A Travis Texas Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a legally binding contract that outlines the terms and conditions for the buying and selling of shares within the corporation. This agreement is specifically designed for closely held corporations operating within the state of Texas and ensures a smooth transition of ownership in the event of certain triggering events. In this type of agreement, the two shareholders of the closely held corporation lay out the rules and procedures for the purchase and sale of shares between them, maintaining control over the ownership within the corporation. The agreement provides a structured process for buyouts, thereby avoiding potential conflicts and disputes. Key provisions in a Travis Texas Buy-Sell Agreement may include: 1. Triggering Events: The agreement typically identifies the triggering events that can initiate a buyout, such as death, disability, retirement, divorce, or voluntary exit. This ensures that the shares are transferred according to pre-determined conditions. 2. Valuation: To establish a fair price for the shares, the agreement may specify the valuation methods, such as appraisals or predetermined formulas. This prevents disputes over the price and allows for an efficient transfer process. 3. Rights of First Refusal: The agreement may grant the remaining shareholder(s) the right of first refusal to purchase the shares being sold, ensuring that existing shareholders have the opportunity to maintain control and prevent unwanted parties from becoming shareholders. 4. Payment Terms: The agreement should outline the payment terms for the buyout, such as cash payments, installment payments, or the use of company assets. Specific guidelines are established to finalize the transaction. 5. Non-Compete and Non-Disclosure Clauses: It is common to include non-compete and non-disclosure clauses to protect the corporation's trade secrets and prevent a departing shareholder from starting a competing business or sharing confidential information. There are various types of Travis Texas Buy-Sell Agreements between Two Shareholders of Closely Held Corporations, including: 1. Cross-Purchase Agreement: In this type, each shareholder agrees to purchase the shares of the other upon the occurrence of a triggering event. The remaining shareholder(s) directly buy the shares, maintaining their proportional ownership. 2. Stock Redemption Agreement: In this arrangement, the corporation itself agrees to redeem the shares of the departing shareholder with the remaining shareholder(s) receiving increased ownership in return. 3. Hybrid Agreement: This type combines elements of both cross-purchase and stock redemption agreements. It allows the shareholders to choose whether they want to purchase the shares individually or have the corporation redeem them based on the specific triggering event. In conclusion, a Travis Texas Buy-Sell Agreement between Two Shareholders of a Closely Held Corporation is a vital legal document that ensures an orderly transfer of ownership in the event of certain triggering events. By establishing clear rules, valuation methods, and payment terms, this agreement protects the interests of the shareholders and the overall stability of the closely held corporation.

Travis Texas Buy-Sell Agreement between Two Shareholders of Closely Held Corporation

Description

How to fill out Travis Texas Buy-Sell Agreement Between Two Shareholders Of Closely Held Corporation?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business objective utilized in your region, including the Travis Buy-Sell Agreement between Two Shareholders of Closely Held Corporation.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Travis Buy-Sell Agreement between Two Shareholders of Closely Held Corporation will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to obtain the Travis Buy-Sell Agreement between Two Shareholders of Closely Held Corporation:

- Ensure you have opened the correct page with your local form.

