Santa Clara California Sample Letter for Charge Account Terms and Conditions

Description

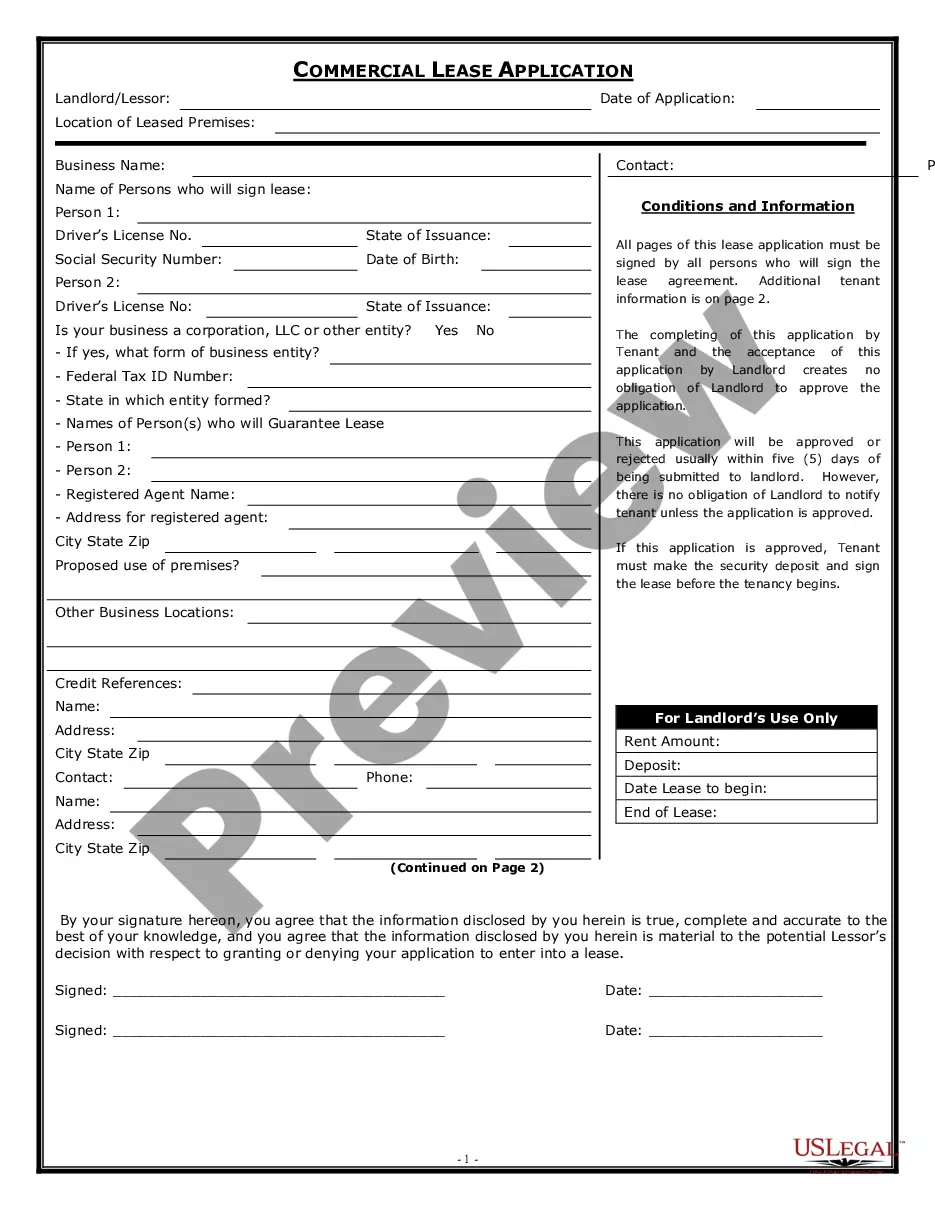

How to fill out Sample Letter For Charge Account Terms And Conditions?

Drafting legal documents is essential in the modern era. Nonetheless, it is not always necessary to seek expert help to create some of them from scratch, including the Santa Clara Sample Letter for Charge Account Terms and Conditions, using a platform like US Legal Forms.

US Legal Forms offers over 85,000 templates to choose from across multiple categories, ranging from living wills to real estate agreements to divorce filings. All templates are categorized by their applicable state, simplifying the research process.

You can access and obtain the Santa Clara Sample Letter for Charge Account Terms and Conditions by following these steps.

Visit the My documents section to re-download the document.

If you are already a member of US Legal Forms, locate the appropriate Santa Clara Sample Letter for Charge Account Terms and Conditions, Log In to your account, and download it. Naturally, our platform cannot entirely replace an attorney's role. If facing a particularly complex matter, we suggest employing the assistance of a lawyer to review your document before signing and submitting it. With over 25 years in the industry, US Legal Forms has established itself as a trusted source for a variety of legal templates for millions of users. Join them today and easily obtain your state-specific documents!

- Review the document's preview and outline (if available) to understand what you’ll receive upon acquiring the document.

- Confirm that the template you select is suitable for your state/county/region since local laws may influence the validity of certain documents.

- Look at similar documents or restart your search for the correct template.

- Click Buy now and set up your account. If you already possess one, opt to Log In.

- Select the payment option and method, then purchase the Santa Clara Sample Letter for Charge Account Terms and Conditions.

- Choose to store the form template in any supported file format.