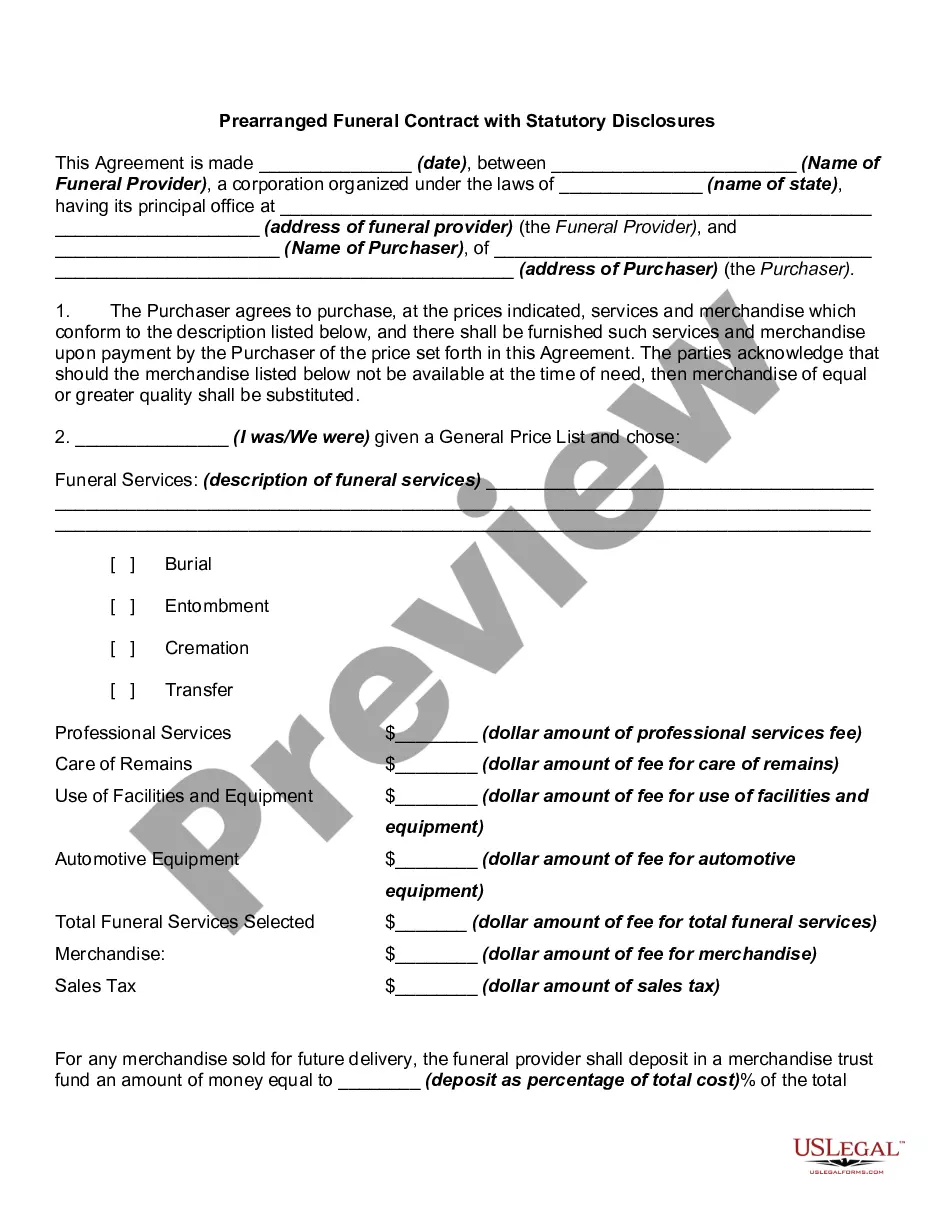

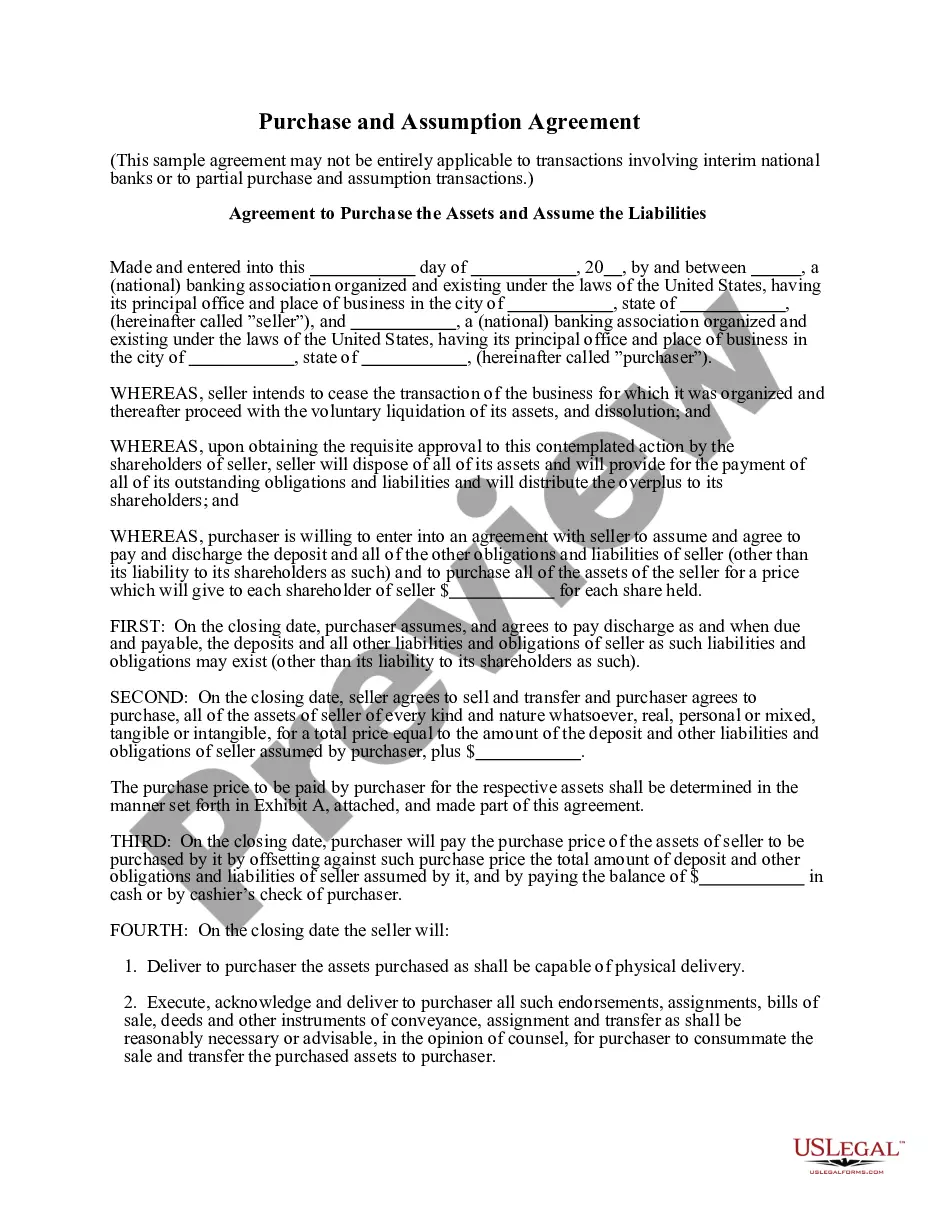

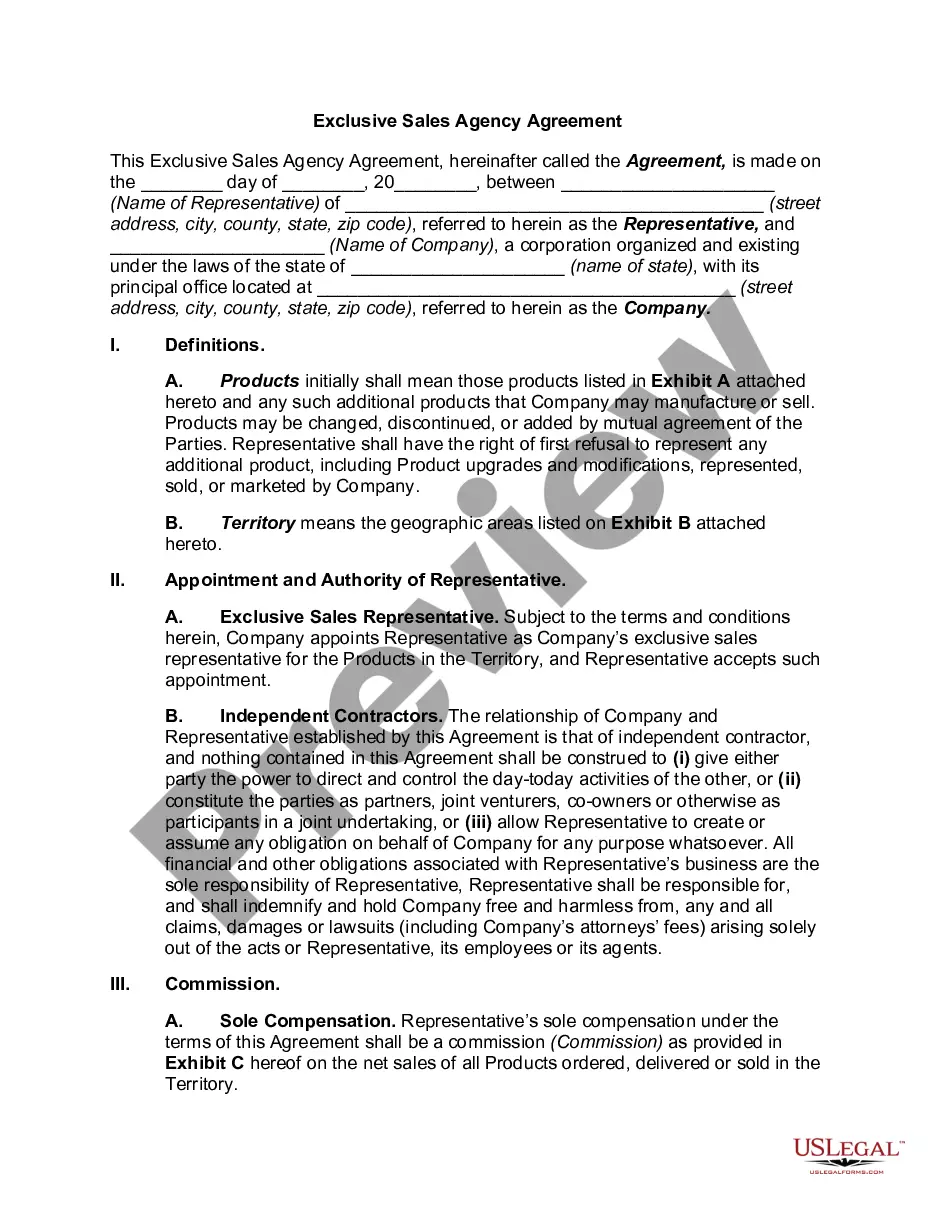

Nassau New York Credit Card Agreement and Disclosure Statement is a legally binding document that outlines the terms and conditions for credit card usage in Nassau County, New York. This agreement provides crucial information regarding the rights and responsibilities of both the credit card issuer and the cardholder. It is essential for individuals residing in Nassau County who seek to obtain a credit card or those who already possess one. The Nassau New York Credit Card Agreement and Disclosure Statement covers various aspects related to credit card usage. It includes details such as the credit limit, interest rates, fees, and penalties associated with the credit card. The agreement also explains how the cardholder's payment history and credit score can impact their credit card account. Key information about billing cycles, statement issuance, and payment due dates are also outlined in the document. By abiding by the Nassau New York Credit Card Agreement and Disclosure Statement, cardholders can understand their rights, responsibilities, and potential consequences. The agreement also highlights the steps the cardholder must take in