Dallas Texas Employment Agreement with Chief Financial Officer is a formal contract between a company based in Dallas, Texas and its Chief Financial Officer (CFO). This agreement outlines the terms and conditions of employment for the CFO, including their rights, responsibilities, compensation, and benefits. It serves as a legally binding document that establishes a professional relationship between the company and the CFO. The Dallas Texas Employment Agreement with Chief Financial Officer typically includes a comprehensive description of the CFO's role and duties within the organization. It outlines the CFO's responsibilities in managing financial affairs, overseeing financial planning and analysis, budgeting, cash management, and financial reporting. Additionally, it may specify other executive-level duties such as participating in strategic decision-making, implementing financial policies, and ensuring compliance with regulations and industry best practices. The agreement also covers the CFO's compensation package, including base salary, incentives, bonuses, and stock options, if applicable. It details the payment terms and frequency, as well as any performance-based criteria that need to be met for bonus or incentive payouts. Additionally, the agreement may include details regarding healthcare benefits, retirement plans, vacation and sick leave, and other perks offered to the CFO by the company. Furthermore, the Dallas Texas Employment Agreement with Chief Financial Officer may include provisions related to confidentiality and non-disclosure of sensitive company information. It generally contains non-compete and non-solicitation clauses that restrict the CFO from engaging in similar roles or divulging proprietary information to competitors during or after their employment with the company. Different types of Dallas Texas Employment Agreements with Chief Financial Officer may vary based on factors such as the size and nature of the organization, the CFO's level of experience, and industry-specific requirements. For instance, a startup may offer a different compensation structure, potentially including equity or stock options, compared to an established corporation. Additionally, the agreement may differ depending on whether the CFO is full-time, part-time, or contracted for a specific project or duration. In conclusion, the Dallas Texas Employment Agreement with Chief Financial Officer is a crucial document that establishes the roles, responsibilities, and expectations for both the company and the CFO. It ensures a transparent and legally binding employment relationship, enabling effective financial management and strategic decision-making within the organization.

Dallas Texas Employment Agreement with Chief Financial Officer

Description

How to fill out Dallas Texas Employment Agreement With Chief Financial Officer?

Whether you intend to open your business, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare certain paperwork meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Dallas Employment Agreement with Chief Financial Officer is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to get the Dallas Employment Agreement with Chief Financial Officer. Adhere to the instructions below:

- Make sure the sample fulfills your personal needs and state law requirements.

