Mecklenburg North Carolina Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions In Mecklenburg County, North Carolina, a shareholders' agreement is a legally binding document that outlines the rights, obligations, and protections of shareholders in a closely held corporation. This agreement is especially crucial when there are only two shareholders involved. It helps establish a framework for decision-making, dispute resolution, and the potential buyback or sale of shares. Buy-Sell Provisions: One important aspect of a Mecklenburg North Carolina Shareholders' Agreement is the inclusion of buy-sell provisions. These provisions specify how shares can be bought or sold between the two shareholders. They are put in place to address various scenarios, such as the death, disability, retirement, or voluntary/involuntary termination of one of the shareholders. Buy-sell provisions ensure a smooth transition and protect the interests of both parties involved. Different Types of Mecklenburg North Carolina Shareholders' Agreement with Buy-Sell Provisions: 1. Cross-Purchase Agreement: This type of agreement allows shareholders to buy each other's shares directly in the event of a triggering event. The remaining shareholder(s) purchase the shares of the departing shareholder based on pre-agreed-upon terms. This approach is commonly used when there are only two shareholders. 2. Stock Redemption Agreement: In this type of agreement, the corporation itself agrees to buy back the shares of a departing shareholder. It is usually funded by the corporation's available cash or by arranging financing. The remaining shareholder(s) typically continue as sole owners of the corporation. 3. Hybrid Agreement: A hybrid agreement combines elements of both cross-purchase and stock redemption agreements. The shareholders have the flexibility to choose whether the remaining shareholder(s) or the corporation will buy back the shares. This type of agreement can provide options based on the specific circumstances of the triggering event. Key Components of a Mecklenburg North Carolina Shareholders' Agreement: 1. Shareholder Rights and Obligations: The agreement should outline the rights and responsibilities of each shareholder, including voting power, decision-making authority, and financial obligations. 2. Triggering Events: It is important to clearly define the triggering events that would activate the buy-sell provisions, such as death, disability, retirement, termination, or bankruptcy. 3. Purchase Price and Valuation: The agreement should establish a mechanism for determining the purchase price of shares in the event of a buyback. This may involve setting a fixed price, determining a formula, or utilizing a third-party valuation expert. 4. Funding Mechanisms: The agreement should address how the buyback will be funded, whether through cash reserves, financing, or insurance policies. 5. Dispute Resolution: In case of disagreements or disputes, the agreement should outline the process for resolution, which may involve mediation, arbitration, or litigation. 6. Confidentiality and Non-Competition: The agreement may include provisions to protect the corporation's confidential information and restrict shareholders from competing with the corporation if they no longer hold shares. It is crucial for shareholders considering a Mecklenburg North Carolina Shareholders' Agreement with Buy Sell Provisions to seek legal counsel to ensure compliance with state-specific laws and to customize the agreement to their specific needs and circumstances.

Mecklenburg North Carolina Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

How to fill out Mecklenburg North Carolina Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the Mecklenburg Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Mecklenburg Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Mecklenburg Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions:

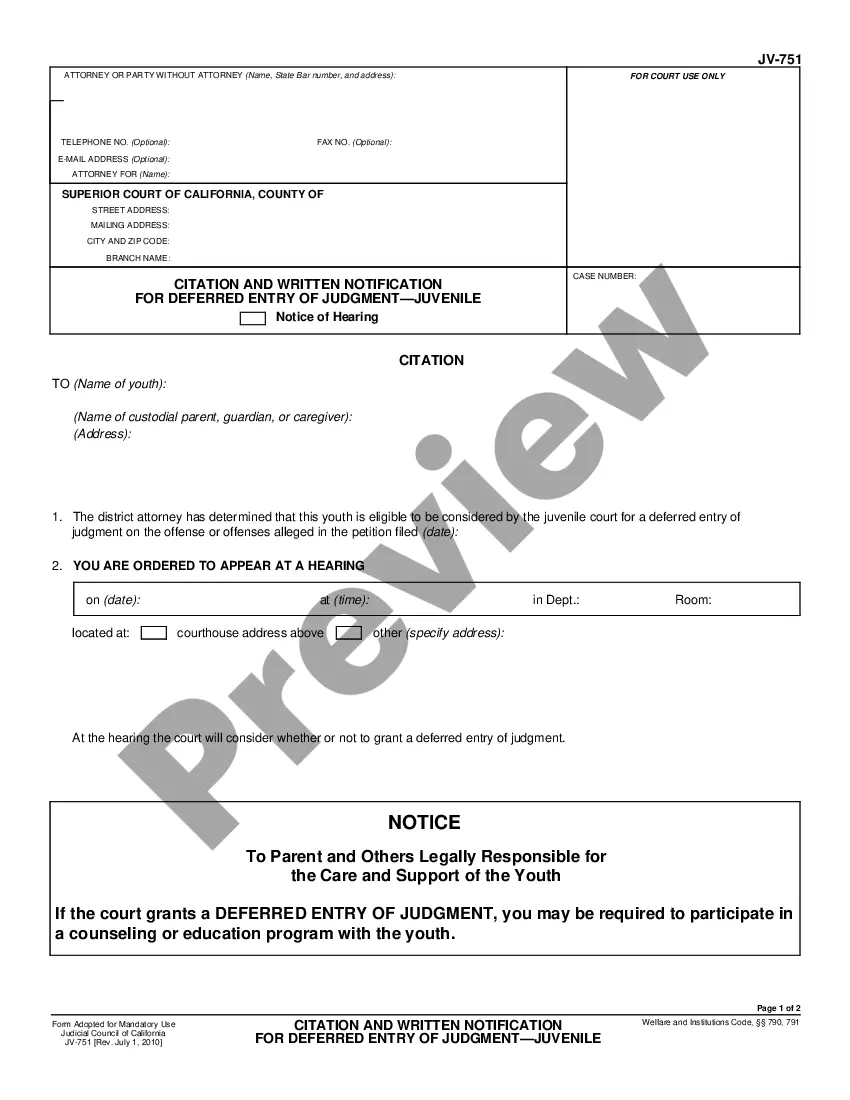

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Mecklenburg Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!