Federal tax aspects of a revocable inter vivos trust agreement should be carefully studied in considering whether to create such a trust and in preparing the trust instrument. There are no tax savings in the use of a trust revocable by the trustor or a non-adverse party. The trust corpus will be includable in the trustor's gross estate for estate tax purposes. The income of the trust is taxable to the trustor.

Mecklenburg North Carolina Revocable Trust Agreement with Husband and Wife as Trustors and Income to

Description

How to fill out Mecklenburg North Carolina Revocable Trust Agreement With Husband And Wife As Trustors And Income To?

Laws and regulations in every area vary around the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Mecklenburg Revocable Trust Agreement with Husband and Wife as Trustors and Income to, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Mecklenburg Revocable Trust Agreement with Husband and Wife as Trustors and Income to from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Mecklenburg Revocable Trust Agreement with Husband and Wife as Trustors and Income to:

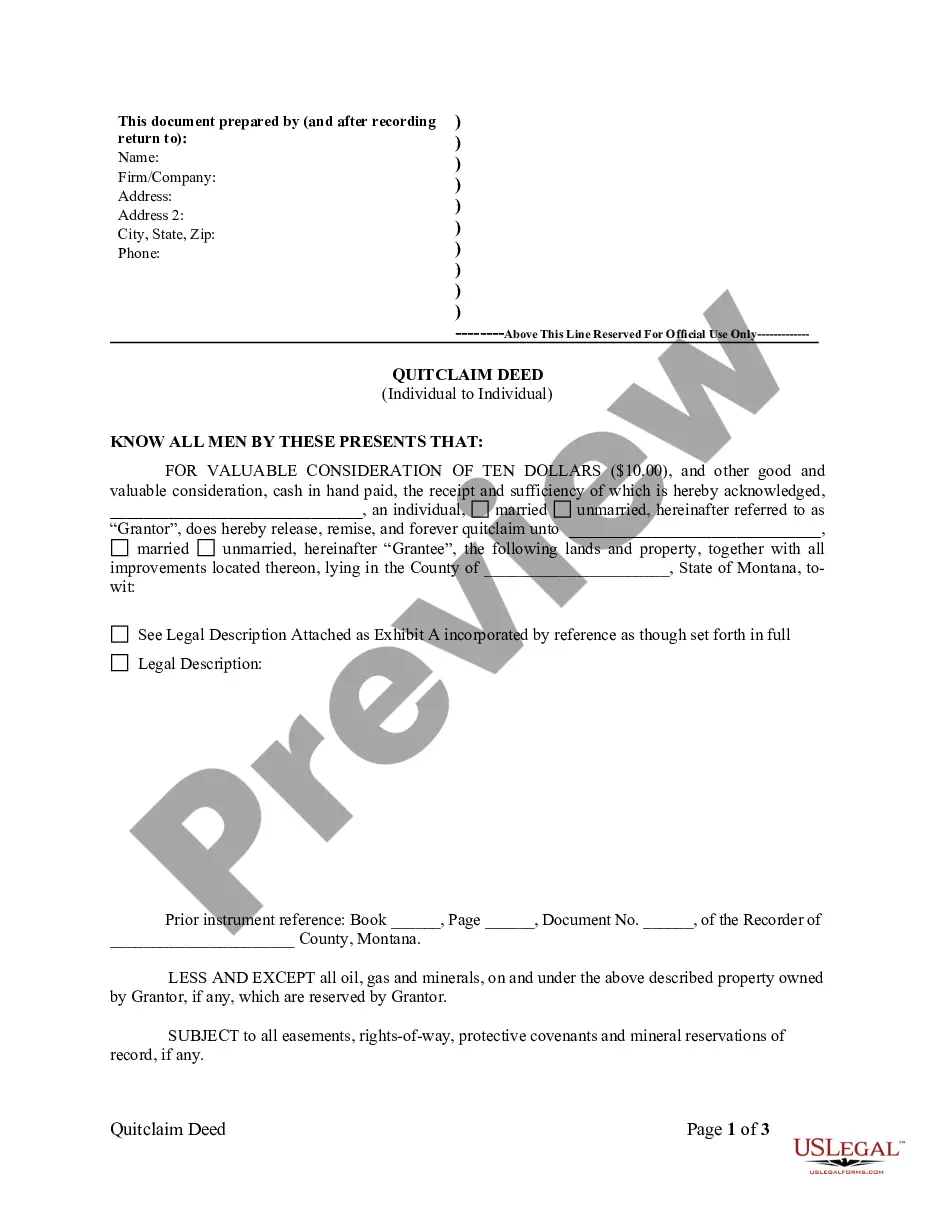

- Analyze the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

In a simple living trust, a couple can share the control and benefits of the trust while they are living. Once one spouse dies, the other spouse will have total control over the trust. After one spouse's death, the survivor can alter the beneficiaries if they wish.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

Though not a silver bullet for every situation, in appropriate circumstances, a Joint Revocable Living Trust ("Joint Trust") can provide a married couple with significant benefits and simplify the administration of assets upon death or incapacity.

However, individual trusts sometimes offer superior benefits for married couples with respect to asset protection, flexible management, and potential cost savings after the death of a spouse. Below we've compared the strengths and weaknesses of each trust in various scenarios.

You can be trustee of your own living trust. If you are married, your spouse can be trustee with you. Most married couples who own assets together, especially those who have been married for some time, are usually co-trustees.

Since each spouse is required to manage their own trust, separate trusts require more work. However, one spouse can name the other as a co-trustee so that both spouses can control all assets in the separate trusts. Joint trusts are easier to manage during a couple's lifetime.

Trusts for Spouses California follows the law of community property, which means that each spouse owns a half interest in community property and a full interest in any separate property. Each spouse is allowed to decide who receives their half of the community property when they die.

More info

To the contrary, the Court of Appeals of North Carolina has upheld felony convictions for violation of a fiduciary obligation in only three cases since 1870: see, e.g., State v. Anderson, 113 N. C. 665, 522 S. E. 2d 605 (1991). [Footnote 5] The court did not say that federal law is inapplicable to conduct regulated by North Carolina statutory law. Indeed, the court said that, “when North Carolina law is adopted as to one of these acts, our law must stand alongside it so that it will be enforced. For that reason, a state statute not specifically limited to regulation or control under federal law cannot be enforced in any other way by North Carolina.” I'd., at 1201. We need not decide whether our holding was the result of a misapprehension of the statute or of the way the statute itself applies. [Footnote 6] The statute was not challenged in court.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.