The Mecklenburg North Carolina Credit Card Agreement and Disclosure Statement is a legal document that outlines the terms and conditions of a credit card issued in Mecklenburg County, North Carolina. This agreement explains the rights and responsibilities of both the credit card issuer and the cardholder. It is important for credit card users to thoroughly review and understand this document before using their credit card. The Mecklenburg North Carolina Credit Card Agreement and Disclosure Statement covers a variety of important topics, including but not limited to: 1. Annual Percentage Rate (APR): This section of the agreement defines the interest rate charged on outstanding balances. It specifies whether the APR is fixed or variable, as well as any introductory or promotional rates. 2. Fees and Charges: The agreement clearly states the various fees associated with the credit card, such as annual fees, cash advance fees, late payment fees, and over-limit fees. It also explains how these fees may be modified or waived. 3. Grace Period: This section outlines the length of time cardholders have to pay their balance in full before interest is charged. It may also specify whether new purchases qualify for a grace period. 4. Billing Cycle: The agreement details the specific dates on which the billing cycle begins and ends, as well as the due date for payment. It also explains the cardholder's rights regarding billing errors and disputes. 5. Credit Limit: This part of the agreement specifies the maximum amount the cardholder can charge on their credit card. It may also provide information on how credit limits can be increased or decreased. 6. Rewards Program: If applicable, the agreement explains any rewards program associated with the credit card, including how points are earned, redeemed, and potentially forfeited. 7. Liability for Unauthorized Use: This section clarifies the cardholder's liability for unauthorized transactions and outlines the steps to take in case of lost or stolen cards. It is worth mentioning that there may be different types of Mecklenburg North Carolina Credit Card Agreement and Disclosure Statements offered by various credit card issuers. Some credit cards may cater specifically to individuals with excellent credit history, while others may target those seeking to build or repair credit. It is essential for consumers to carefully compare the terms and conditions of different credit card agreements in order to choose the one that best suits their financial needs and preferences.

Mecklenburg North Carolina Credit Card Agreement and Disclosure Statement

Description

How to fill out Mecklenburg North Carolina Credit Card Agreement And Disclosure Statement?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Mecklenburg Credit Card Agreement and Disclosure Statement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the Mecklenburg Credit Card Agreement and Disclosure Statement, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Mecklenburg Credit Card Agreement and Disclosure Statement:

- Look through the page and verify there is a sample for your area.

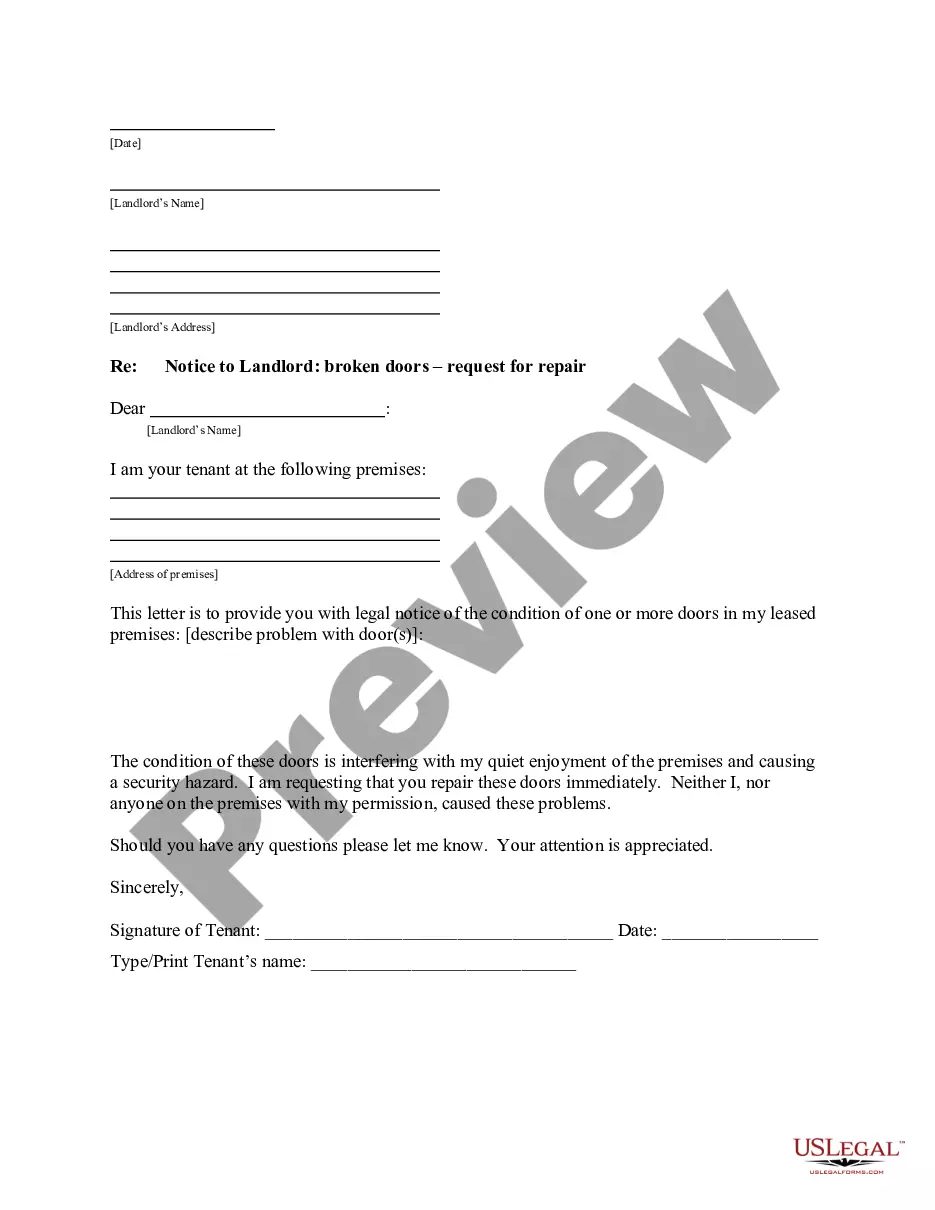

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the document format for your Mecklenburg Credit Card Agreement and Disclosure Statement and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!