case of a lost or stolen card or unauthorized transactions. Some specific types of Nassau New York Credit Card Agreement and Disclosure Statement may include: 1. Standard Credit Card Agreement: This type of agreement typically covers the terms and conditions for a regular, unsecured credit card tailored to individuals with good credit history. 2. Secured Credit Card Agreement: In this agreement, the credit card is secured with collateral, such as a deposit or savings account, to mitigate risk for the card issuer. It caters to individuals with limited credit history or poor credit scores. 3. Rewards Credit Card Agreement: This agreement focuses on credit cards that offer rewards or benefits programs to cardholders based on their spending. It covers the terms and conditions specific to earning, redeeming, and maintaining rewards. 4. Balance Transfer Credit Card Agreement: This agreement outlines the terms and conditions associated with transferring existing credit card balances to a new card with potential benefits, such as lower interest rates or promotional offers. It is important for individuals in Nassau County, New York, to carefully read and understand the Nassau New York Credit Card Agreement and Disclosure Statement before accepting any credit card offer. By doing so, they can make informed decisions, effectively manage their credit cards, and protect their financial well-being.

Nassau New York Credit Card Agreement and Disclosure Statement

Description

How to fill out Nassau New York Credit Card Agreement And Disclosure Statement?

Draftwing forms, like Nassau Credit Card Agreement and Disclosure Statement, to manage your legal affairs is a difficult and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents created for various cases and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Nassau Credit Card Agreement and Disclosure Statement form. Go ahead and log in to your account, download the form, and personalize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before getting Nassau Credit Card Agreement and Disclosure Statement:

- Make sure that your template is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Nassau Credit Card Agreement and Disclosure Statement isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our website and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is ready to go. You can try and download it.

It’s easy to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Subscribe to it now if you want to check what other advantages you can get with US Legal Forms!