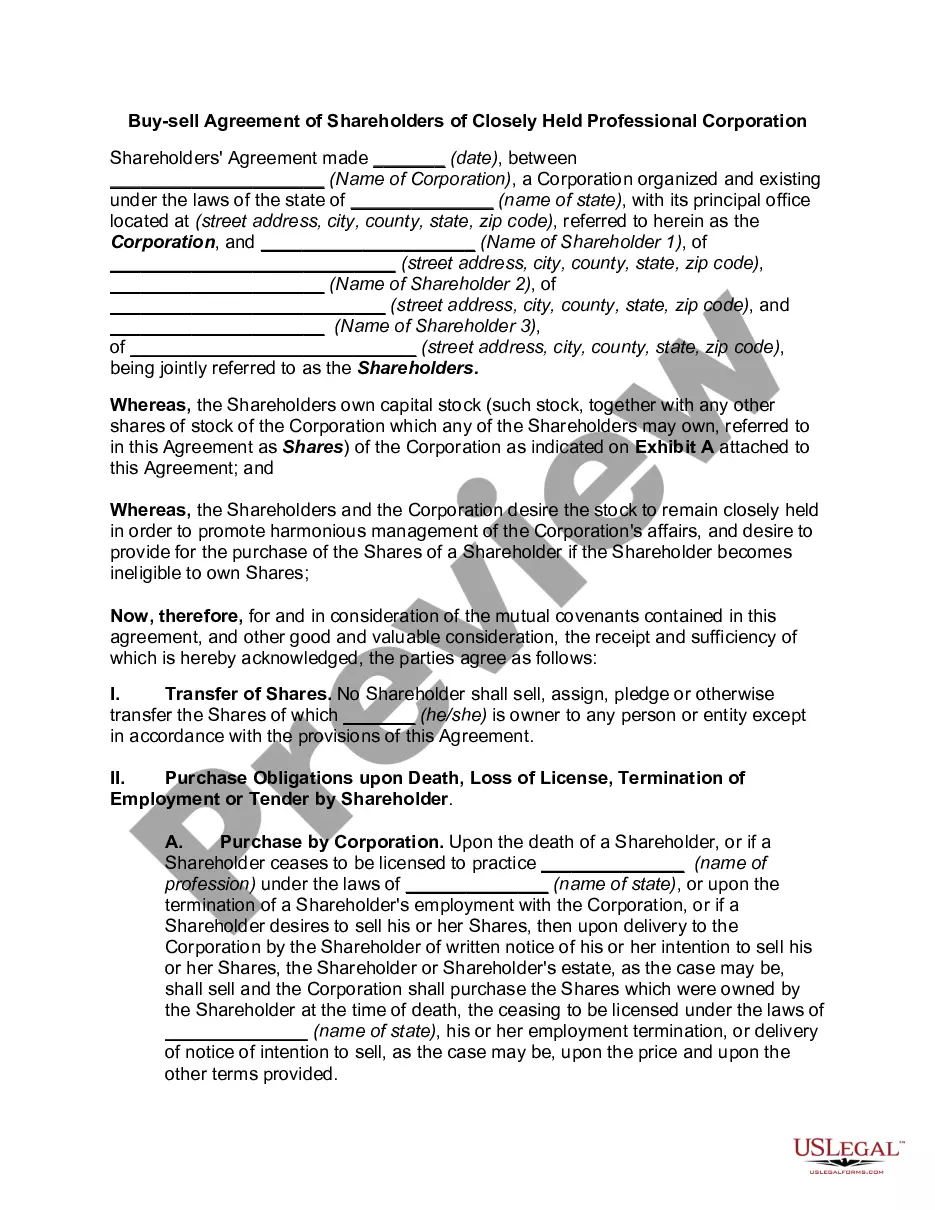

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

A document procedure consistently accompanies any legal endeavor you undertake.

Starting a business, applying for or accepting a job offer, transferring possession, and numerous other life situations require you to prepare formal documentation that differs from state to state.

That’s the reason having everything gathered in one location is extremely advantageous.

US Legal Forms is the largest online repository of current federal and state-specific legal documents.

