Franklin Ohio Angel Investor Agreement is a legally binding contract entered into by a startup or an entrepreneur seeking funding and an angel investor interested in providing financial assistance to the business. This agreement outlines the terms, conditions, and obligations of both parties involved in the investment transaction. The main purpose of the Franklin Ohio Angel Investor Agreement is to establish a framework for the investment, define the rights and responsibilities of the investor, and protect the interests of both parties. It typically covers crucial aspects such as equity ownership, investment amount, use of funds, roles and responsibilities, exit strategy, intellectual property rights, and dispute resolution. There are different types of Franklin Ohio Angel Investor Agreements, each tailored to suit the specific needs and preferences of the parties involved: 1. Equity Financing Agreement: This type of agreement specifies that the investor will receive equity or ownership stake in the startup in exchange for their investment. It lays out details regarding the percentage of ownership, voting rights, and distribution of profits or losses. 2. Convertible Note Agreement: In certain cases, rather than receiving immediate equity, the investor may opt for a convertible note. This agreement outlines the terms under which the debt will convert into equity at a later stage, typically upon the occurrence of a specific event or milestone. 3. Simple Agreement for Future Equity (SAFE): SAFE agreements are becoming increasingly popular in angel investing. They provide a straightforward and flexible alternative to convertible notes. A SAFE agreement details the investment amount, valuation cap, and discount rate, but defers the determination of exact equity until a future financing round. Regardless of the type, Franklin Ohio Angel Investor Agreements are critical for establishing a solid foundation for the investor-entrepreneur relationship. These agreements help align the expectations of both parties, safeguard their respective interests, and provide a clear roadmap for the investment journey. It is crucial for both parties to conduct due diligence, seek legal counsel, and negotiate the terms of the agreement to ensure a fair and mutually beneficial outcome.

Franklin Ohio Angel Investor Agreement

Description

How to fill out Franklin Ohio Angel Investor Agreement?

Preparing paperwork for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to generate Franklin Angel Investor Agreement without professional help.

It's possible to avoid wasting money on attorneys drafting your documentation and create a legally valid Franklin Angel Investor Agreement on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Franklin Angel Investor Agreement:

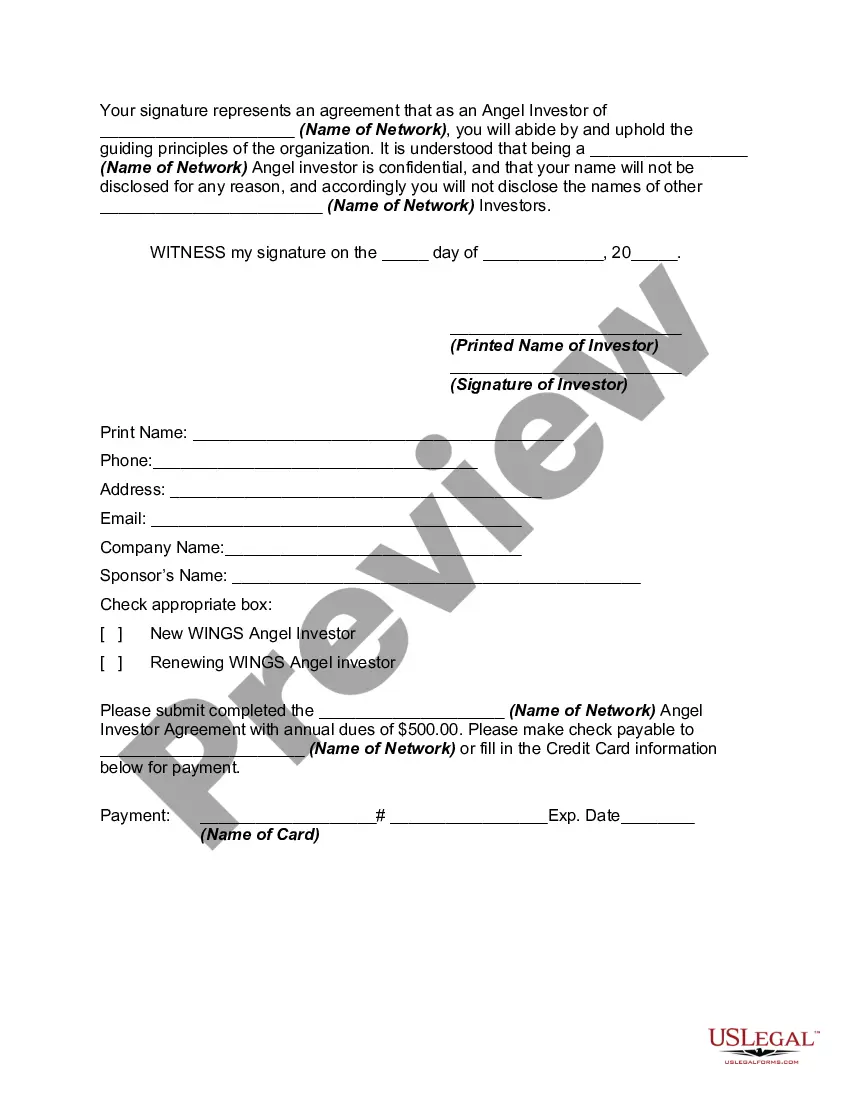

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any situation with just a few clicks!