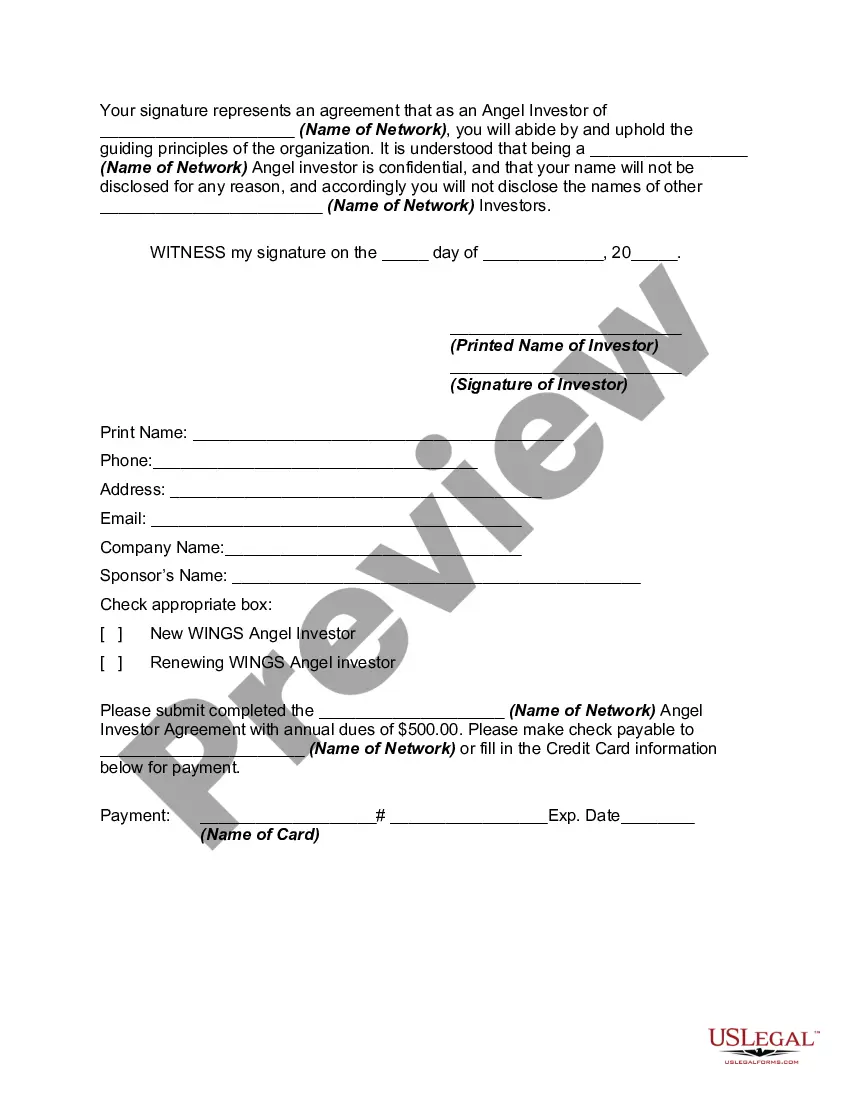

An angel investor agreement in Houston, Texas is a legal document that outlines the terms and conditions of an investment made by an individual, known as an angel investor, into a startup or early-stage company based in Houston. This agreement serves as a contract between the angel investor and the entrepreneur, providing a framework for the investment, as well as defining the rights, obligations, and responsibilities of both parties. The Houston Texas angel investor agreement typically includes essential elements such as: 1. Investment Details: This section covers the amount of funding the angel investor will provide, the form of the investment (equity, convertible note, etc.), and any additional terms or conditions related to the funding. 2. Equity Ownership: If the angel investor agreement involves an equity investment, this section outlines the percentage of ownership the investor will hold in the company and the terms of stock issuance. 3. Investor Rights: This clause specifies the rights and privileges granted to the angel investor, such as voting rights, information rights, and participation in future funding rounds. 4. Use of Funds: It elucidates how the funds provided by the angel investor will be used, ensuring transparency and alignment with the company's growth plans. 5. Exit Strategy: This part lays out the potential exit options for the angel investor, including provisions related to IPOs, acquisitions, or other liquidity events. 6. Term and Termination: It states the duration of the agreement and conditions under which either party can terminate the agreement, ensuring a clear understanding of the contractual relationship. There can be variations in angel investor agreements based on the specific needs and preferences of both parties involved. Some variations include: 1. Standard Angel Investor Agreement: This is the typical agreement used for angel investments in Houston, Texas, covering the general terms and conditions of the investment. 2. Convertible Note Agreement: In some cases, the angel investor may prefer providing a loan instead of making an equity investment. A convertible note agreement outlines the terms under which the loan can convert into equity in the future. 3. Syndicated Agreement: When multiple angel investors collaborate to invest in a startup, a syndicated agreement is used to define the collective terms and obligations of all investors involved. 4. SAFE Agreement: Another variation is the Simple Agreement for Future Equity (SAFE) agreement, which allows the investor to receive future equity upon specified events rather than an immediate equity stake. These are some common variations of the Houston Texas angel investor agreement, each designed to cater to the unique preferences and circumstances of the angel investor and the startup.

Houston Texas Angel Investor Agreement

Description

How to fill out Houston Texas Angel Investor Agreement?

Whether you intend to start your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you must prepare specific paperwork meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Houston Angel Investor Agreement is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Houston Angel Investor Agreement. Follow the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Houston Angel Investor Agreement in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!