Allegheny Pennsylvania Employment Agreement with Chief Financial Officer: In Allegheny, Pennsylvania, an Employment Agreement with a Chief Financial Officer (CFO) is a legal and binding document that outlines the terms and conditions of employment between a company and its CFO. This agreement is crucial to establish a clear understanding between both parties regarding duties, responsibilities, compensation, and other important aspects of the employment relationship. The Allegheny Pennsylvania Employment Agreement with a CFO is divided into various sections to address different aspects, including but not limited to: 1. Position and Duties: Clearly defines the CFO's role, responsibilities, and reporting structure within the organization. It outlines specific duties such as budgeting, financial planning, risk management, financial reporting, and strategic decision-making. 2. Term of Employment: Specifies the duration of the agreement, including the start and end dates. It may include provisions for automatic renewal or termination of the agreement under certain circumstances. 3. Compensation and Benefits: Details the CFO's salary, bonus, stock options, and other financial incentives. It also states provisions for reimbursement of travel, health insurance, retirement plans, and any other benefits offered by the company. 4. Performance Expectations: Outlines the performance standards, goals, and objectives that the CFO is expected to meet. It may include metrics related to financial performance, cost reduction, profitability, and other relevant targets. 5. Confidentiality and Non-Disclosure: Protects the company's proprietary information by requiring the CFO to maintain confidentiality, both during and after employment. It may include provisions on trade secrets, intellectual property, client lists, and other confidential information. 6. Non-Compete and Non-Solicitation: Contains clauses preventing the CFO from competing directly or indirectly with the company's business during and after employment. It also prohibits the solicitation of clients, employees, or other company stakeholders for personal gain. 7. Termination: Defines the circumstances under which the agreement may be terminated, such as breach of contract, resignation, retirement, or termination without cause. It also outlines the notice period required for termination and any severance package or benefits provided upon termination. Types of Allegheny Pennsylvania Employment Agreements with Chief Financial Officers may include: 1. Permanent Employment Agreement: A long-term agreement where the CFO is hired on a permanent basis with no specified end date. This type of agreement provides stability and security for both the CFO and the company. 2. Fixed-Term Employment Agreement: An agreement with a CFO for a predetermined period, typically for a specific project or to cover a temporary absence or transition period. This type of agreement allows for flexibility in employment duration. 3. Part-Time or Interim Employment Agreement: An agreement that outlines the terms and conditions for hiring a CFO on a part-time or interim basis. This type of agreement is suitable for companies that do not require a full-time CFO or need temporary financial expertise. In conclusion, the Allegheny Pennsylvania Employment Agreement with a Chief Financial Officer is a vital document that ensures a clear understanding between the CFO and the company. It protects the interests of both parties and establishes the framework for a successful employment relationship.

Allegheny Pennsylvania Employment Agreement with Chief Financial Officer

Description

How to fill out Allegheny Pennsylvania Employment Agreement With Chief Financial Officer?

Do you need to quickly create a legally-binding Allegheny Employment Agreement with Chief Financial Officer or maybe any other document to take control of your own or corporate affairs? You can go with two options: hire a professional to write a legal document for you or draft it entirely on your own. Thankfully, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a rich catalog of more than 85,000 state-specific document templates, including Allegheny Employment Agreement with Chief Financial Officer and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the Allegheny Employment Agreement with Chief Financial Officer is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

