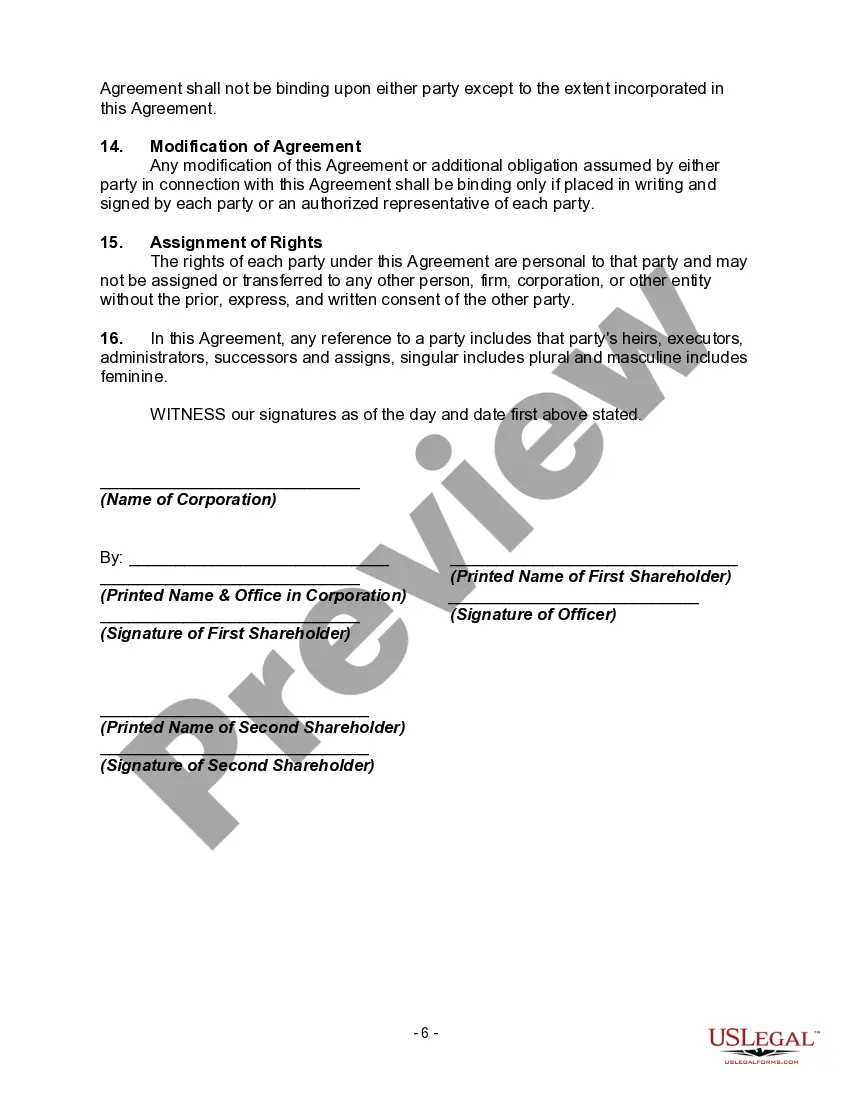

Bronx, New York, is a vibrant and culturally diverse borough located in the northeastern part of New York City. As the third most populous borough, it provides its residents with a rich urban experience, combined with a strong sense of community. Known for its rich history, iconic landmarks, and diverse neighborhoods, Bronx offers a unique blend of opportunities for both residents and visitors. A Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions is a legally binding contract that outlines the rights, responsibilities, and expectations of shareholders in a closely held corporation. This agreement specifically addresses the buy-sell provisions, which pertain to the circumstances under which a shareholder may sell or transfer their shares, and the procedures for doing so. There are different types of Shareholders' Agreements that can be used between two shareholders of a closely held corporation with buy-sell provisions: 1. Standard Shareholders' Agreement: This is a comprehensive agreement that covers various aspects of shareholder rights, including buy-sell provisions. It establishes the procedures for selling shares, determining the price, and ensuring fair treatment between shareholders. 2. Put Option Agreement: This type of agreement grants a shareholder the right to sell their shares to the other shareholder(s) at a predetermined price or formula within a specified time frame. It can be beneficial when one shareholder wants to exit the business or if there is a disagreement between shareholders. 3. Call Option Agreement: In contrast to the Put Option Agreement, this agreement gives a shareholder the right to purchase the shares of the other shareholder(s) at a predetermined price or formula within a specified time frame. It can be useful when a shareholder wants to increase their ownership or to resolve disputes. 4. Cross-Purchase Agreement: This arrangement involves each shareholder agreeing to purchase the shares of the other shareholder(s) upon certain triggering events, such as death, disability, retirement, or voluntary withdrawal. This helps ensure a smooth transition of ownership in the event of unforeseen circumstances. 5. Stock Redemption Agreement: With this agreement, the corporation agrees to repurchase the shares of a shareholder upon certain triggering events, similar to a Cross-Purchase Agreement. It provides liquidity for the exiting shareholder(s) without requiring the remaining shareholder(s) to purchase the shares. In summary, a Shareholders' Agreement between Two Shareholders of a Closely Held Corporation with Buy Sell Provisions is a vital agreement that outlines the rights and obligations of shareholders in a closely held corporation. By utilizing different types of agreements like Standard, Put Option, Call Option, Cross-Purchase, or Stock Redemption, shareholders can establish a clear framework for the sale and transfer of shares, ensuring a fair and efficient process in Bronx, New York, and beyond.

Bronx New York Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

How to fill out Bronx New York Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

Preparing papers for the business or personal needs is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft Bronx Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions without expert help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Bronx Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Bronx Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any scenario with just a couple of clicks!