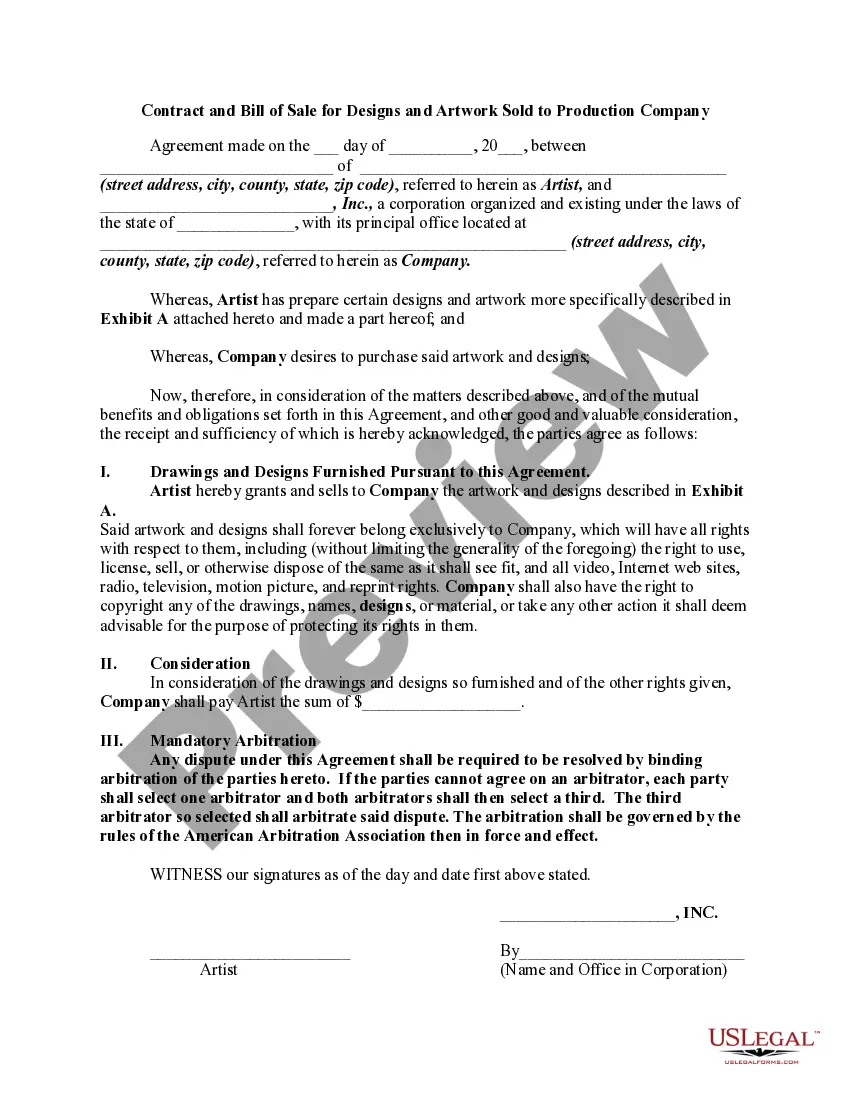

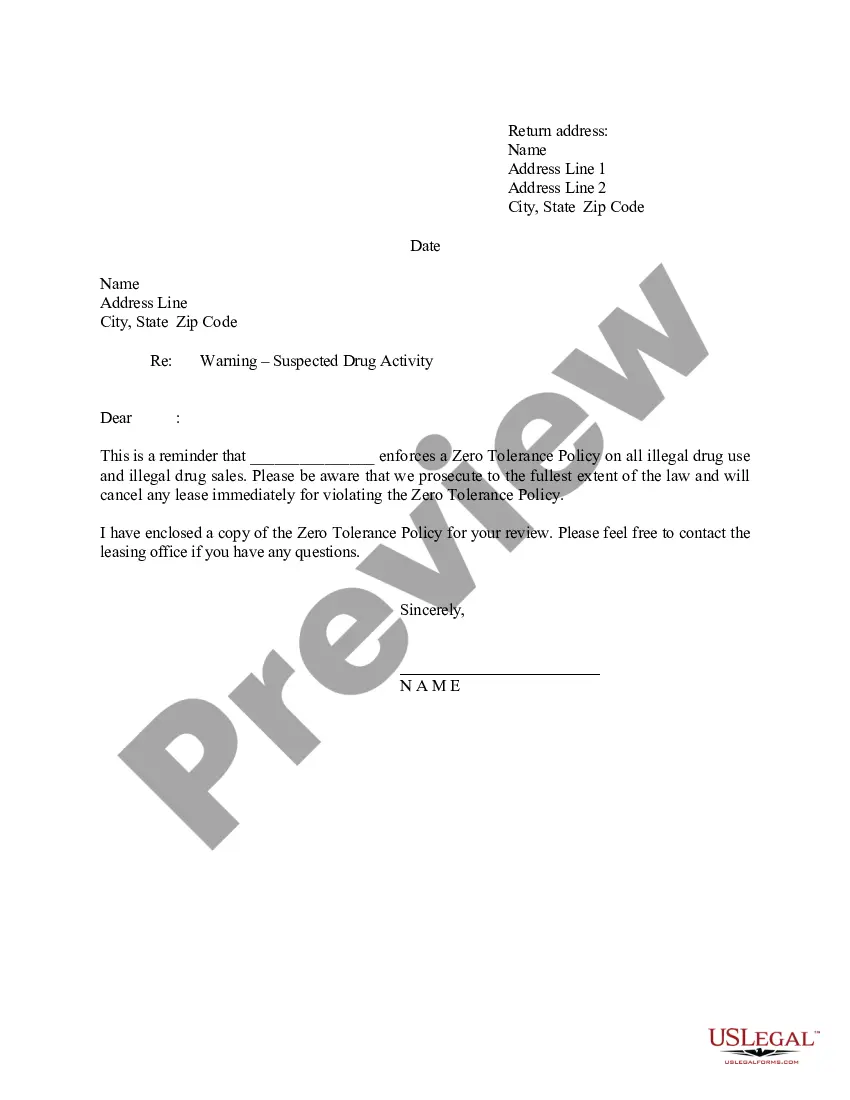

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Travis Buy-Sell Agreement between Two Shareholders of Closely Held Corporation on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!