Maricopa, Arizona Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions between a debtor and a creditor to settle a debt through the return of secured property. This agreement is designed to enable both parties to reach a mutually-beneficial compromise and alleviate the debtor's financial burden. In Maricopa, Arizona, there are different types of agreements to compromise debt by returning secured property, each specific to the unique circumstances of the debtor and creditor. Some of these variations include: 1. Residential Property Agreement: This agreement focuses on compromising debt related to residential properties, such as homes, apartments, or rental units. It provides a framework to return the property to the creditor in exchange for reducing or eliminating the outstanding debt. 2. Commercial Property Agreement: This type of agreement pertains to compromising debt tied to commercial properties, such as retail spaces, offices, or industrial buildings. It allows the debtor to return the property to the creditor as a means of settling the outstanding debt. 3. Vehicle Agreement: In cases where the secured property is a vehicle, the debtor and creditor can negotiate an agreement to return the vehicle and settle the debt. This may apply to various types of vehicles, including cars, motorcycles, or recreational vehicles. 4. Equipment or Machinery Agreement: If the secured property is equipment or machinery used for business or personal purposes, this agreement can be utilized to compromise the debt. The debtor returns the equipment or machinery, and the creditor agrees to discharge or reduce the debt in return. The Maricopa, Arizona Agreement to Compromise Debt by Returning Secured Property typically includes important details such as: 1. Parties involved: This section identifies the debtor (individual or entity) seeking debt relief and the creditor who is owed the debt. 2. Description of the secured property: The agreement specifies the type, condition, and any relevant identifying details of the property to be returned. 3. Outstanding debt amount: This clause outlines the exact amount of debt owed by the debtor, including any applicable interest or fees. 4. Terms of compromise: The agreement outlines the terms and conditions under which the secured property will be returned to the creditor in full satisfaction of the debt. This may include details such as the method of return, any necessary repairs or maintenance responsibilities, and any associated costs to be borne by the debtor or creditor. 5. Debt discharge or reduction: This section clarifies how the return of the secured property will impact the outstanding debt. It specifies whether the debt will be discharged in full or reduced by a certain percentage. 6. Release of claims: Both parties release each other from any further claims, demands, or liabilities related to the debt or the secured property, ensuring a clean break and preventing future disputes. It is crucial to consult legal counsel or a qualified professional when negotiating and finalizing a Maricopa, Arizona Agreement to Compromise Debt by Returning Secured Property to ensure compliance with local laws and protect the interests of all parties involved.

Maricopa Arizona Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Maricopa Arizona Agreement To Compromise Debt By Returning Secured Property?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Maricopa Agreement to Compromise Debt by Returning Secured Property, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Agreement to Compromise Debt by Returning Secured Property from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Maricopa Agreement to Compromise Debt by Returning Secured Property:

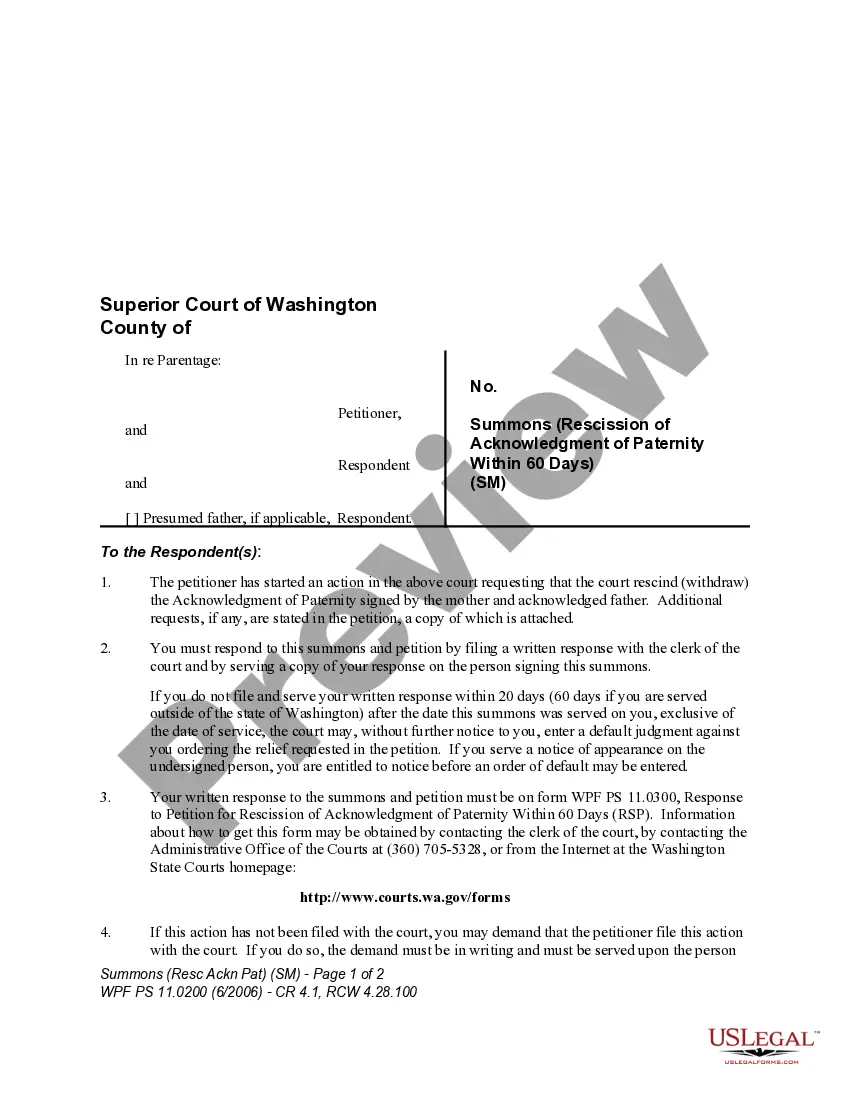

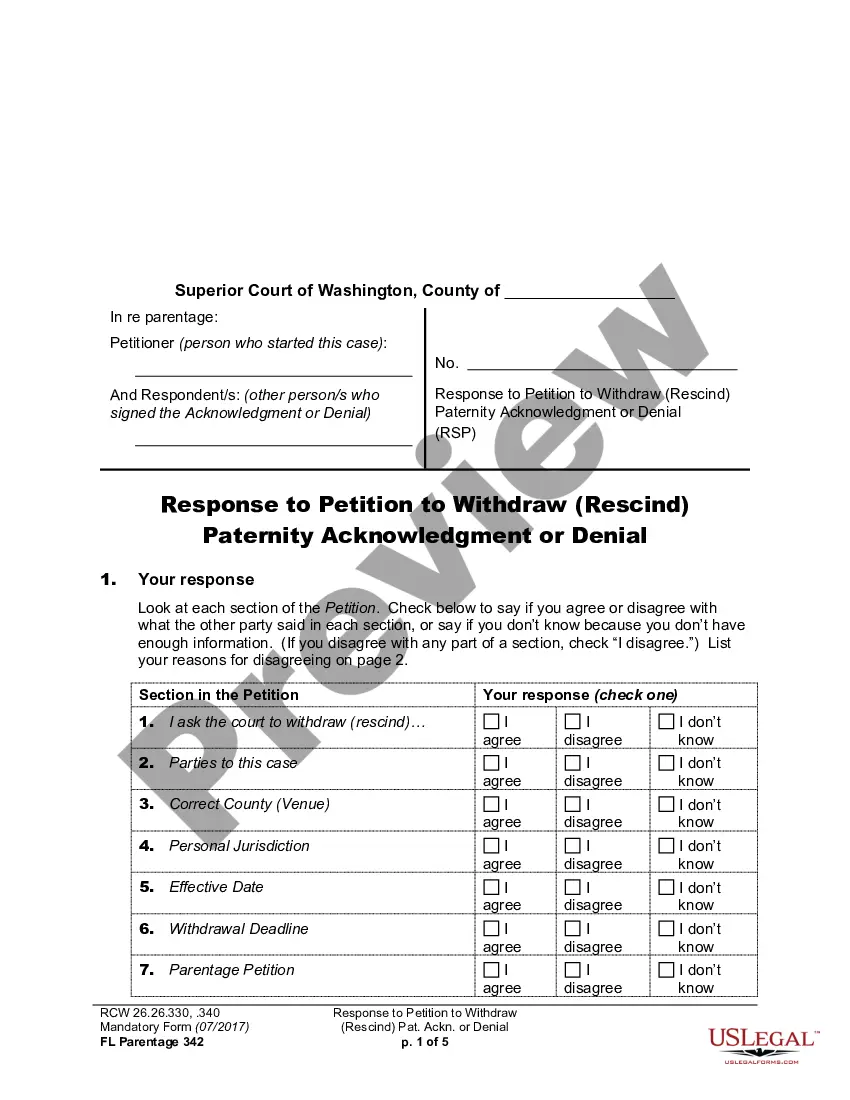

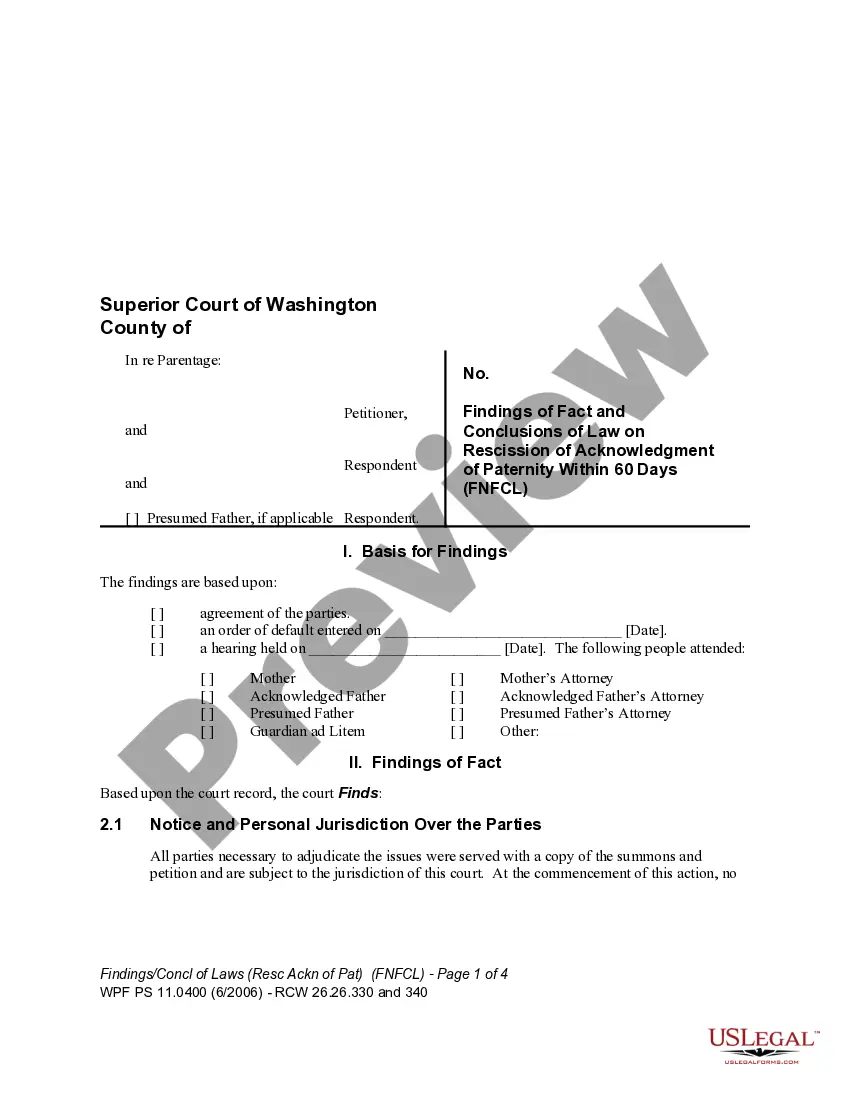

