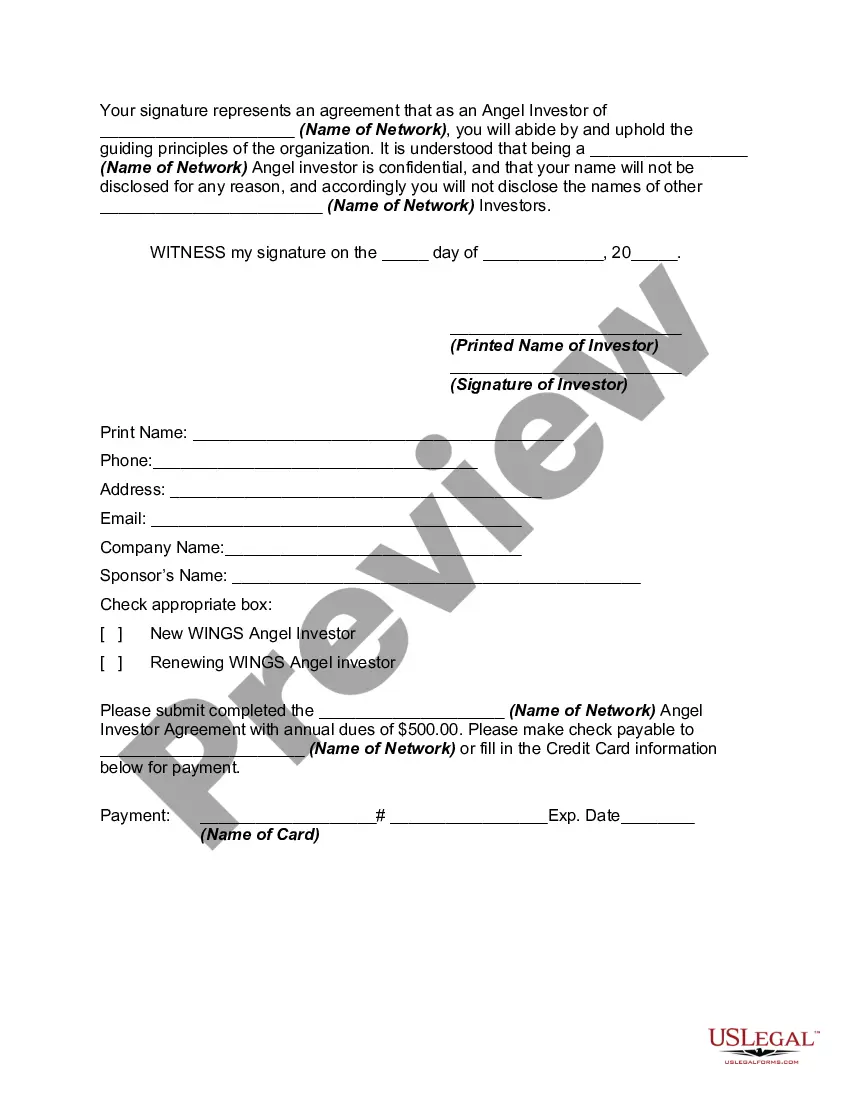

The Phoenix Arizona Angel Investor Agreement is a legally binding contract that outlines the terms and conditions agreed upon between an angel investor and an entrepreneur or startup seeking funding. It serves as a vital tool in facilitating investments in the Phoenix area, helping entrepreneurs secure the necessary funds to launch or expand their ventures. This agreement provides a framework that protects the interests of both the investor and the entrepreneur, fostering a mutually beneficial relationship. The Phoenix Arizona Angel Investor Agreement typically covers several key elements. Firstly, it outlines the investment amount provided by the angel investor, be it in the form of equity financing, convertible debt, or other investment vehicles. Additionally, it defines the ownership stake the investor will hold in the company, detailing the percentage of shares or equity they will acquire. The agreement also specifies the terms of the investment, including the repayment structure and expected return on investment. It may include provisions for dividends, interest rates, or other forms of financial return to compensate the investor for their risk. Furthermore, the agreement may outline any obligations or responsibilities of the entrepreneur to the investor, such as providing regular financial reports or participating in board meetings. In Phoenix, Arizona, there are various types of angel investor agreements tailored to different investment scenarios. One common agreement is the Standard Angel Investor Agreement, which provides a general framework for investments in startups or early-stage companies. It includes standard clauses and terms commonly used in angel investing. Another type is the Convertible Note Angel Investor Agreement. This agreement allows the investor to provide a loan to the entrepreneur, which can be converted into equity at a future date or triggered by specific events, such as reaching a predetermined valuation or securing additional funding. The Series Seed Angel Investor Agreement is often used for startups that have already established some traction and need additional funding to further grow their business. It provides more sophisticated terms, including anti-dilution protection and rights for the investor. Regardless of the specific type, a Phoenix Arizona Angel Investor Agreement is crucial to establish a clear understanding between the investor and entrepreneur, protecting their rights and defining the financial and legal parameters of the investment. Keywords: Phoenix Arizona, Angel Investor Agreement, entrepreneur, startup, funding, legally binding contract, terms and conditions, investment amount, equity financing, convertible debt, ownership stake, repayment structure, return on investment, obligations, responsibilities, financial reports, board meetings, Standard Angel Investor Agreement, Convertible Note Angel Investor Agreement, Series Seed Angel Investor Agreement, traction, anti-dilution protection, rights.

Phoenix Arizona Angel Investor Agreement

Description

How to fill out Phoenix Arizona Angel Investor Agreement?

How much time does it normally take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Phoenix Angel Investor Agreement suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, gathered by states and areas of use. Apart from the Phoenix Angel Investor Agreement, here you can get any specific document to run your business or individual affairs, complying with your county requirements. Experts check all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the platform, there will be some extra steps to complete before you obtain your Phoenix Angel Investor Agreement:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Phoenix Angel Investor Agreement.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!