Title: Understanding Chicago, Illinois Conveyance of Deed to Lender in Lieu of Foreclosure Introduction: Chicago, Illinois, known as the "Windy City," is not only famous for its stunning skyline and rich cultural heritage but also for its unique real estate landscape. In cases where homeowners face the prospect of foreclosure, one possible solution is a Conveyance of Deed to Lender in Lieu of Foreclosure. This article aims to provide a comprehensive understanding of this process, its benefits, and explore any variations or types within Chicago, Illinois. 1. What is a Conveyance of Deed to Lender in Lieu of Foreclosure? A Conveyance of Deed to Lender in Lieu of Foreclosure, commonly referred to as a "deed in lieu," is a legal agreement between a distressed homeowner and their lender. The homeowner transfers the property's ownership to the lender to avoid foreclosure proceedings, effectively giving up their rights and relinquishing the property. 2. Benefits of a Conveyance of Deed to Lender in Lieu of Foreclosure: — Avoiding the foreclosure process: Rather than going through lengthy and often emotionally distressing foreclosure proceedings, homeowners can voluntarily surrender the property to the lender. — Minimizing damage to credit score: Though negative credit implications are inevitable, a deed in lieu generally has a lesser impact on credit scores compared to a foreclosure. — Potential financial incentives: Under certain circumstances, lenders may offer financial incentives, such as relocation assistance or reduced deficiency judgments, to encourage homeowners to opt for a deed in lieu. 3. The Chicago, Illinois Perspective: In Chicago, Illinois, the Conveyance of Deed to Lender in Lieu of Foreclosure process follows the legal guidelines established at the state level. While there might not be specific variations or types unique to Chicago, understanding the state laws and regulations is crucial for both homeowners and lenders. 4. Key Considerations for Chicago homeowners: — Legal implications: Seek professional legal advice to ensure compliance with local laws and understand the consequences of proceeding with a deed in lieu. — Negotiation with lenders: Engage in open communication with the lender to explore possible incentives and mitigate future liabilities. — Documentation: Accurate and thorough documentation throughout the process is vital to protect the homeowner's interests and ensure a smooth transaction. Conclusion: A Conveyance of Deed to Lender in Lieu of Foreclosure can offer struggling homeowners in Chicago, Illinois an alternative to the ordeal of foreclosure. While the overall procedure aligns with state guidelines, it is crucial to fully comprehend the implications and explore potential incentives before going ahead. Seeking legal counsel and maintaining open dialogue with the lender are imperative for a successful and well-documented transaction. By understanding this process, homeowners can make informed decisions to alleviate their financial burdens and secure a fresh start.

Chicago Illinois Conveyance of Deed to Lender in Lieu of Foreclosure

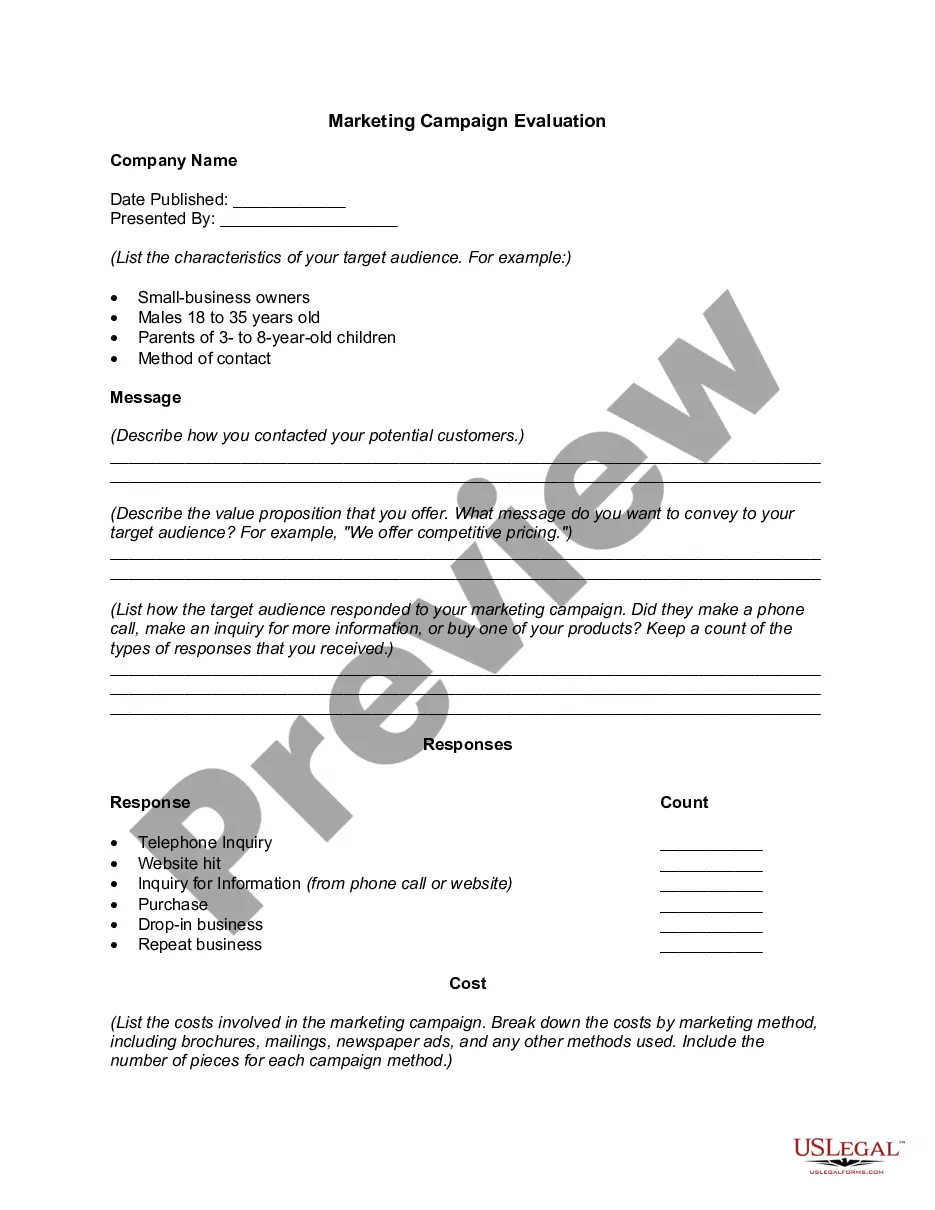

Description

How to fill out Chicago Illinois Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Preparing legal documentation can be burdensome. In addition, if you decide to ask a lawyer to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Chicago Conveyance of Deed to Lender in Lieu of Foreclosure, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the latest version of the Chicago Conveyance of Deed to Lender in Lieu of Foreclosure, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Chicago Conveyance of Deed to Lender in Lieu of Foreclosure:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Chicago Conveyance of Deed to Lender in Lieu of Foreclosure and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!