Franklin Ohio Credit Card Agreement and Disclosure Statement is a comprehensive document that outlines the terms and conditions of using a credit card issued by Franklin Ohio Bank. This statement serves as a legally binding contract between the cardholder and the bank, ensuring clarity and transparency in all credit card transactions. The Franklin Ohio Credit Card Agreement and Disclosure Statement contains essential information such as interest rates, fees, and payment terms. By clearly defining these aspects, it allows the cardholder to understand their financial obligations and responsibilities. Moreover, it helps the bank set clear expectations for cardholders, reducing any potential disputes or misunderstandings. The different types of Franklin Ohio Credit Card Agreement and Disclosure Statement can include: 1. Regular Credit Card Agreement and Disclosure Statement: This is the standard agreement for general credit card usage, applicable to most individuals or businesses applying for a Franklin Ohio credit card. 2. Rewards Credit Card Agreement and Disclosure Statement: This agreement is specifically designed for credit cards that offer reward programs such as cashback, travel points, or other incentives. It includes additional clauses regarding the accrual and redemption of rewards. 3. Business Credit Card Agreement and Disclosure Statement: Targeting small businesses or corporate entities, this agreement outlines the terms and conditions for using a Franklin Ohio credit card in business-related transactions. It may include provisions on expense tracking, authorized cardholder management, and liability distribution. It is crucial for cardholders to familiarize themselves with the Franklin Ohio Credit Card Agreement and Disclosure Statement before accepting and using the credit card. This document protects both parties involved and ensures a fair and transparent credit card relationship. Keywords: Franklin Ohio, Credit Card, Agreement, Disclosure Statement, terms and conditions, contract, interest rates, fees, payment terms, financial obligations, responsibilities, standard agreement, reward programs, cashback, travel points, incentives, small businesses, corporate entities, expense tracking, authorized cardholder management, liability distribution, fair, transparent.

