Riverside California Agreement to Compromise Debt by Returning Secured Property is a legal document that outlines the terms and conditions for resolving a debt issue between a debtor and a creditor. This agreement involves the compromise of debt by returning a secured property to the creditor as a means of settling the outstanding balance owed. In Riverside, California, there are several types of Agreement to Compromise Debt by Returning Secured Property, including: 1. Residential Property Agreement: This type of agreement specifically deals with compromising debt related to residential properties, such as houses or apartments. It outlines the terms for returning the property to the creditor in exchange for debt forgiveness or a reduced repayment amount. 2. Commercial Property Agreement: This agreement pertains to compromising debt associated with commercial properties, like office buildings, retail spaces, or industrial premises. It outlines the specific conditions for returning the property in order to reach a compromise on the outstanding debt. 3. Vehicle Agreement: This type of Riverside California Agreement to Compromise Debt by Returning Secured Property focuses on compromising debt related to vehicles, such as cars, motorcycles, or recreational vehicles. It specifies the terms for returning the vehicle to the creditor as a means of settling the debt issue. 4. Personal Property Agreement: This agreement is applicable when the debt is tied to personal assets other than real estate or vehicles. It covers various items like jewelry, electronics, artwork, or any other valuable possession that was used as collateral against the debt. The agreement outlines the conditions for returning the personal property to the creditor to resolve the debt. Regardless of the specific type, Riverside California Agreement to Compromise Debt by Returning Secured Property is a legally binding document that protects the rights and interests of both the debtor and the creditor. It establishes the terms for returning the secured property and achieving a mutual agreement on debt resolution. This agreement aims to provide a fair and equitable solution for debtors and creditors, helping them avoid legal disputes and financial hardships.

Riverside California Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Riverside California Agreement To Compromise Debt By Returning Secured Property?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including Riverside Agreement to Compromise Debt by Returning Secured Property, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories varying from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching experience less frustrating. You can also find information materials and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how to find and download Riverside Agreement to Compromise Debt by Returning Secured Property.

