San Diego, California, is a vibrant and diverse city located in the southwestern part of the United States. Known for its stunning beaches, pleasant climate, and thriving cultural scene, San Diego offers a unique blend of history, natural beauty, and modern amenities. When it comes to opening a charge account in San Diego, various businesses and financial institutions may have their own specific terms and conditions. These documents are essential in establishing a clear understanding of the rights and responsibilities of both the merchant and the customer. One type of San Diego, California, sample letter for charge account terms and conditions could be for a retail store. This letter would outline the rules and regulations for customers who wish to open a charge account with the store. It may include details such as credit limits, payment due dates, interest rates, and any penalties for late or missed payments. Additionally, the letter may also mention the process of returning or exchanging goods purchased on the account and provide information on potential fees associated with these transactions. Another type of San Diego, California, sample letter for charge account terms and conditions could be for financial institutions like banks or credit unions. These letters would generally cover the specifics of terms and conditions related to credit cards, personal loans, or other financial accounts. Such letters often include information about the annual percentage rate (APR), grace period, minimum monthly payments, and other relevant financial details. They may also include sections on the expected use of the account, rights of the institution in case of default, and the customer's liability for unauthorized charges. In conclusion, San Diego, California, is a vibrant city with diverse businesses that may offer consumers different types of charge accounts. Sample letters for charge account terms and conditions provide detailed information regarding customers' responsibilities, restrictions, and the rules set forth by the merchant or financial institution. Such documents help both parties establish a transparent agreement and maintain a smooth, mutually beneficial relationship.

San Diego California Sample Letter for Charge Account Terms and Conditions

Description

How to fill out San Diego California Sample Letter For Charge Account Terms And Conditions?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the San Diego Sample Letter for Charge Account Terms and Conditions, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Sample Letter for Charge Account Terms and Conditions from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Diego Sample Letter for Charge Account Terms and Conditions:

