The Clark Nevada Credit Card Agreement and Disclosure Statement is a legal document that outlines the terms and conditions of using a Clark Nevada credit card. It provides important information about the cardholder's rights, responsibilities, and obligations, ensuring transparency in the credit card agreement. The disclosure statement is a crucial document that helps individuals understand the terms under which they'll be using their credit card. There are different types of Clark Nevada Credit Card Agreement and Disclosure Statements, including: 1. Clark Nevada Basic Credit Card Agreement and Disclosure Statement: This standard agreement applies to the basic credit card offered by Clark Nevada. It details the key features, such as the annual percentage rate (APR), grace period, finance charges, and any associated fees. 2. Clark Nevada Rewards Credit Card Agreement and Disclosure Statement: This type of agreement is specifically for a rewards credit card offered by Clark Nevada. It includes information about the rewards program, such as earning points, redeeming rewards, and any limitations or expiry dates on rewards. 3. Clark Nevada Secured Credit Card Agreement and Disclosure Statement: If Clark Nevada offers a secured credit card option, this agreement would apply. It explains the specific terms and conditions of using a secured credit card, including the requirement for a security deposit, credit limit, and how it affects the cardholder's credit history. 4. Clark Nevada Balance Transfer Credit Card Agreement and Disclosure Statement: This agreement is tailored for individuals looking to transfer their balances from other credit cards to a Clark Nevada credit card. It outlines the process, fees, and any promotional APR's or terms related to balance transfers. These variations of the Clark Nevada Credit Card Agreement and Disclosure Statements cater to different types of customers and their specific credit card needs. It is important for cardholders to carefully review and understand the agreement before using their Clark Nevada credit card to ensure compliance with the terms and conditions, fees, and rights they possess as cardholders.

Clark Nevada Credit Card Agreement and Disclosure Statement

Description

How to fill out Clark Nevada Credit Card Agreement And Disclosure Statement?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Clark Credit Card Agreement and Disclosure Statement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Clark Credit Card Agreement and Disclosure Statement from the My Forms tab.

For new users, it's necessary to make several more steps to get the Clark Credit Card Agreement and Disclosure Statement:

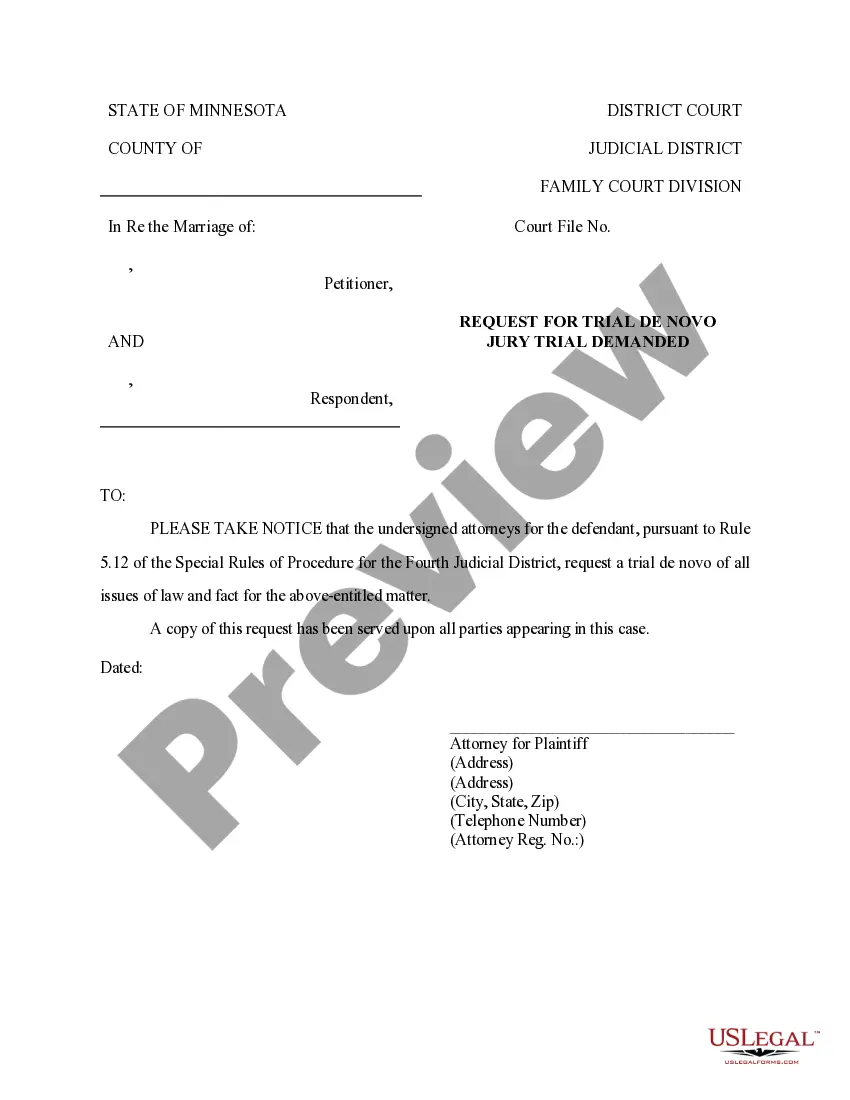

- Analyze the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!