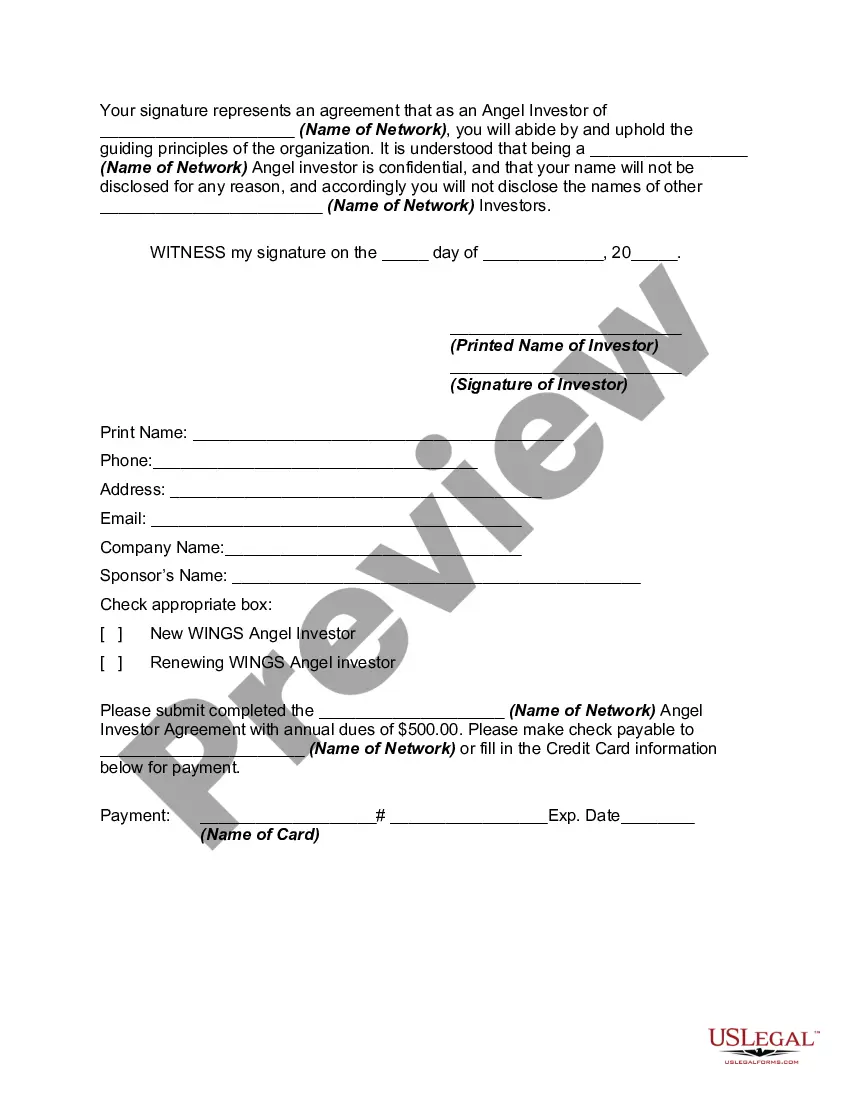

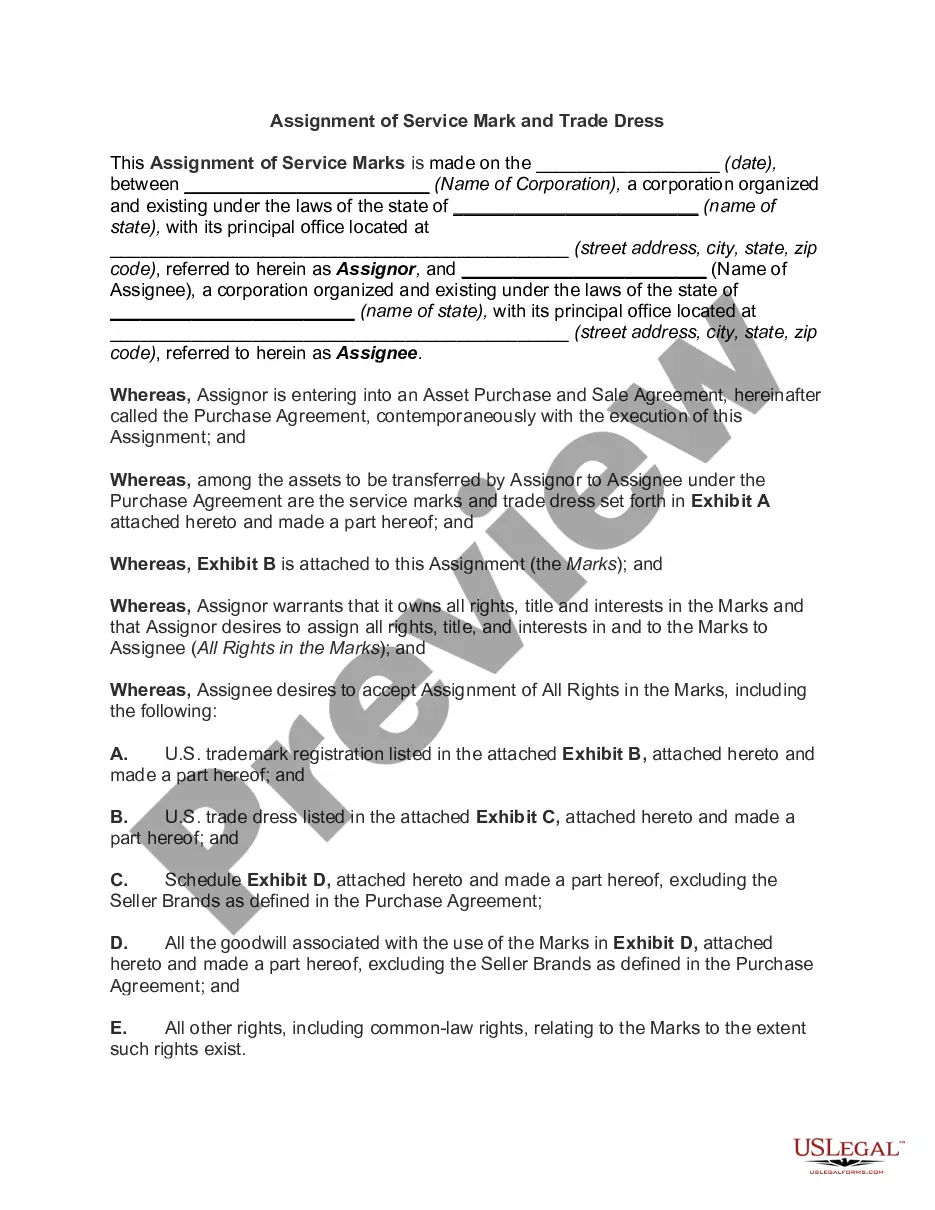

Fairfax Virginia Angel Investor Agreement is a legal document that outlines the terms and conditions between an angel investor and an entrepreneur or early-stage startup based in Fairfax, Virginia. This agreement serves as a crucial tool for securing funding and establishing a mutually beneficial relationship between both parties. The Fairfax Virginia Angel Investor Agreement typically includes the following key components: 1. Investment Terms: This section outlines the amount of money the angel investor agrees to invest and the equity or ownership stake they will receive in return. It may also specify any future funding commitments or milestone-based investment provisions. 2. Vesting and Dilution: This clause defines how the investment will be released to the startup or entrepreneur over time and addresses any potential dilution of the angel investor's equity stake during future financing rounds. 3. Use of Funds: The agreement will specify how the invested funds can be utilized by the startup, providing transparency and accountability for the angel investor to monitor the startup's financial activities. 4. Investor Rights: This section outlines the rights and privileges granted to the angel investor, such as the ability to attend board meetings, receive regular updates on the company's progress, and participate in future funding rounds. 