Franklin Ohio Credit Card Agreement and Disclosure Statement

Description

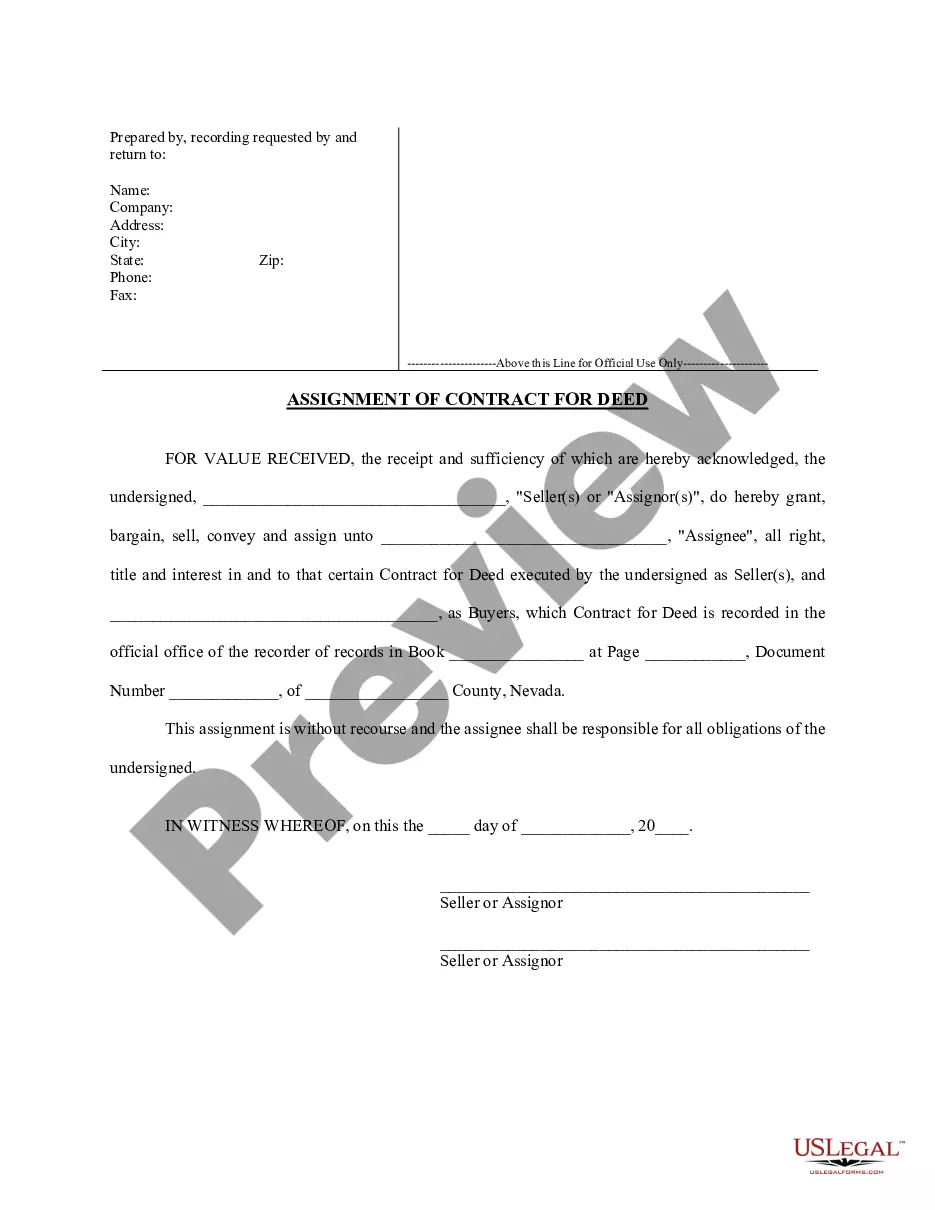

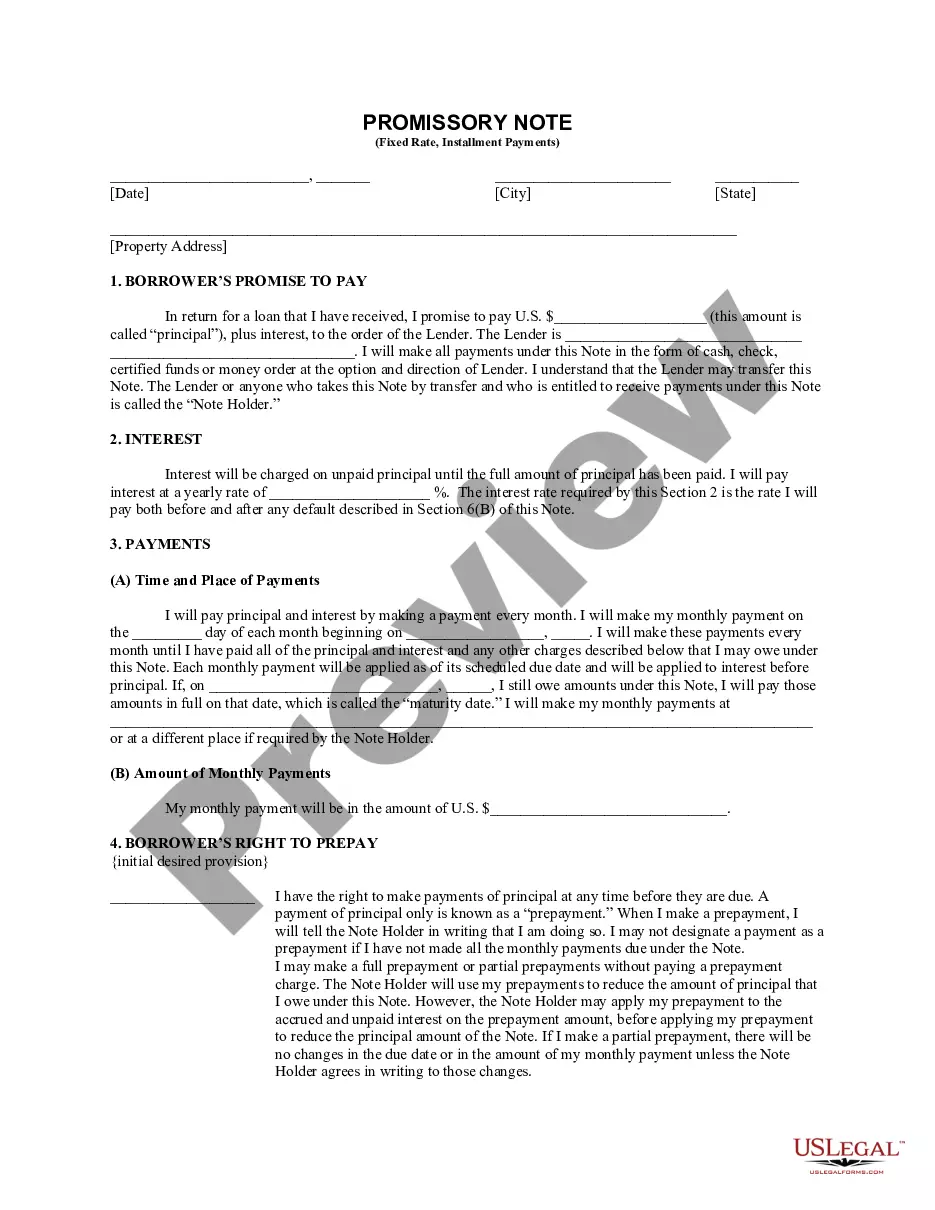

How to fill out Franklin Ohio Credit Card Agreement And Disclosure Statement?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Franklin Credit Card Agreement and Disclosure Statement, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Franklin Credit Card Agreement and Disclosure Statement from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Franklin Credit Card Agreement and Disclosure Statement:

- Analyze the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

What Is a Cardholder Agreement? A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

DEFINITION. A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card. Institutions that offer credit cards are required by law to disclose this information.

A credit agreement is a legally-binding contract documenting the terms of a loan agreement; it is made between a person or party borrowing money and a lender. The credit agreement outlines all of the terms associated with the loan.

A merchant agreement is a contract establishing the parameters of the relationship between a merchant acquiring bank and the business it serves. Although merchant banks chiefly facilitate electronic transaction processing, some also furnish credit cards.

Being responsible with your credit means living within your means and not spending beyond what you can afford. When you use your credit card, keep an index card in your wallet and write down the purchases you make.

What Is a Cardholder Agreement? A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

You should be able to find your card's agreement on the issuer's website. Otherwise, the Consumer Financial Protection Bureau (CFPB) has an extensive database of credit card agreements from hundreds of card issuers.

7 Tips on How to Use a Credit Card Responsibly Read Your Card Agreement and Know Your Terms.Make Payments on Time.Pay More Than the Minimum.Stay Below Your Credit Limit.Check Your Monthly Statements Carefully for Accuracy.Report a Lost or Stolen Card Immediately.Monitor Your Credit.

Already have a Bank of America® credit card? Log in to Online Banking and request a copy of your Credit Card Agreement. If you still have questions, contact one of our associates at 800.932. 2775.