In many jurisdictions, the requirements as to the sufficiency of notice of lien are prescribed by statute. Counsel should be certain to consult the applicable statutes in the particular jurisdiction to ensure full compliance with the necessary requirements.

Alameda California Notice of Special or Charging Lien on Judgment

Description

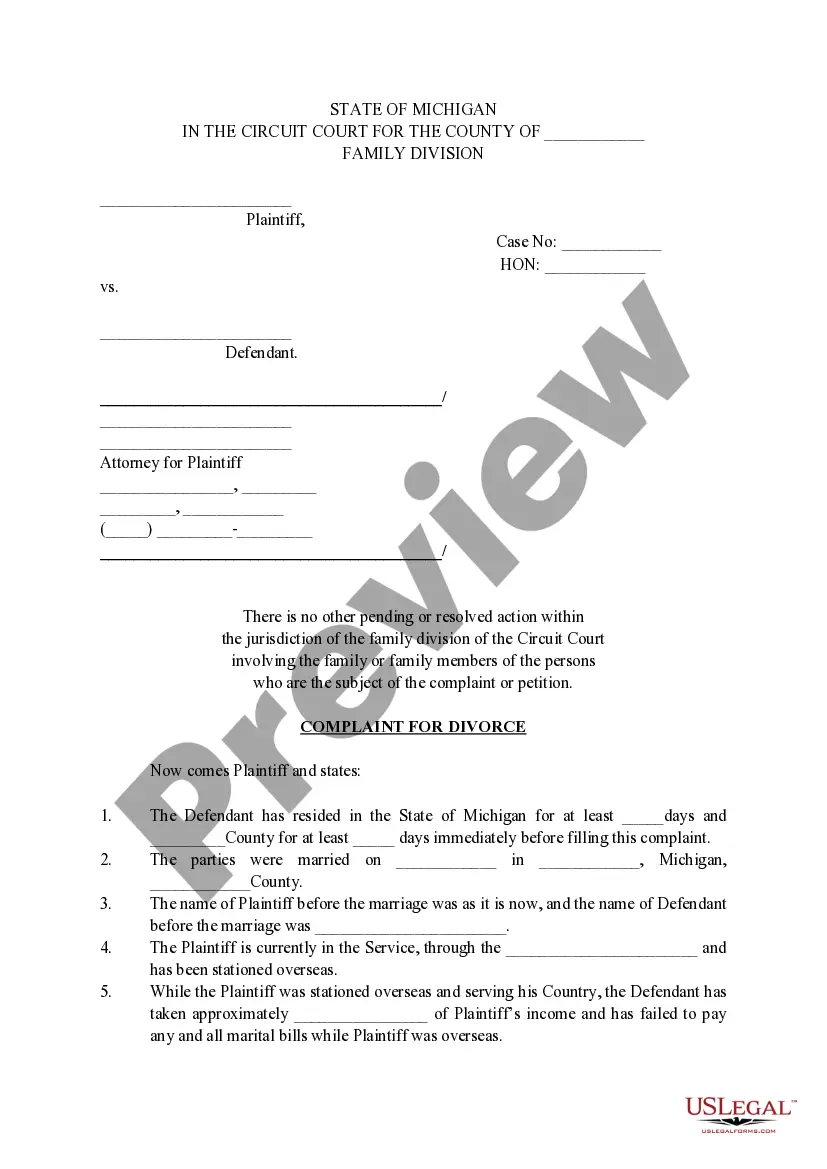

How to fill out Alameda California Notice Of Special Or Charging Lien On Judgment?

Preparing papers for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Alameda Notice of Special or Charging Lien on Judgment without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Alameda Notice of Special or Charging Lien on Judgment on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Alameda Notice of Special or Charging Lien on Judgment:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!

Form popularity

FAQ

Los Angeles County Registrar-Recorder/County Clerk website at lavote.net/home/records/real-estate-records/general-info or calling (800) 201-8999.

Time Limits California law gives judgment liens a 10-year life-cycle. Once the judgment is declared it may take weeks before the creditor finally gets the lien officially recorded in the county registry of deeds. The 10-year run starts from when the court issues its judgment.

How Do You Remove a Lien? Pay the debt: If you have a valid judgment lien against your property, paying the creditor in full will remove the lien. Negotiate with creditors: With the help of an attorney, you may be able to work out a settlement with your creditor to remove a judgment lien.

Step 1: Contact the Lien Claimant and Request. Step 2: Obtain a Certified Copy of the Claim of Lien.Step 3: Prepare the Required Court Pleadings.Step 4: Copy and Assemble the Documents.Step 5: File Documents in Court, Pay Filing Fee, and Ask Clerk for a Hearing Date.Step 6: Have the Petition and Other Documents Served.

If you need to payoff a lien or assessment you must: Complete the Citywide Liens Demand Request Form. Send a check for $150.00 to Citywide Liens at 150 Frank Ogawa Plaza, Oakland, CA 94612. If you need a copy of your lien(s) contact the Alameda County Recorder's Office, 1106 Madison St.

A lien expires 10 years from the date of recording or filing, unless we extend it. If we extend the lien, we will send a new Notice of State Tax Lien and record or file it with the county recorder or California Secretary of State.

File the PCOR. Pay fees. Record the deed at the Alameda County Clerk-Recorder's Real Property Recording Office along with a Preliminary Change of Ownership Report (PCOR.) H) File reassessment exclusion claim, if any, at the Assessor's Office.

Liens are public records in California. Therefore, anyone who wants to check for liens recorded in the state can contact or visit the relevant government office. For real estate liens, a resident can go to the county clerk/recorder's office in the county where the property is situated to request a title deed search.