5. Exit Strategies: The agreement may include provisions for exit strategies, such as the entrepreneur's obligation to offer the angel investor a first opportunity to buy back their equity stake or participate in the sale of the company. Different types of Fairfax Virginia Angel Investor Agreements include: 1. Convertible Note Agreement: This type of agreement is commonly used when the startup is in its early stages and the valuation is uncertain. It allows the angel investor to provide a loan to the startup, which will convert into equity during a future financing round. 2. Preferred Equity Agreement: In this agreement, the angel investor receives preferred shares in exchange for their investment. Preferred shares often come with additional rights and privileges, such as priority liquidation preference or anti-dilution protection. 3. SAFE (Simple Agreement for Future Equity): The SAFE agreement is a relatively new form of investment agreement. It allows the angel investor to provide funding to the startup in exchange for the right to future equity if certain triggering events occur, such as a subsequent funding round or acquisition. In conclusion, the Fairfax Virginia Angel Investor Agreement is a vital legal document that helps formalize the relationship between angel investors and startups or entrepreneurs in Fairfax, Virginia. It outlines the terms of the investment, the rights and responsibilities of both parties, and provides a framework for achieving mutual success.

Fairfax Virginia Angel Investor Agreement

Description

How to fill out Fairfax Virginia Angel Investor Agreement?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Fairfax Angel Investor Agreement, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Angel Investor Agreement from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Fairfax Angel Investor Agreement:

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!