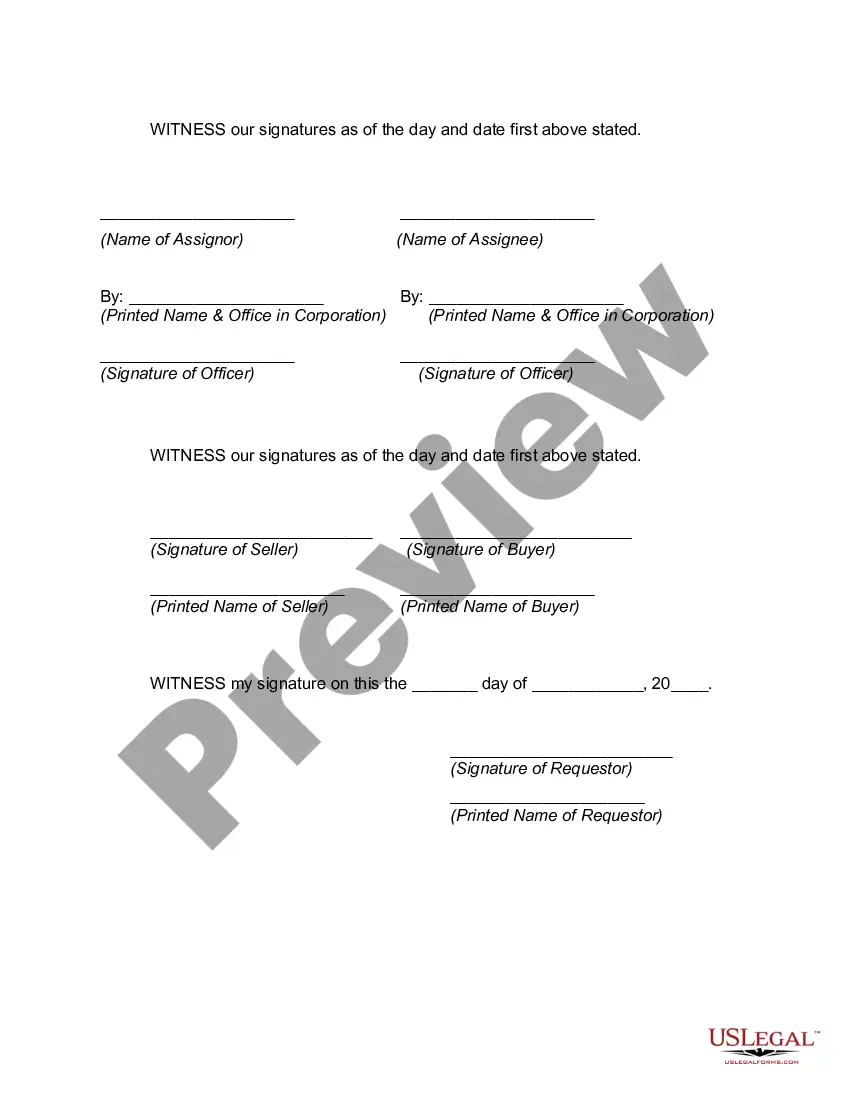

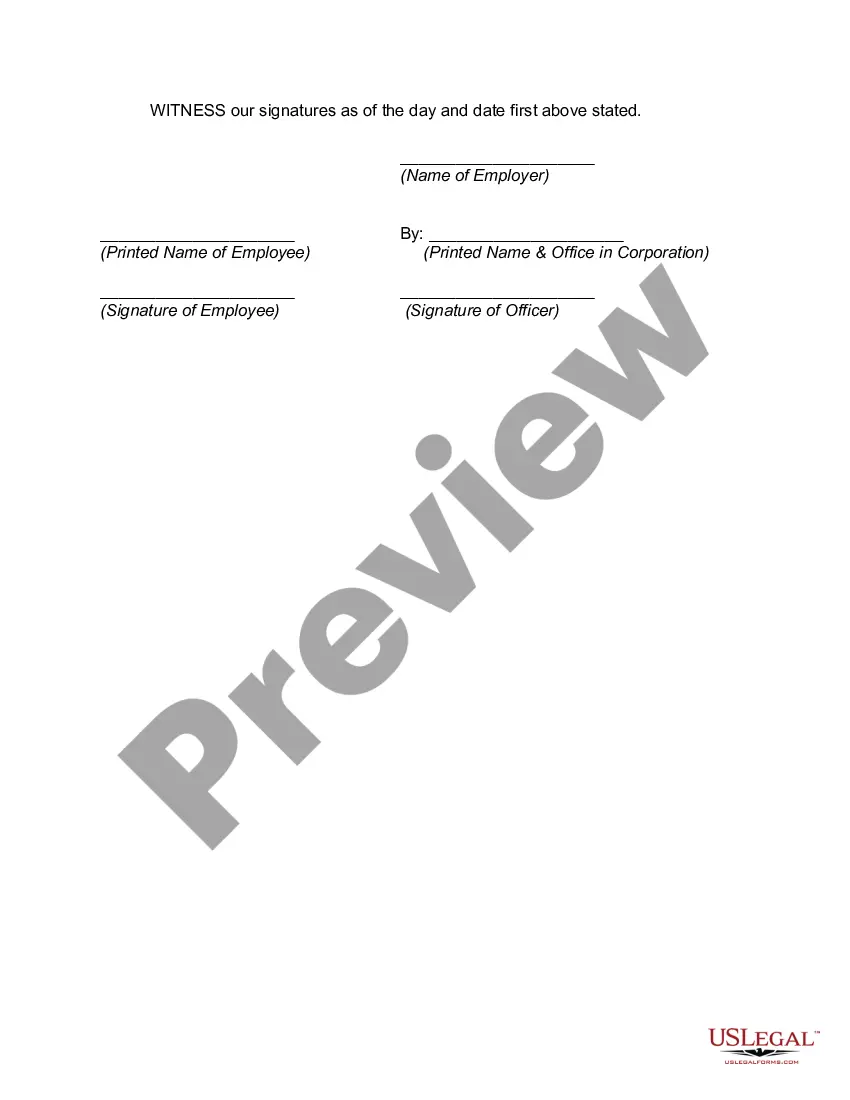

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Allegheny Employment Agreement with Chief Financial Officer template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Moreover, the documents we provide are updated by law professionals, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!