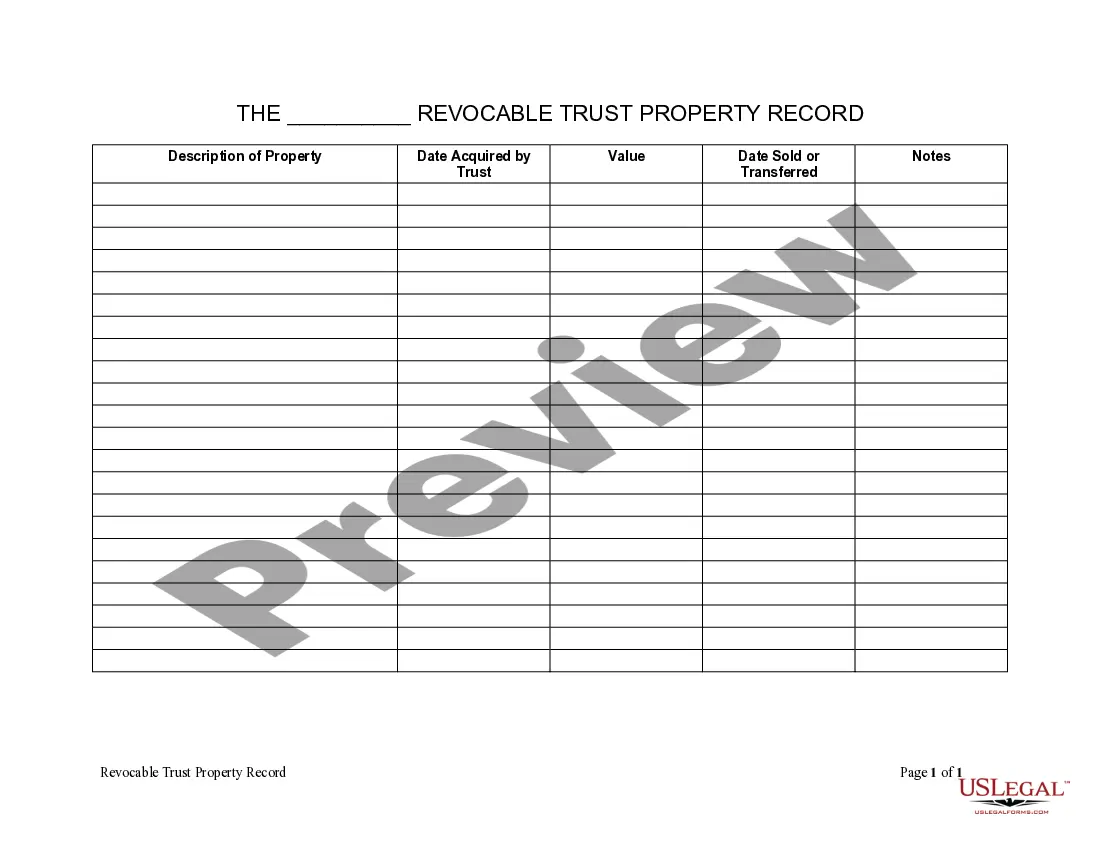

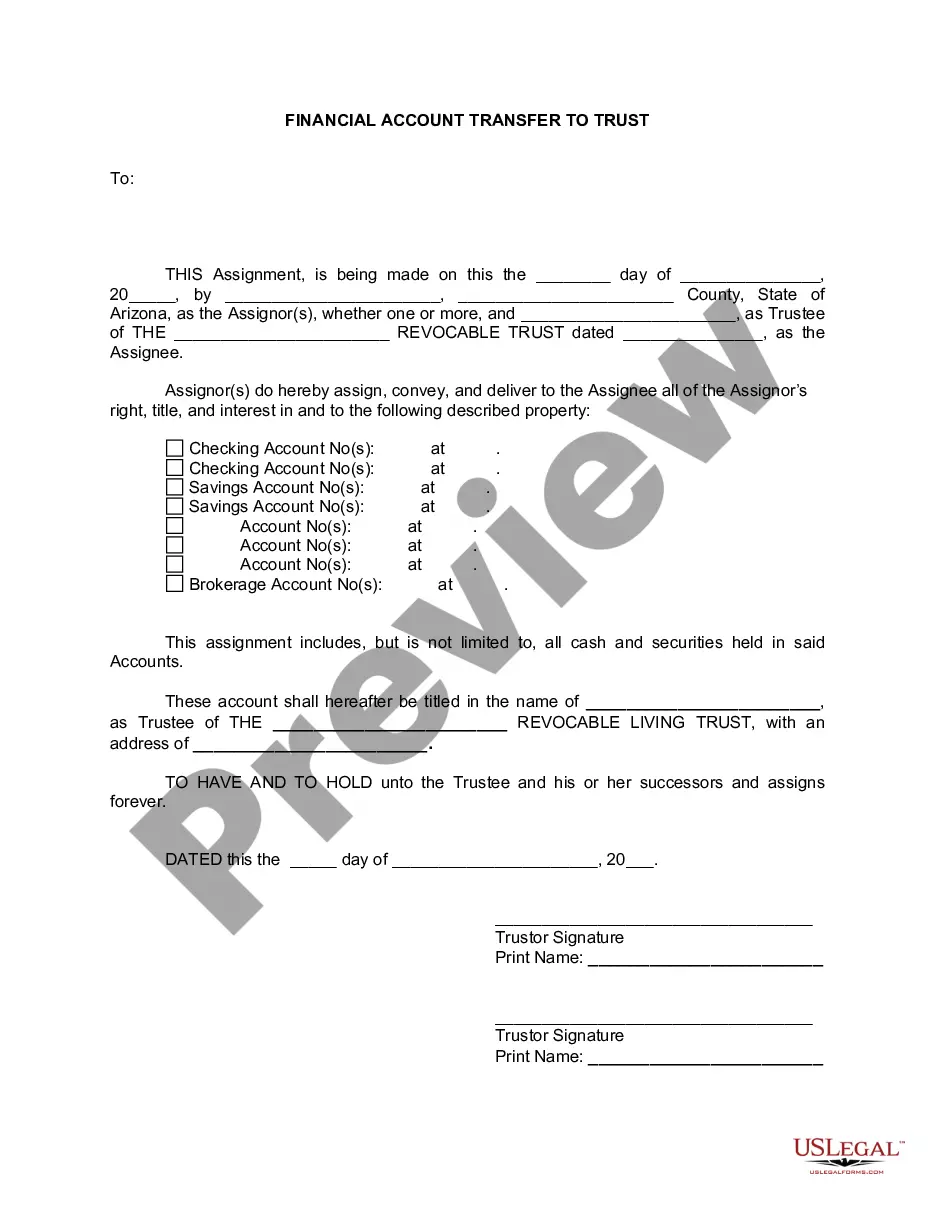

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!