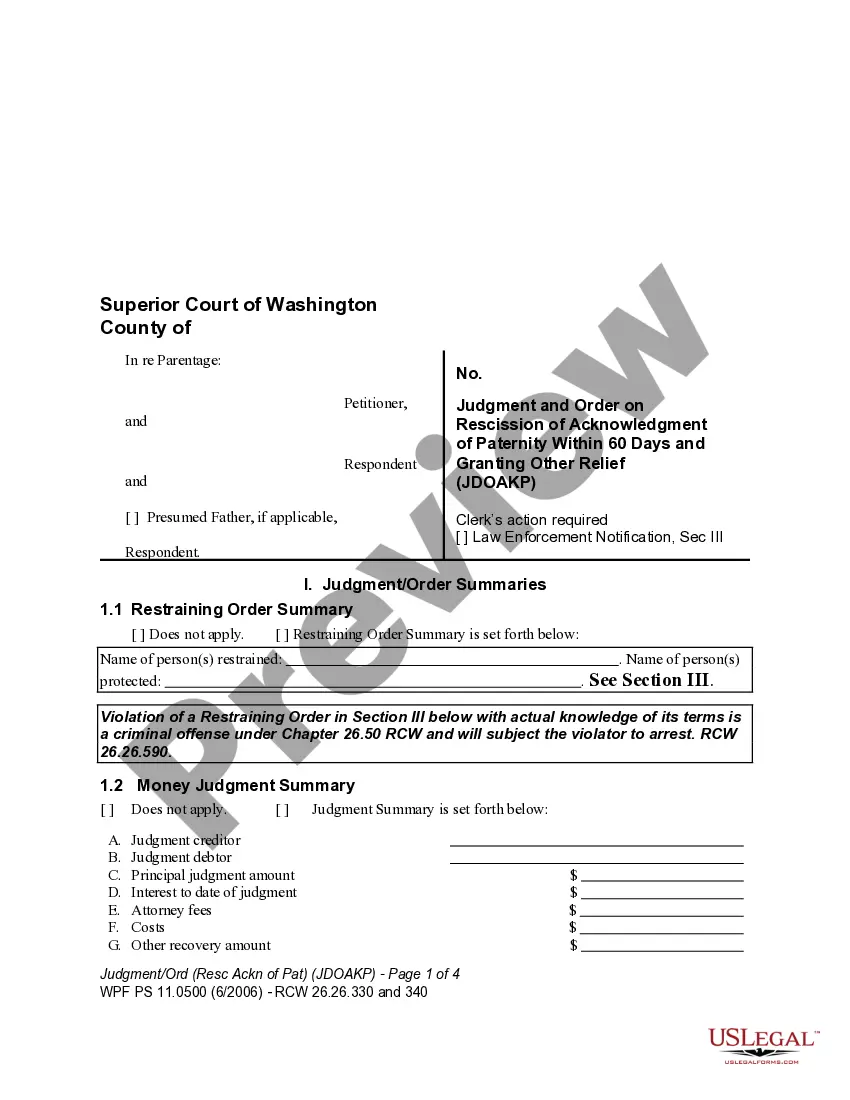

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!