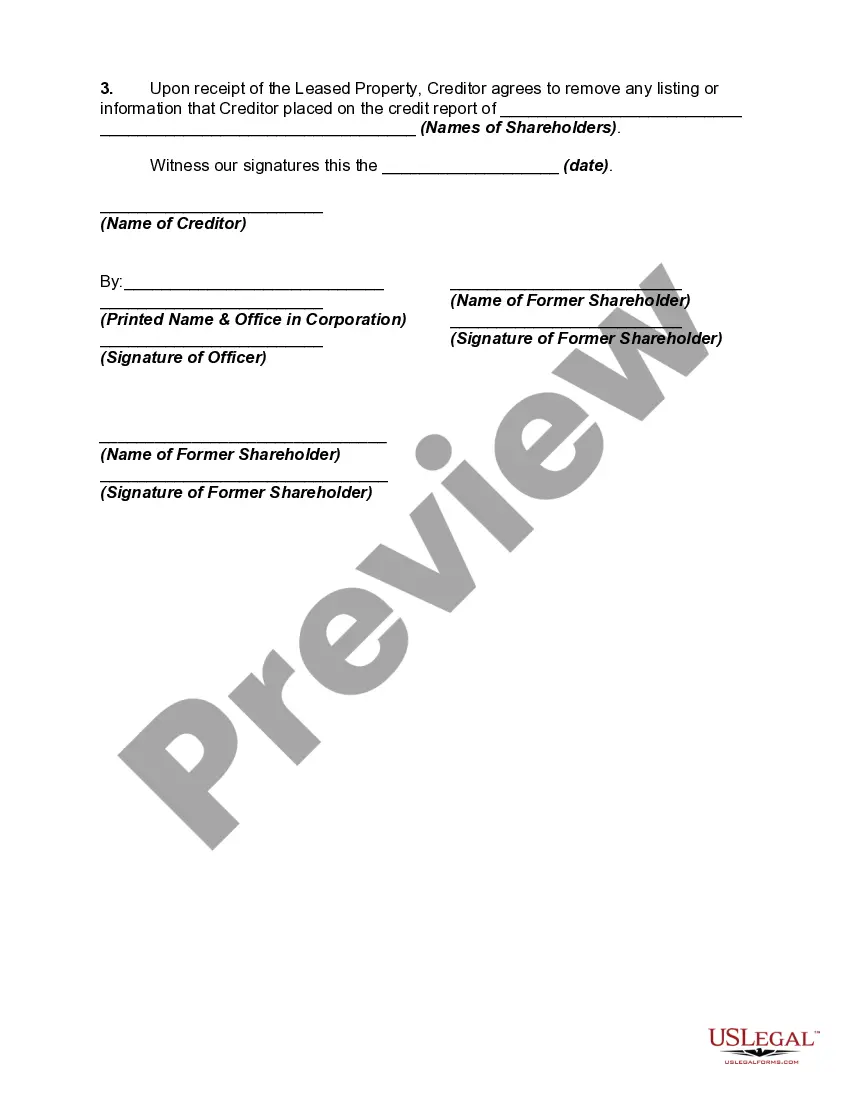

Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions regarding the settlement of a debt through the return of secured property. This agreement is specifically designed for residents of Allegheny County, Pennsylvania, and is a recognized legal solution to resolve debt-related disputes. While there may not be different types of Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property, it is crucial to understand its significance in debt settlement and the process involved. Key factors to consider include: 1. Debt Compromise: The Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property allows debtors and creditors to reach a mutually beneficial arrangement to settle an outstanding debt. In this scenario, the debtor agrees to return the property that was initially used as collateral for the loan. 2. Legal Protection: By executing this agreement, both parties ensure legal protection and eliminate the need for further litigation or legal action. It provides a comprehensive framework that addresses the terms and conditions of debt repayment and the return of secured property. 3. Debtor's Responsibilities: The agreement outlines the debtor's obligations, such as returning the secured property promptly, ensuring it is in good condition, and exempting the creditor from any liabilities or claims related to the property. The debtor must adhere to these responsibilities to conclude the settlement successfully. 4. Creditor's Rights: The agreement specifies the rights of the creditor, ensuring they receive the returned property as promised. It also outlines the reasonable timeframe for completing the property transfer and the consequences if the debtor fails to comply. 5. Terms of Settlement: The Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property includes details regarding the settlement amount, payment terms, interest rates, and any additional fees or charges. These terms are mutually agreed upon to facilitate a fair resolution for both parties. 6. Documentation and Notarization: To ensure its legal validity, this agreement may require notarization and the involvement of legal professionals. This reinforces its enforceability and provides additional security for both the debtor and creditor. The Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property offers a practical solution for debtors and creditors to resolve outstanding debts amicably. By returning the secured property, the debtor can alleviate their financial burden, and the creditor can recover at least a portion of the outstanding debt. It is essential to consult with legal experts to draft and execute this agreement accurately, ensuring compliance with relevant laws and regulations in Allegheny County, Pennsylvania.

Allegheny Pennsylvania Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Allegheny Pennsylvania Agreement To Compromise Debt By Returning Secured Property?

Preparing legal paperwork can be difficult. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Allegheny Agreement to Compromise Debt by Returning Secured Property, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the current version of the Allegheny Agreement to Compromise Debt by Returning Secured Property, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Allegheny Agreement to Compromise Debt by Returning Secured Property:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Allegheny Agreement to Compromise Debt by Returning Secured Property and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!