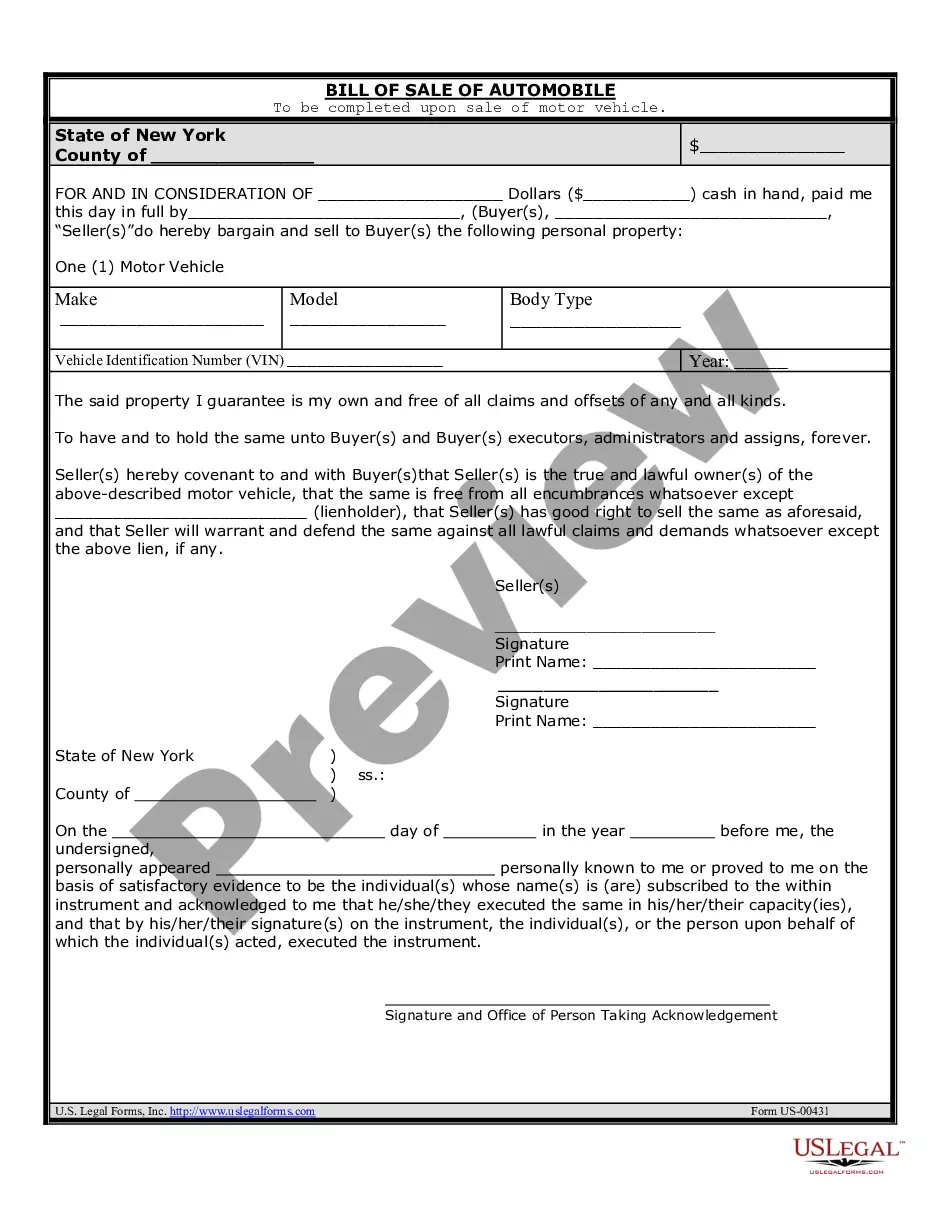

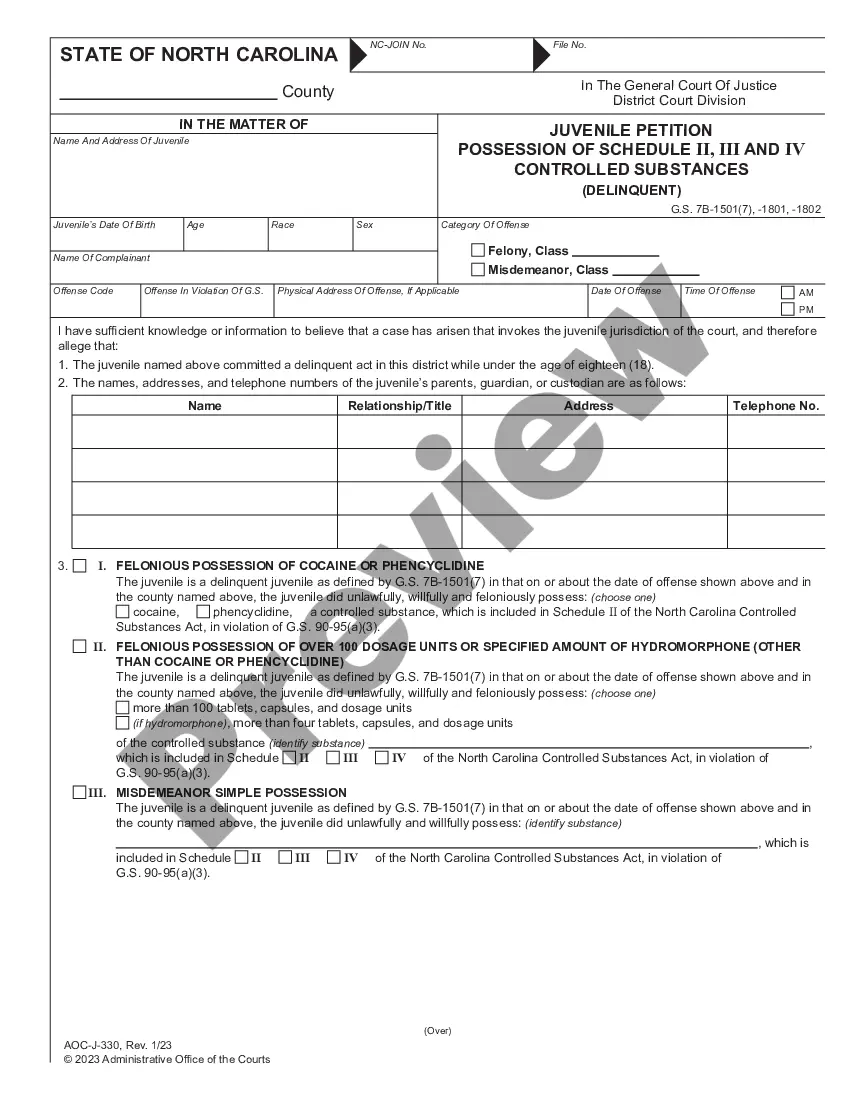

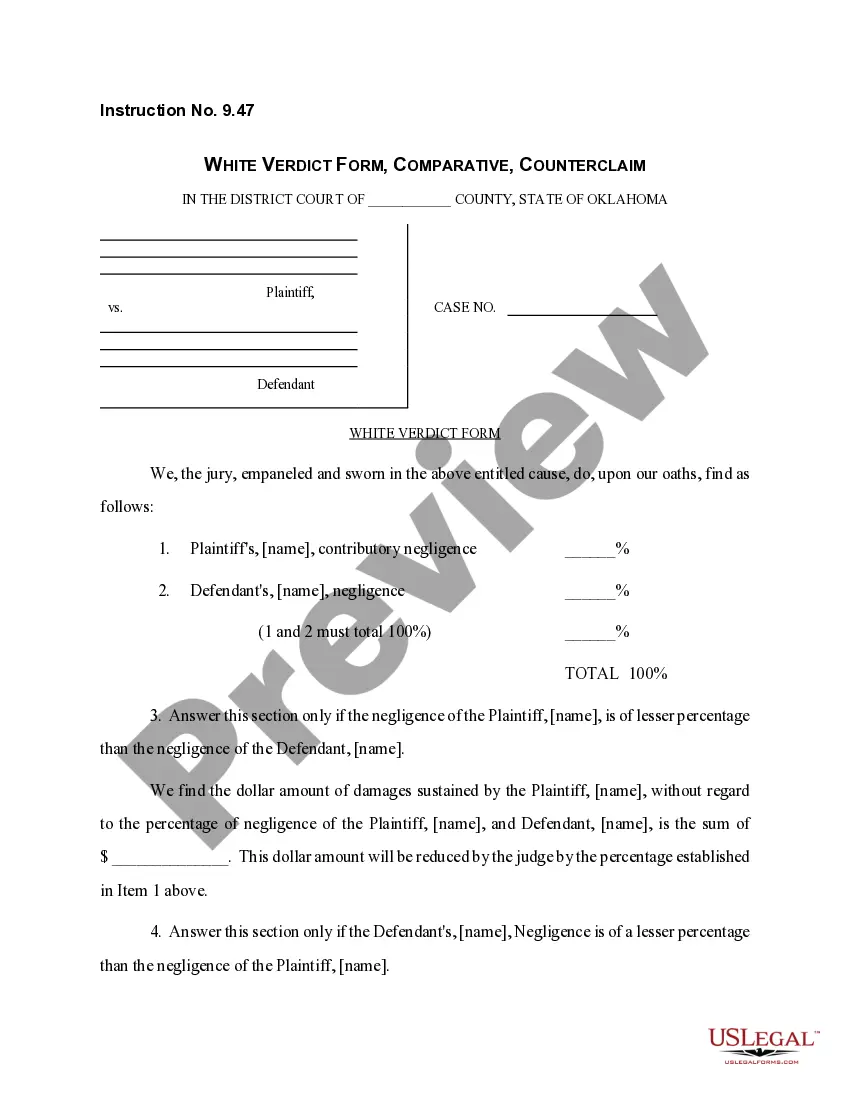

- Take a look at the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the validity of some documents.

- Examine the related forms or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Riverside Agreement to Compromise Debt by Returning Secured Property.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Riverside Agreement to Compromise Debt by Returning Secured Property, log in to your account, and download it. Needless to say, our platform can’t replace a lawyer entirely. If you need to deal with an extremely complicated situation, we advise using the services of a lawyer to check your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for many different legal forms for millions of users. Join them today and purchase your state-specific paperwork with ease!