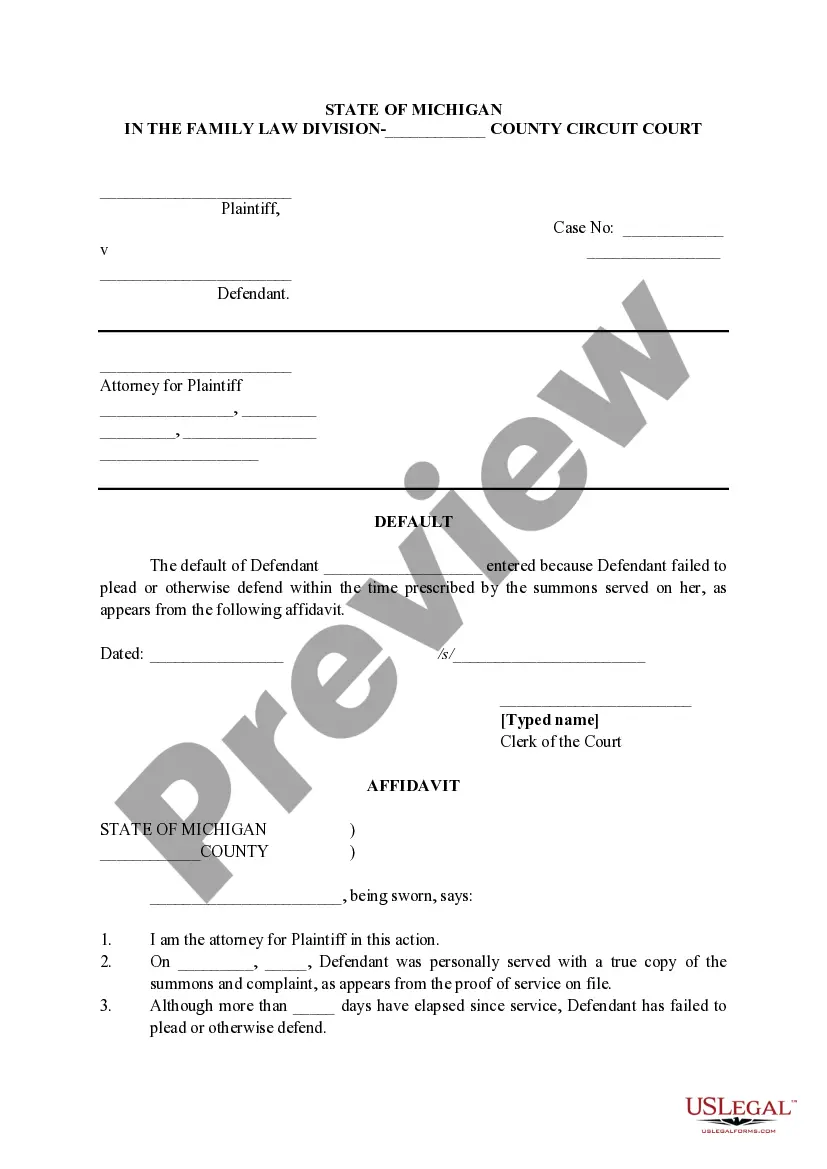

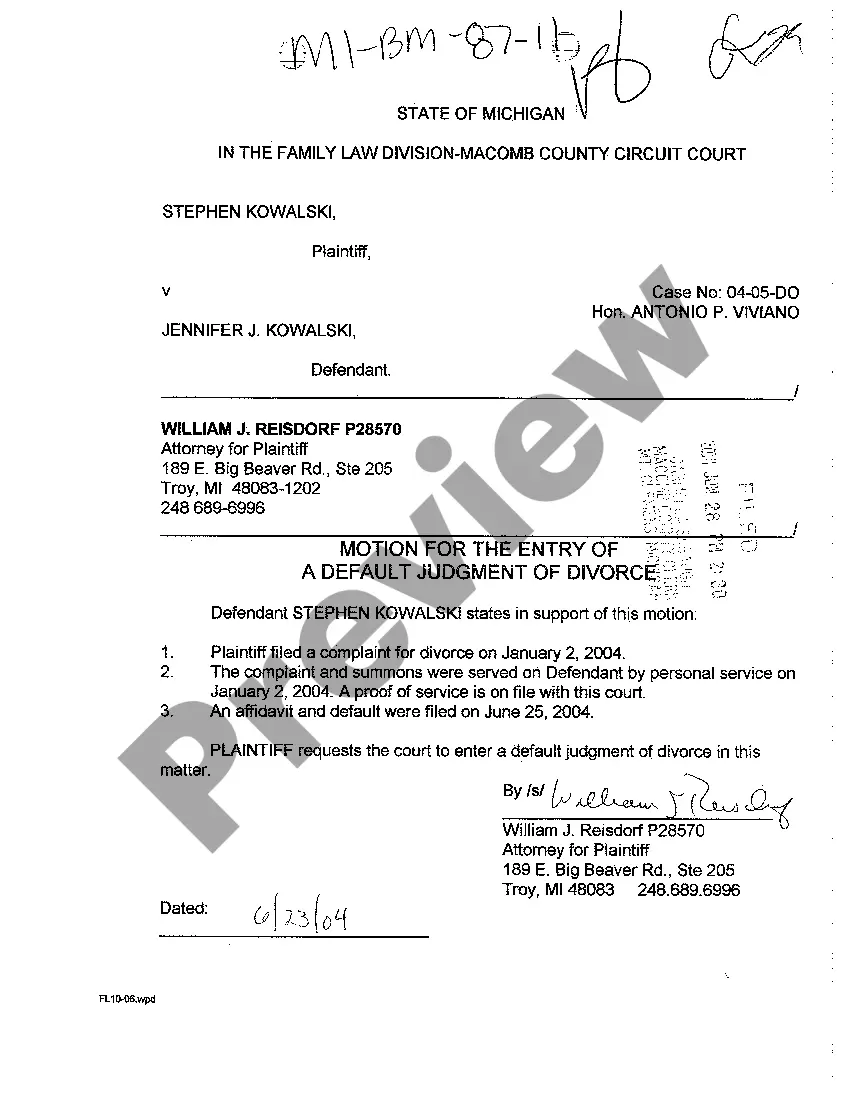

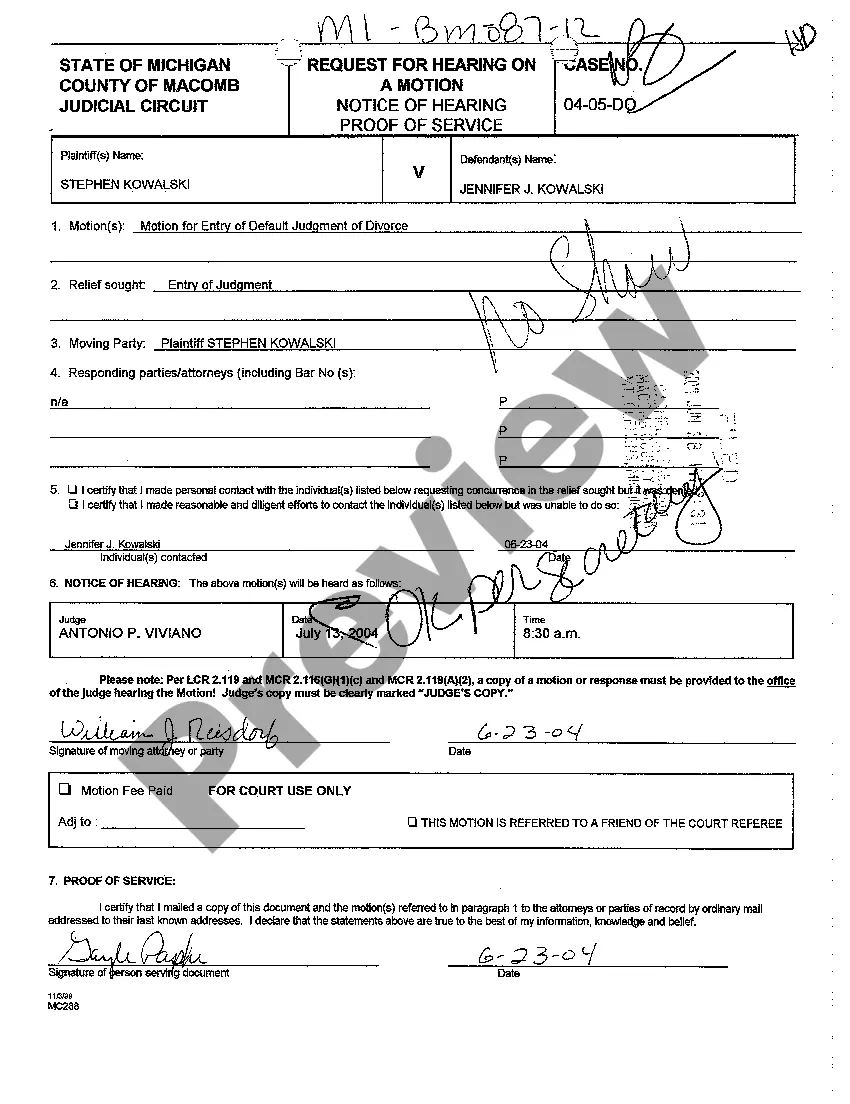

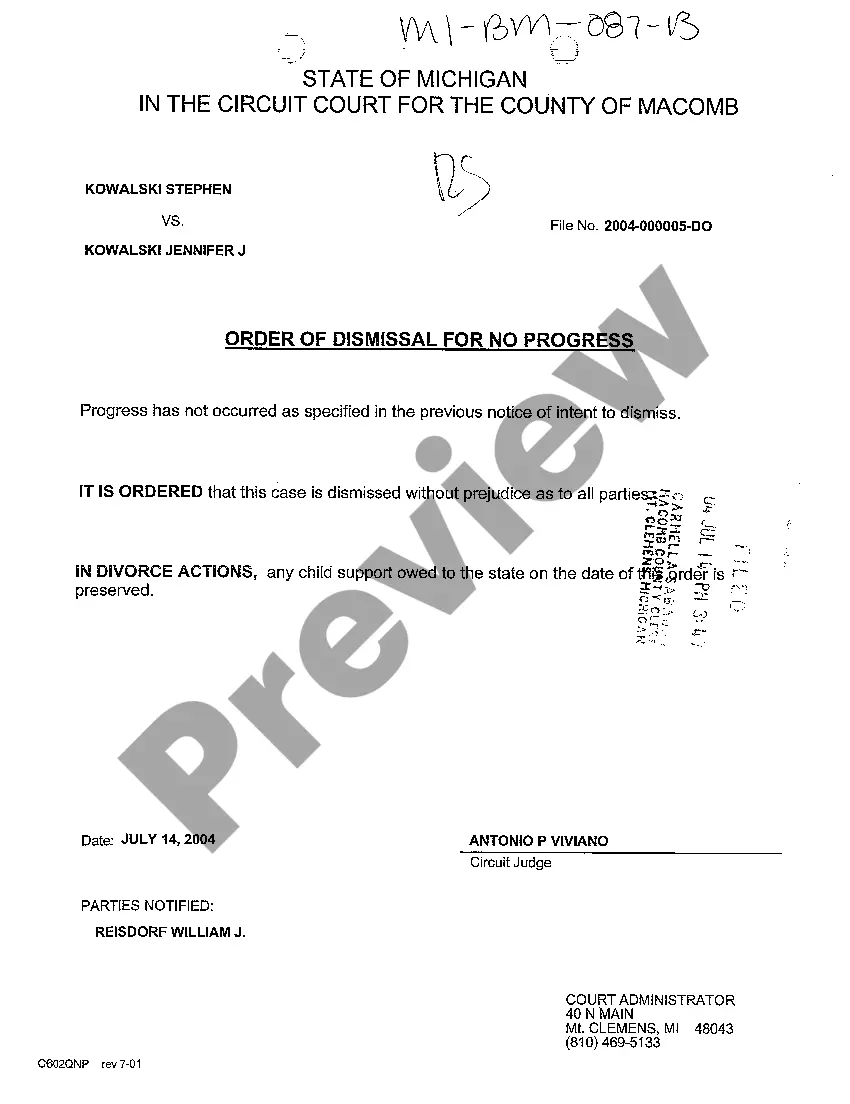

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Dallas Employment Agreement with Chief Financial Officer in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!