This represents the simplest and most dependable method to obtain legal documents. All templates within our collection are professionally crafted and validated for compliance with local laws and regulations. Organize your documentation and manage your legal matters efficiently with US Legal Forms!

- On this site, you can effortlessly locate and acquire a document for any personal or commercial purpose utilized in your region, including the San Jose Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Finding templates on the site is remarkably easy.

- If you already possess a subscription to our service, Log In to your account, locate the template through the search box, and click Download to save it on your device.

- Afterwards, the San Jose Buy-Sell Agreement between Two Shareholders of Closely Held Corporation will be accessible for future use in the My documents section of your profile.

- In case you are utilizing US Legal Forms for the first time, follow this straightforward guideline to obtain the San Jose Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

- Ensure you have navigated to the correct page with your localized form.

- Use the Preview mode (if available) and review the sample.

- Check the description (if any) to confirm the template suits your requirements.

- Search for an alternative document via the search feature if the sample does not meet your needs.

- Click Buy Now when you find the required template.

Form popularity

FAQ

Yes, a buy-sell agreement is legally binding when properly drafted and executed. This type of agreement governs the terms under which shares can be sold or transferred, providing security for all parties involved. Consequently, if you're looking for a sound San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation, it's essential to ensure it meets legal requirements. Utilizing a platform like uslegalforms can simplify the process and help create a well-structured agreement.

Drafting a buy-sell agreement involves several key steps to ensure clarity and enforceability. First, identify the parties involved—namely, the shareholders—and outline the purpose of the agreement in relation to the San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation. Next, determine the valuation method for shares and any conditions triggering the buy-sell agreement, such as death, disability, or voluntary withdrawal. Utilizing straightforward templates from platforms like USLegalForms can simplify this process, making it easier to create a comprehensive and legally sound document.

While both documents relate to shareholder interests, a San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation serves a different function than a shareholder agreement. A buy-sell agreement specifically outlines terms for buying or selling shares under certain circumstances, whereas a shareholder agreement typically covers broader governance issues and rights of each shareholder. Therefore, understanding the distinctions helps you better secure your interests and responsibilities.

Backing out of a buy-sell agreement is not straightforward and usually depends on the terms outlined in the agreement itself. Generally, once the agreement is signed, it is legally binding, and exiting without mutual consent can lead to legal consequences. However, some provisions may allow for termination under specific conditions. Therefore, always consult legal advice when considering a San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

Although buy-sell agreements have benefits, they also come with potential downsides. One con is that these agreements can limit a shareholder's ability to sell their shares to third parties, potentially decreasing marketability. Additionally, they may create conflicts if valuations are contested, leading to legal disputes. A comprehensive San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can mitigate some of these issues with clear terms.

Writing a buy-sell agreement involves several key steps, starting with identifying the stakeholders and their roles. Next, you should outline the conditions and trigger points for initiating the buy-sell process. Including terms for valuation and payment ensures clarity and understanding among all parties involved. Utilizing resources from uslegalforms can guide you in creating a well-structured San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

The main purpose of a buy-sell agreement is to establish a clear plan for the transition of shares among shareholders in key situations. This agreement helps prevent disputes by outlining how shares will be valued and transferred during significant events. It ensures continuity and stability in a closely held corporation by laying down structured procedures. A well-crafted San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation can significantly enhance business resilience.

A shareholder agreement outlines the roles, rights, and responsibilities of shareholders within a corporation. In contrast, a buy-sell agreement specifically focuses on the transfer of shares and the procedure for buying out a shareholder's interest. While both documents share elements, understanding their differences is vital for effective corporate governance. For a solid foundation, consider utilizing a San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

Trigger points in a buy-sell agreement define conditions that activate the buy-sell provisions. Common triggers include the death, disability, or voluntary exit of a shareholder. Other potential triggers might involve a major financial downturn or legal disputes among shareholders. Clearly defining these points in your San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation ensures everyone understands their rights and obligations.

While a buy-sell agreement can provide clarity and structure, it may also present disadvantages. One challenge is that it can create financial constraints if a shareholder wants to exit the corporation but lacks the funds to buy the shares. Additionally, disagreements about valuations can lead to disputes, complicating the exit process. Therefore, it is crucial to thoroughly discuss these potential drawbacks when drafting a San Jose California Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.