Fulton Georgia Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions under which a debtor can settle their debt by returning the secured property to the creditor. This agreement allows both parties to reach a compromise and avoid lengthy legal proceedings. The Fulton Georgia Agreement to Compromise Debt by Returning Secured Property serves as a legally binding contract between the debtor and the creditor and provides a clear understanding of the responsibilities and obligations of each party involved. By returning the secured property, the debtor is able to satisfy their debt, while the creditor has the opportunity to recover a portion of their losses. Keywords: Fulton Georgia Agreement to Compromise Debt, returning secured property, settlement, debtor, creditor, legal document, compromise, debt resolution, responsibilities, obligations, satisfaction, recovery, losses. Types of Fulton Georgia Agreement to Compromise Debt by Returning Secured Property: 1. Residential Property Compromise Agreement: This type of agreement is specifically used when the secured property in question is a residential property, such as a house or apartment. It outlines the terms and conditions for the debtor to return the property and settle the debt. 2. Commercial Property Compromise Agreement: If the secured property involves a commercial property, such as a retail store or office space, this specific agreement is utilized. It covers the details of returning the property and resolving the debt through compromise. 3. Vehicle Compromise Agreement: In cases where the secured property is a vehicle, such as a car or truck, this agreement will be employed. It provides a framework for the debtor to return the vehicle to the creditor as a method of fulfilling their debt obligation. 4. Personal Property Compromise Agreement: This type of agreement applies to secured debts involving personal property, such as electronics, jewelry, or furnishings. It outlines the terms and conditions for the debtor to return the specific items to the creditor in order to reach an agreement on the outstanding debt. 5. Real Estate Compromise Agreement: When the secured property is real estate, such as land or a building, this agreement is used. It addresses the specific requirements and conditions for the debtor to transfer the property to the creditor as a method of debt compromise. It is important to note that the actual names of the different types of Fulton Georgia Agreement to Compromise Debt by Returning Secured Property may vary depending on the legal terminology used in the state or by individual lawyers or creditors.

Fulton Georgia Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Fulton Georgia Agreement To Compromise Debt By Returning Secured Property?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Fulton Agreement to Compromise Debt by Returning Secured Property, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Fulton Agreement to Compromise Debt by Returning Secured Property from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Fulton Agreement to Compromise Debt by Returning Secured Property:

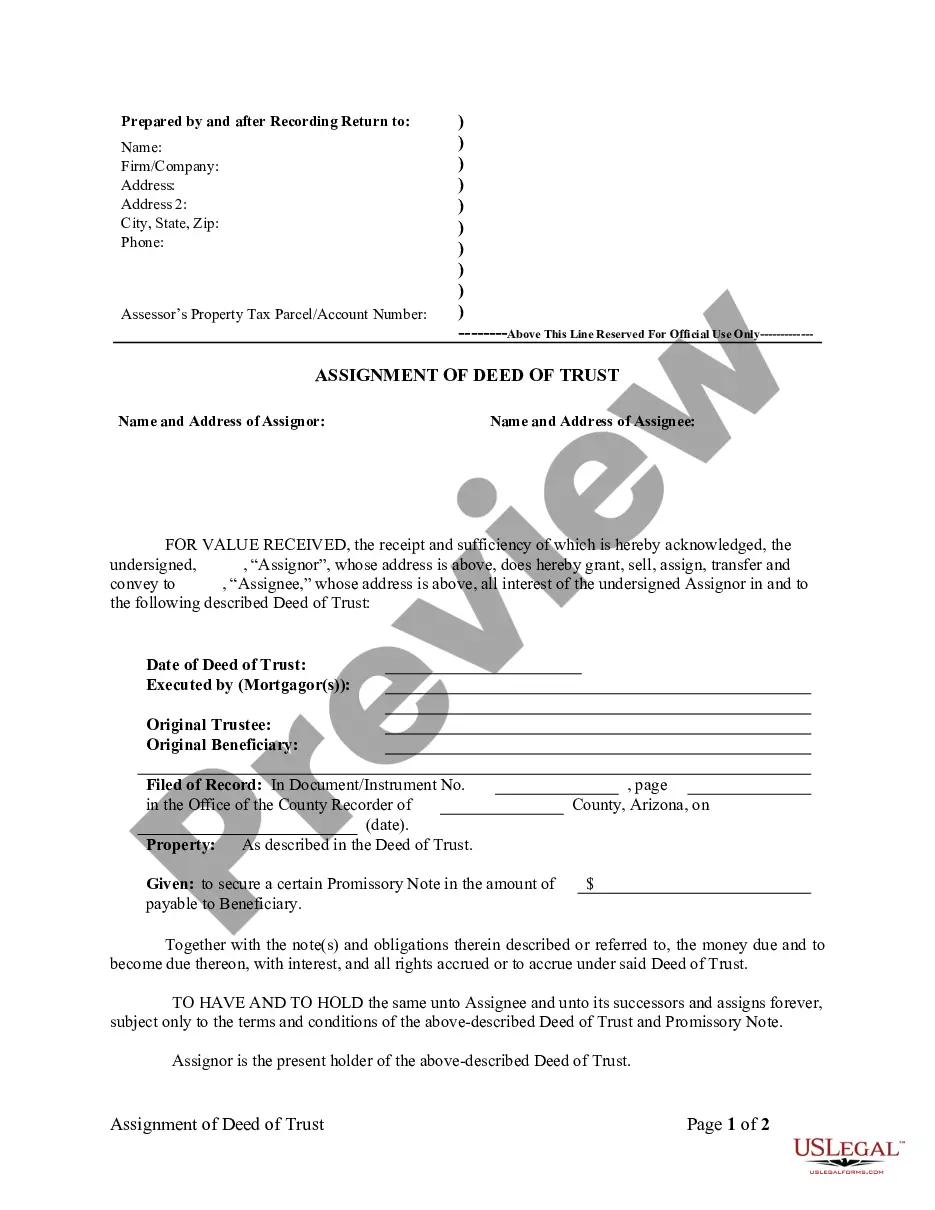

- Examine the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template once you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!